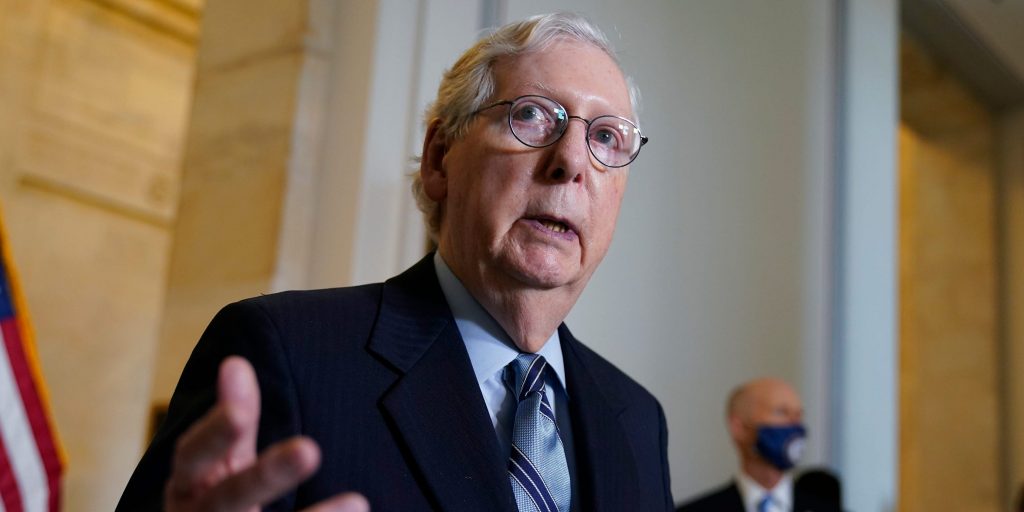

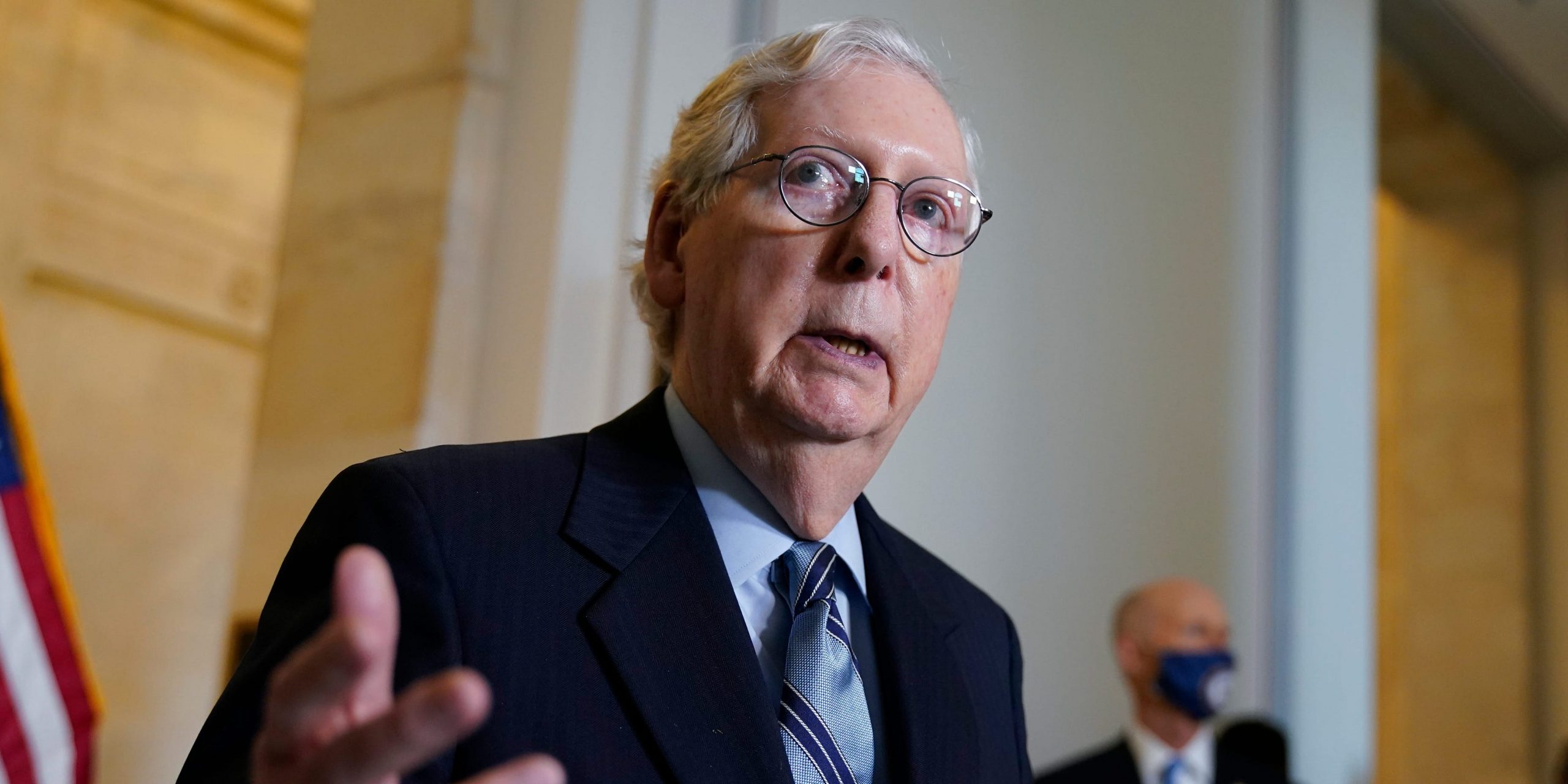

AP Photo/J. Scott Applewhite, File

- The Biden administration is suggesting an international minimum tax rate on corporations.

- Republicans are unlikely to support it given their reluctance to cede domestic tax authority overseas.

- There was already early criticism of a minimum tax last week from McConnell.

- Sign up for the 10 Things in Politics newsletter.

The Biden administration moved one significant step closer to achieving one of its key tax goals over the weekend when the G-7 group of major global economies announced it had struck a deal to levy a 15% minimum tax on multinational corporations.

The G-7 deal marks the start of a potentially historic measure, and signals support from key allies for a deal that would tamp down on tax havens – and work in tandem with tax increase proposals from the Biden administration.

The agreement contains a pair of planks that, if enacted, would increase the amount of taxes large firms pay. The first is an accord to tax major companies wherever they operate, not merely where they are headquartered. That would open up large tech companies like Amazon and Facebook to new taxes in European countries.

The other is a 15% minimum corporate tax rate, aimed at setting a floor so firms can't move their operations to a country with a lower taxation, and pit major economies against each other.

"That global minimum tax would end the race-to-the-bottom in corporate taxation, and ensure fairness for the middle class and working people in the US and around the world," Treasury Secretary Janet Yellen said in a statement on Saturday.

Yet Republicans are unlikely to support the measure, arguing it cuts the nation's economic competitiveness overseas and cedes a level of tax decision-making to foreign countries.

Yellen has emerged as a vocal proponent of the tax, consistently pushing it since taking office. She called for the new levy in her first major address as Treasury Secretary.

She said it would ensure "the global economy thrives based on a more level playing field in the taxation of multinational corporations, and spurs innovation, growth, and prosperity."

