- Jessica Alba's The Honest Company is set to begin trading on the Nasdaq at a valuation over $1.4 billion.

- New Constructs' David Trainer said the company's expected valuation is way too high.

- The company has never turned a profit and faces competition from well-established competitors, he said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The Honest Company's IPO is overvalued, according to David Trainer, CEO of investment research firm New Constructs.

At the midpoint of its IPO price-range, Jessica Alba's sustainable products company has an expected valuation of roughly $1.4 billion, which Trainer says is "honestly overvalued."

On Tuesday the company priced its initial public offering of 25,807,000 shares of common stock at $16 per share, slightly higher than the midpoint.

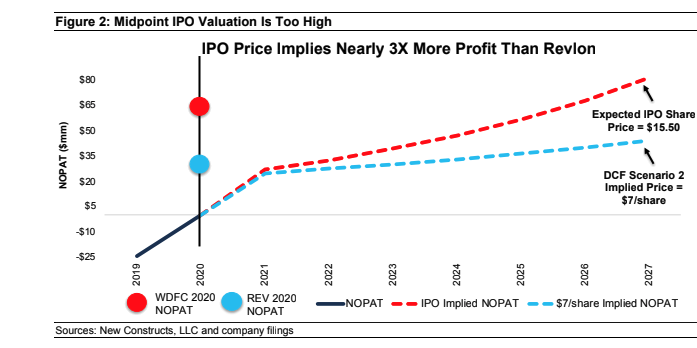

But Trainer says the stock shouldn't be worth more than $7 a share.

"A valuation at $15/share implies the company's profits will be three times greater than Revlon (REV), and we think the chances of that happening are very low because the incumbent consumer companies that compete with The Honest Company already own all the shelf space and dominate the industry," Trainer said.

The company, co-founded by actress Jessica Alba, offers "clean and sustainable" personal care products for babies and adults. Trainer said that's a "nice gimmick," but it's not a large enough business to justify a valuation of $1.4 billion and compete with well-established competitors like Kimberly-Clark, Procter & Gamble, Johnson & Johnson, and Unilever, and Revlon.

He added that the company held just 1.4% of market share in 2019, and its lack of shelf space is a competitive disadvantage. The Honest Company even acknowledged this as a risk in its IPO filings.

"The Honest Company is largely missing from many retailers' shelves," Trainer said. "In 2020, ~70% of The Honest Company's retail sales resulted from relationships with Target (TGT) and Costco (COST). Such heavy customer concentration increases the risks of investing in the company, as its distribution network is less diversified than its competition."

The Honest Company has never been profitable, but generated $300.5 million in revenue last year, with diapers and wipes driving 63% of sales. Skin products, household items, personal care, and wellness products made up the rest of its sales.

While the company's 2020 revenue grew about 28% from the previous year, it reported a net loss of $14.5 million, reported Insider's Dan Whateley.

According to Trainer, The Honest Company's path to profitability would be difficult. Using New Constructs' cash flow projection models, he found that the company's shares are priced for revenue growth that outpaces the projected growth of its target markets.

The Honest Company is set to begin trading on the Nasdaq under the ticket "HNST" Wednesday afternoon.