- Goldman Sachs forecasts the S&P 500 will stay at around 4,000 in 2023.

- But opportunities for returns still exist, said a team of strategists.

- They shared specific sectors and stocks they think will outperform next year.

Strategists at Goldman Sachs don’t have much faith in the stock market for 2023.

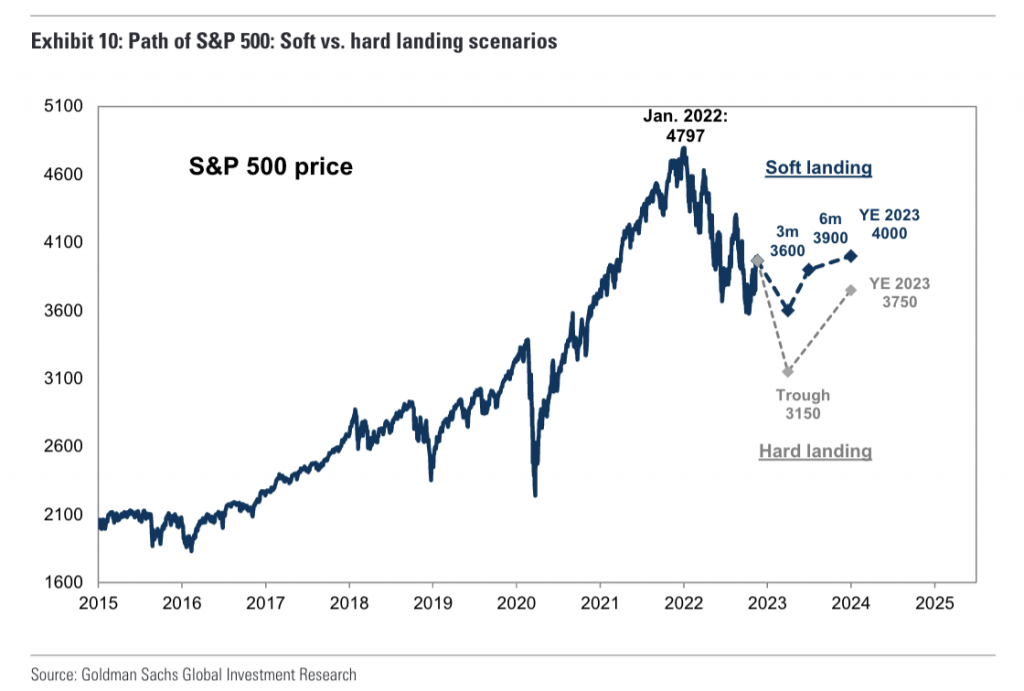

In a note to clients on Monday, the bank’s Chief US Equity Strategist David Kostin and a team of his colleagues put a price target of 4,000 on the S&P 500 for next year, which is right around the index’s current level.

Their call assumes the Federal Reserve can achieve a soft landing, where they succeed in bringing down inflation without sending the US economy into a recession. If a recession does unfold, however, Kostin sees the S&P 500 falling to 3,150.

Foto: Goldman Sachs

Even though his base case is a soft landing, Kostin cited a likely decline in earnings due to rising interest rates as his reasoning for his neutral view for 2023. But while he thinks any return from the broader market is improbable, opportunities still remain, he said.

In the note, the strategists shared their five-part playbook for how investors should approach the market next year, including where to find returns and what to do to avoid losses.

Goldman's 5-part plan for investing in 2023

First, Kostin said investors should skew their portfolios toward defensive stocks that aren't vulnerable to rising interest rates.

Goldman recommends the healthcare, consumer staples, and energy sectors in particular.

The Health Care Select Sector SPDR Fund (XLV); the Vanguard Consumer Staples ETF (VDC); and the iShares Global Energy ETF (IXC) offer exposure to the above sectors.