The G-7 followed the US lead on how high the rate should be. Reports at the end of May said the US had proposed a 15% rate, lower than the anticipated 21%. But that's the rate that the G-7 ultimately went with, unlike a draft proposal seen by Reuters that did not have a number attached.

The tax complements US proposals to raise corporate rates domestically.

President Joe Biden is seeking to increase the corporate tax rate to 28% from 21%, amounting to a partial reversal of the 2017 Republican tax cuts. Yellen defended the measure in an interview with The New York Times on Sunday: "I honestly don't think there's going to be a significant impact on corporate investment."

Negotiations between the White House and Senate Republicans on a bipartisan infrastructure package are now entering their fifth week with few signs of progress, and on Wednesday, The Washington Post reported on Thursday that Biden had pitched a $1 trillion infrastructure plan that scrapped the corporate tax increase and would instead levy a 15% minimum.

Even the idea of a new minimum tax as part of a deal triggered early Republican criticism. "I don't think that's gonna appeal to members of my party, and I think it'll be a hard sell to the Democrats," Senate Minority Leader Mitch McConnell said Thursday in Kentucky.

Republicans are already staunchly against any tax increase. Sen. Shelley Moore Capito of West Virginia, the chief GOP negotiator, has long called a corporate tax increase "a non-negotiable red line."

But while the global minimum tax may seem like a promising first entry in what's shaping up to be a hot tax summer, there's still a long way to go before it becomes anything close to law. The G-7 proposal is a powerful endorsement, but the measure heads to the G20 next, according to The New York Times. From there, it goes to the OECD group taking on taxes.

And, if and when the OECD agrees to a framework, the measure will probably have to be passed through legislation. That's where the Republicans could come in and sink it.