Frederic J. Brown/AFP/Getty Images

- Rent prices soared 9.2% in the first half of 2021, tripling the average pace and exceeding the pre-crisis trend.

- Shelter inflation is set to keep climbing as millennial demand booms, analyst Logan Mohtashami said.

- That upswing risks turning higher inflation permanent, as rent prices are tougher to rein in.

- See more stories on Insider's business page.

Pandemic-era rental deals are gone. Prices are shooting up, and new data suggests they'll keep climbing at a breakneck pace.

The rally began in the housing market, where a buying frenzy dragged national inventory to historic lows and led prices to surge at their fastest rate in over 30 years. Now it's spilling over into the rental market.

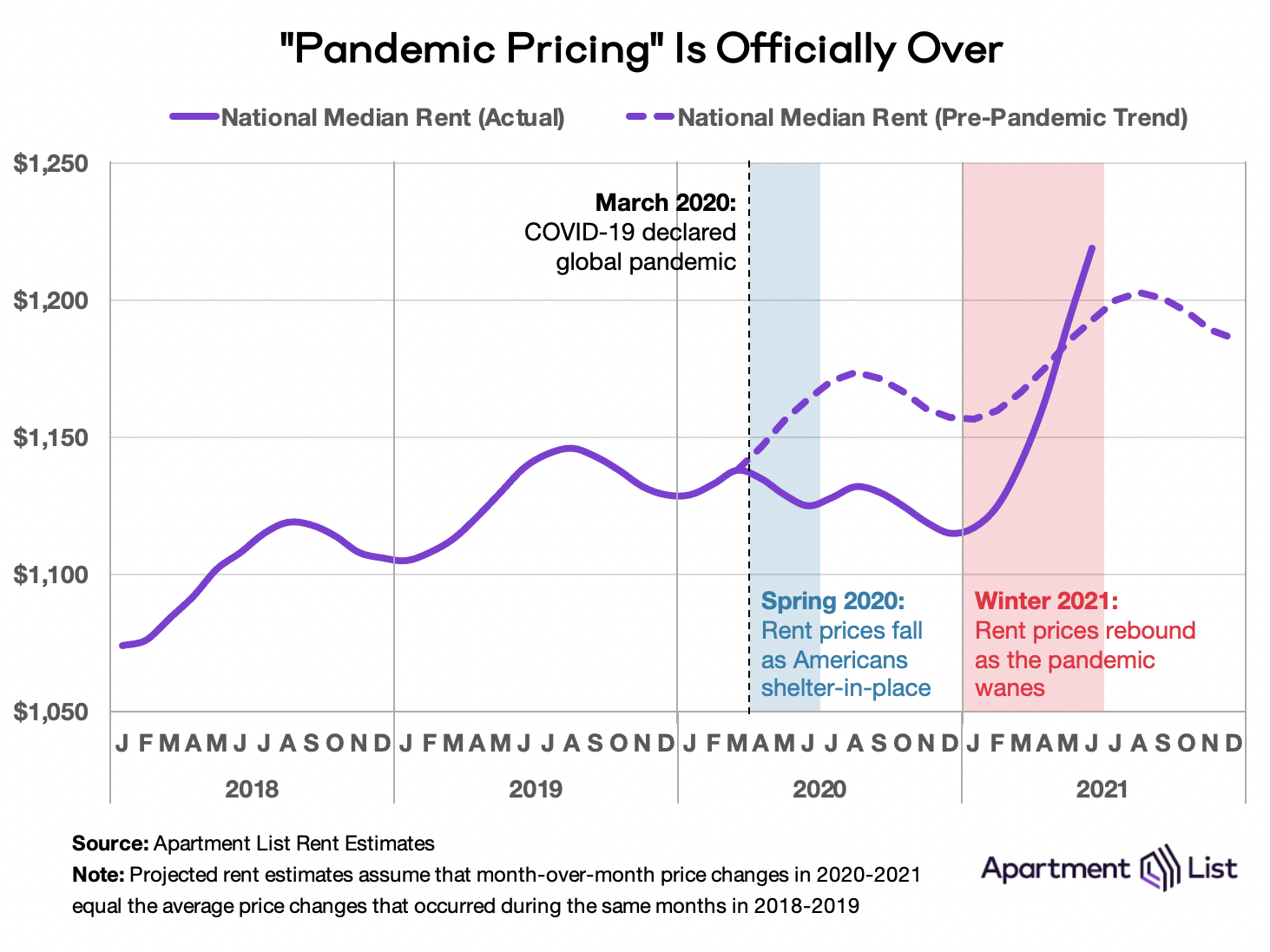

The median apartment rent in the US rose 9.2% through the first six months of 2021, rental website Apartment List said in a June 29 report. That compares to the typical first-half growth of 2% to 3%. June alone saw the website's national rental index leap 2.3%.

The typical price nationwide now stands 2% higher than had the pandemic not taken place, according to Apartment List. That overshoot is concentrated in growing markets like Austin and San Diego, as rents in the largest metropolitan areas remain below trend.

"Whereas last year's peak moving season was halted by the pandemic, this year's seasonal spike appears to be making up for lost time," Apartment List economists Chris Salviati, Igor Popov, and Rob Warnock said in a blog post.

Apartment List

The elevated price growth isn't likely to cool off anytime soon, Logan Mohtashami, lead analyst at Housing Wire, said. Millennials are set to power unprecedented demand over the next three years throughout the housing market. That shift will drive an even bigger gap between supply and demand, the analyst said.

"We never built enough apartments anyway. And now we have the biggest household-formation demographic group in history," he told Insider. "Whether they're not buying homes, they still have to live somewhere. So yeah, rent inflation should pick up."

Rising rents pose a larger-than-usual risk to broad price growth. Shelter inflation is stickier than inflation in other categories, meaning it's less likely to immediately cool after leaping higher.

The Federal Reserve, the White House, and most economists expect decade-high inflation to cool off as bottlenecks are addressed. Inflation for used cars, food, and utilities is expected to weaken as supply rebounds. Rent prices, however, complicate the consensus outlook. If shelter inflation continues to boom, forecasts for temporarily faster price growth could fall flat.

To be sure, rent prices are highly seasonal, and prices tend to be highest in the summer, according to Apartment List. If prices follow trends seen in 2018 and 2019, prices would fall modestly through the fall and winter. Such declines could line up with a slowing of broader inflation.

But with rents in major cities expected to keep climbing, shelter inflation is a top gauge to watch for hints at whether price growth fades as expected or stays past its welcome.