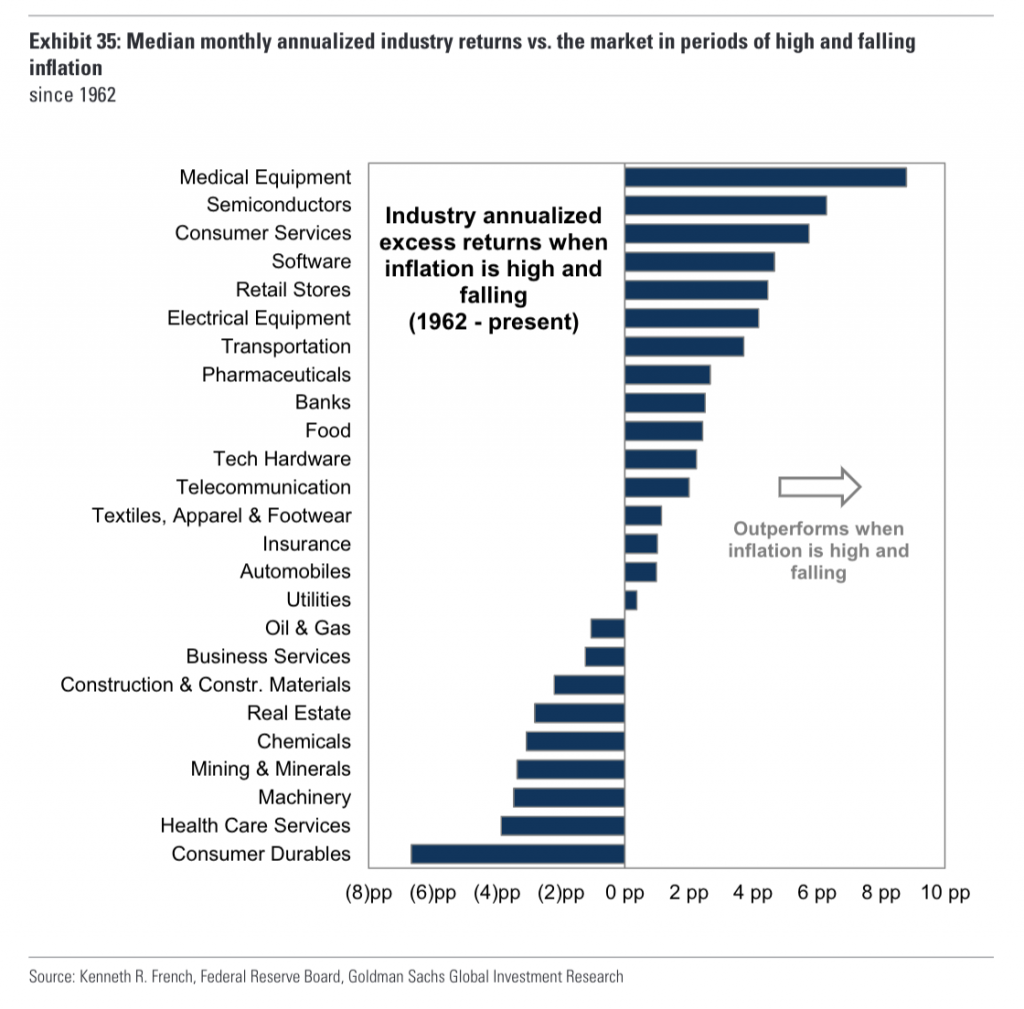

Second, Kostin said he likes stocks that outperform when inflation is high but falling.

Sub-sectors that best fit that bill include medical equipment, semiconductors, consumer services, and software, among others.

Foto: Goldman Sachs

Exposure to these areas of the market can be found in diversified funds like the First Trust Indxx Medical Devices ETF (MDEV); the VanEck Semiconductor ETF (SMH); the iShares U.S. Consumer Discretionary ETF (IYC); and the SPDR S&P Software & Services ETF (XSW).

Third, long-duration stocks that are unprofitable — typically these are growth stocks found in the tech sector — should be avoided, Kostin said.

"Unprofitable growth stocks will continue to face both elevated discount rate risk from a higher cost of capital and the additional risk from needing to source funding in an environment of tight financial conditions," he said.

Fourth, Kostin likes stocks that have growing profit margins despite the tightening economic conditions.

He shared a list of stocks with the most resilient profit margins over the last few year, and which are expected to grow margins next year. A few companies expected to grow margins the most next year include: Air Lease Corporation (AL) (4.29% profit margin growth expected in 2023); T-Mobile US (TMUS) (3.75%); and Eli Lilly and Company (LLY) (3.68%).

And finally, Kostin recommended avoiding stocks whose profit margin growth in recent years may have been due to a decrease in expenses as opposed to an increase in sales. Rising or normalizing expenses for these companies could chip away at profit margins.

A few companies whose expenses shrank the most, excluding research and development spending, since 2019 — and could therefore be at the highest risk of profit margin declines — include: Pfizer (PFE); Autodesk (ADSK); and Hologic (HOLX).

"The decline in SG&A as a share of sales accounted for at least half of the increase in net margins for every stock on the list, implying potential for downward margin pressure as the cost environment normalizes and demand slows," Kostin said about a list of stocks which included the three above. "SG&A" stands for selling, general, and administrative expenses.

"These stocks may lag if SG&A cost ratio normalization leads to negative EPS revisions," he added.