- UK Prime Minister Liz Truss' tax plan sparked immediate market backlash and, eventually, her resignation.

- The US's electoral system and government checks and balances protect against such blunders.

- Truss was forced to choose between two economic battles, whereas the US is wholly focused on one.

The resignation of the UK's prime minister caps a frenzied month in which an unpopular tax plan tanked financial markets, forced emergency intervention from the Bank of England, and sowed immense disapproval among the British public.

Those looking on from across the pond don't need to be too concerned. While the economic outlook in the US isn't pretty, such a chaotic battle between markets and the government isn't likely to emerge any time soon. The Federal Reserve has been raising interest rates at the fastest pace since the 1980s to crush inflation. The snail's pace at which legislation moves through Congress puts the odds of any near-term policy close to zero.

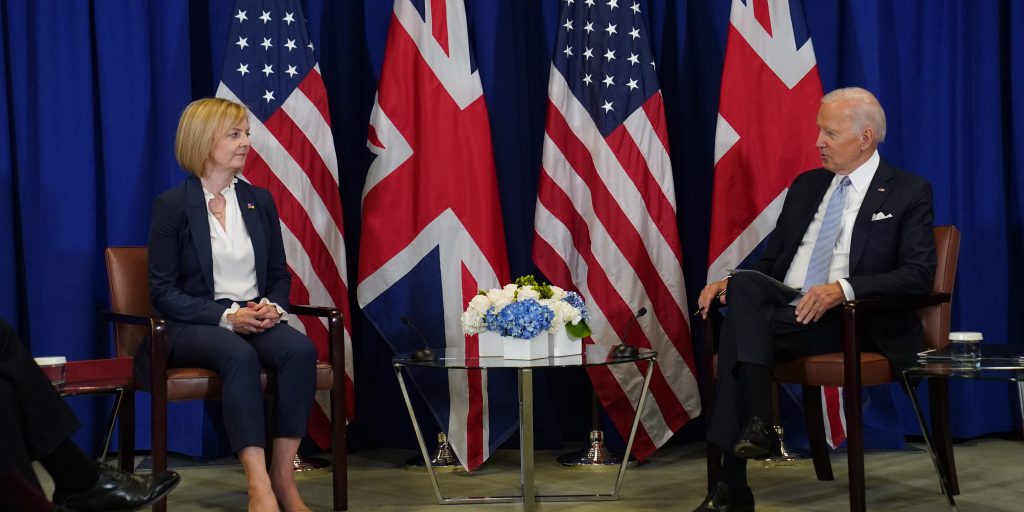

As such, Biden has had an easy choice to make: let the Fed do its job, and hope the strength of the US economy can keep it out of a 2023 downturn.

Truss, meanwhile, was forced to pick between boosting short-term economic growth and ramping up the fight against inflation. The weeks since have shown how damaging the wrong choice can be.

How Liz Truss became the shortest-serving PM in UK history

Things went south fast for the UK's new Conservative government late last month. Prime Minister Liz Truss, just 22 days into her leadership role, unveiled a mini-budget that proposed tax cuts that primarily benefited the wealthy. The aim, according to now-ousted Chancellor Kwasi Kwarteng, was to supercharge economic growth and lessen the odds of a near-term recession.

Investors didn't see it that way. The British pound plummeted to a record low against the US dollar while gilts — the UK's government bonds — similarly sank. Economists balked at the proposal, arguing it would drive the government's deficit sharply higher and exacerbate inflation that was already among the worst in the world. The Bank of England intervened with unlimited bond purchases in order to avoid a full-blown financial crisis.

Truss reversed course days later, but most of the damage was done by then. Gilt yields sat substantially higher, reflecting increased concern about the government's financial health. The central bank's action directly undermined its own plans to start selling bonds and continue tightening financial conditions. And the weakened pound threatened to make importing — which the UK relies heavily on — much more expensive.

