- Beijing has been threatening to withhold exports of its rare-earth materials to the US as a trade-war tactic.

- China is the world’s largest supplier of rare earth, and the US heavily relies on it to make things like smartphones and cruise missiles.

- But rare-earth experts believe Beijing won’t follow through with those threats and say they are just “loud saber-rattling” to get Washington back to the negotiating table.

- It wouldn’t be in China’s interests if the US and other countries looked to other sources for their rare-earth imports.

- Visit Business Insider’s homepage for more stories.

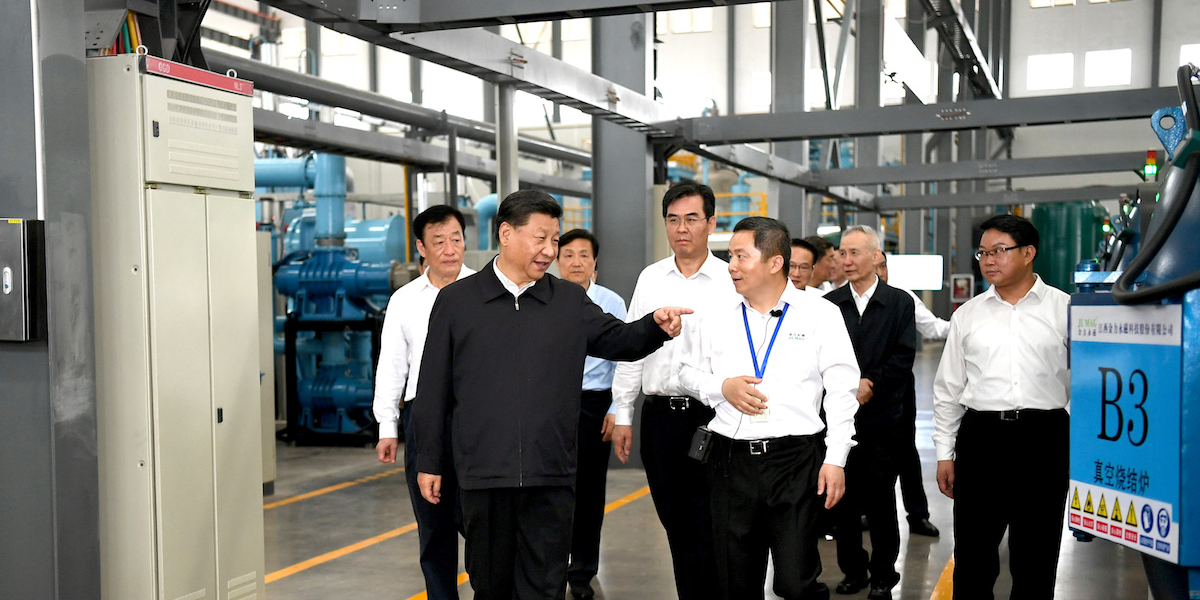

Over the past week China has dropped numerous hints, via state-media editorials and a highly publicized visit by President Xi Jinping to a magnet factory, that it might restrict exports of rare-earth materials to the US to retaliate against Washington in the countries’ trade war.

Given the US’s heavy reliance on the minerals – composed of 17 elements on the periodic table – in its supply chains, such a move could cripple the American tech, defense, and manufacturing industries. Rare earths are crucial to the making of products such as batteries, smartphones, electric cars, and cruise missiles.

Read more: China drops heavy hint it is about to pull the trigger on its most powerful weapon in the trade war

Stocks in Chinese rare-earth companies have skyrocketed, and global stocks plummeted as traders braced for further trade-war tensions.

But experts don't think Beijing will follow through with those threats. Here's why.

When China last weaponized rare earths, it didn't go well

China temporarily cut off rare-earth exports to Japan in 2010 amid a maritime dispute that saw a Chinese boat captain captured by Japanese authorities.

Though Japan immediately released the Chinese captain - in what The New York Times described at the time as a "humiliating retreat" - it also started looking into how to wean itself off Chinese exports of rare earths.