The prime minister announced her resignation on Thursday, just 45 days after taking office. The market carnage offered a stark warning to officials that, should the government even propose such misguided economic policy, the rebuke will be swift and severe. Truss is poised to go down as the shortest-serving PM, and her mini-budget is the foremost reason.

The prime minister was dealt a less-than-ideal hand when she entered office. Sky-high energy prices were already crippling the UK economy, and growth was expected to slow dramatically in 2023. Yet inflation remained historically high, and the Bank of England had been raising interest rates to quickly slow the economy and rein in price growth.

By proposing her mini-budget, Truss prioritized concerns around the economic slowdown over stifling inflation. The public reaction signals it was the worse of the two battles to fight.

The US's checks and balances protect a Truss-esque blunder

So much of the UK market carnage seen in the first weeks of fall stemmed from the way its government is structured. With the Conservative Party holding a healthy majority in the House of Commons, there were few obstacles for Truss to enact her tax proposals. Until she reversed her stance and took the tax hikes off the table, markets were left unsure whether the prime minister would push the package through the legislative body or cave to outside pressure.

Truss came into power in the wake of former Prime Minister Boris Johnson's summer exit, securing the role in a contest between members of the Conservative Party. As such, she didn't face the same pressures from the British populace that a publicly elected leader typically would.

The checks and balances throughout the US government also stand in the way of such rapid-fire economic policy. Congress has been criticized for its sluggish pace of policymaking for decades, yet the same factors slowing lawmakers keep deeply unpopular proposals from becoming law. The Senate filibuster currently stands in the way of Democrats' most ambitious legislative plans, just as it held up Republicans' efforts throughout the Trump presidency. Had Biden or Trump proposed an economic plan as intensely opposed as Truss', the package would almost surely die in Congress.

That Truss could've easily pushed her mini-budget through Parliament exacerbated the market reaction. Without effective checks delaying or stopping the proposal outright, investors rushed for the exit amid sudden fear that the plans would worsen inflation and drive the UK government into an entirely new crisis.

Investors trade on the outlook of US economic policy, too, but the lengthy and unpredictable process needed to pass laws dulls market volatility. By the time a stimulus package is approved or tax cuts are finalized, traders have typically had weeks — if not months — to price in the policies and their economic impacts.

Such disastrous policy reactions could still slam the US

The US may be more insulated from such a political and financial blunder, but it's not invulnerable.

For one, the president can easily spook markets with questionable policy choices. Trump's trade-war threats repeatedly drove stocks lower and boosted market volatility. Yet the moves usually normalized soon after as economists weighed in and the former president's ultimatums led to little immediate change.

More recently, clashes over the federal debt ceiling have brought Congress within hours of a market cataclysm. The threshold limits how much the government can borrow to cover its bills for previous spending, and lawmakers have routinely punted the issue down the road by lifting the limit to a fresh high. More recently, debt-ceiling deadlines sparked passionate debates between Democrats and Republicans over which party should be held responsible for the government's multi-trillion dollar dues.

Biden approved a $2.5 trillion increase to the debt ceiling on December 16, 2021, just one day before government debt was set to hit the limit. Yet concerns over whether such a hike could be achieved fueled serious concerns on Wall Street. Failure to lift the limit would destroy global confidence in the US dollar, as the currency rests on the assurance that the government always has — and always will — repay its debt.

Had Congress not reached an agreement in September 2021 to raise the ceiling, the ensuing economic damage would have cost households $15 trillion in investment losses and put nearly 6 million Americans out of work, Moody's Analytics said last year.

So far, that threat has been enough to spur bipartisan action. Yet lawmakers have gotten increasingly close to the deadline in recent episodes, leading markets to grow more fearful that the ceiling could soon be breached.

The $2.5 trillion increase pushes the next debt-ceiling squabble to 2023, when Republicans are expected to hold control of the House. That'll likely make the next debate even more down-to-the-wire than the last. Should policymakers lose sight of the potential consequences, the US could be in for an economic catastrophe akin to the UK's tumultuous September.