For the five to seven years after the maritime dispute, Japan started sourcing from rare-earth mines outside China and switching to alternative means of producing its electronics.

Beijing is aware that cutting off rare-earth supplies to other countries would end up weaning them off its exports, experts say.

"China recognizes that other countries would do that if it weaponizes and bans rare earths," Ryan Castilloux, the managing director of the rare-earth consultancy Adamas Intelligence, told Business Insider. "They know they shouldn't do that."

Kokichiro Mio, an expert on China's economy at Japan's NLI Research Institute, also told Agence France-Presse that a Chinese halt on rare-earth exports to the US "would accelerate moves to find alternative supply sources."

'Loud saber-rattling'

China's threat to withhold rare-earth materials from the US is most likely just a form of "loud saber-rattling" to get the US to return to negotiations over the yearlong trade war, Castilloux said.

"It suggests that China feels its hands are tied, and eyeing the nuclear button that is rare earths," he said.

Beijing hopes to "instill some more cooperation at the negotiating with the US by hoping the US will back down," he said, adding that China was "using rare earths, which they recognize are so integral to US industries."

Washington and Beijing have engaged in a tit-for-tat battle over tariffs over the past two months after US officials accused their Chinese counterparts of reneging on commitments to which they previously committed.

China's recent publicity around its rare-earth industry has already driven up share prices in related companies and driven up the prices of the commodities.

"China will cause some disruption in supply to show that they are serious but will not stop supplying as this is too disruptive and aggressive for the present state of conflict," Brian Menell, the CEO of the metal-investment group TechMet, told Business Insider.

"China also does not want a flood of new rare-earth investments into non-Chinese sources of supply," he added.

Shares in Rainbow Rare Earths, a mining company that sources minerals outside China, jumped 17% on Wednesday in light of China's threats. TechMet also invests in Rainbow Rare Earths.

Martin Eales, the CEO of Rainbow Rare Earths, believes Beijing could afford to take the plunge, however, because rare-earth exports make up a relatively small amount of China's export balance with the US.

"I'm sure it is quite possible for China to do this as part of a wider series of actions linked to any trade war with the US," he told Business Insider.

The US imported $160 million worth of rare-earth materials in 2018, according to the US Geological Survey. Eighty percent of such imports came from China from 2014 to 2017, the USGS noted, meaning that the US most likely imported about $128 million worth of rare earth from China last year.

That would be just 0.024% of the $526 billion that the US imported from China in 2017, per World Bank statistics.

"This is certainly a relatively insignificant sum to China in the context of overall trade," Eales said.

'The damage is done'

China's threat to withhold rare earths is already causing the US to explore ways to reduce its dependence on the Chinese exports - such as by developing rare-earth sources outside China.

"Even if it doesn't go ahead, it's a wake-up call," Castilloux said of Chinese restrictions. "It's causing the US and other countries to take a more serious look into their supply chains."

The Department of Defense on Wednesday said it was seeking new federal funds to support US production of rare-earth minerals to wean the country off its reliance on China, according to Reuters. While there are some rare-earth mines in the US, American manufacturers still largely depend on China.

Bill Bishop, who writes the Sinocism newsletter on Chinese current affairs, tweeted on Wednesday in response to Beijing's editorials on rare earth: "There is no walking back this threat, even if not implemented the damage is done."

Read more: The US-China trade war could slash economic output across the world

Rare-earth experts overwhelmingly agree that shifting rare-earth supplies out of China could take several years.

For this reason, Beijing's halting rare-earth exports is "not necessarily a high-confidence, viable plan B right now, as it would take one to several years to establish an entirely standalone supply chain outside China," Castilloux said.

"The US will need to develop and construct a full processing facility but also have this tailored to a known source of feedstock that can provide a guaranteed long-term supply," Eales, the Rainbow Rare Earths CEO, whose company mines in Burundi, said. "All of this may take several years."

Menell, the CEO of TechMet, added: "Provided other non-Chinese sources are developed and expanded, it may take five to 10 years for the US to wean itself off Chinese supply of rare earths."