Rachel Mendelson/Insider

- An income statement is a financial document that details the revenue and expenses of a company.

- Some investors and analysts use income statements to make investing decisions.

- The income statement along with additional financial documents are required to be filed with the Securities and Exchange Commission (SEC).

- Visit Insider's Investing Reference library for more stories.

An income statement tells you whether or not a company made a profit or loss during the reporting period. It is one of three major financial statements used to evaluate the health of a company with the balance sheet and cash flow statement.

The income statement, sometimes referred to simply as the profit and loss statement or just "P & L" begins with the amount of money the company made and deducts expenses made during the reporting period ending with either a net profit or net loss. "Income statements are important because it can show how well a company is being managed and can give historical data to develop trends to help a company run better," says Camari Ellis, EA, a former portfolio manager and founder of The Philly Tax Team.

Understanding how income statements work

The income statement is important for different parties. Investor's may use income statements, along with other financial statements to make investing decisions and determine the financial health of a company. "The income statement should be used by anyone trying to understand the business conducted as well as the profitability of a company,"says Patrick Badolato, PhD, CPA, and a senior lecturer in the accounting department at the McCombs School of Business.

An increasing amount of sales from year-to-year might be attractive for a potential investor and can be found in the first line of an income statement. Conversely, if costs are rising this can also be seen on the income statement and may lead an investor to ask more questions about the long term profitability of the company. Investors and financial analysts also use the income statement to derive popular financial ratios like Earnings Per Share (EPS).

Earnings per share is a measure that compares a company's net income compared to the outstanding shares. The price-to-earnings ratio, or P/E ratio, is another commonly used metric that factors in the company's stock price in relation to EPS. When comparing companies, EPS and the P/E ratio can help differentiate two companies in the same category and help an investor make a more sound investing decision but both use the information given through the income statement.

"The equation driving the Income Statement is: Revenues - Expenses + Gains - Losses = Net Income," says Patrick Badolato, PhD, CPA

Income statements are also important to regulators. All public companies are required to file a Form 10-K each year with the SEC and Form 10-Q each quarter which include the income statement and other financial documents and disclosures.

The income statement is broken down into several key components to help understand how the company manages its income.

- Revenue: This is the amount of money the company brought in during the reporting period. With revenue, it may be important to note any trends to determine whether the company is making more money over time or if sales are slowing down.

- Expenses: This line details how much the company has spent. Similar to revenue, it may be important to note trends to see if the company is spending more or if they're becoming more efficient over time. When looking at expenses, "We should consider whether the expenses grow in proportion to revenue and the drivers of these expenses," Badolato says.

- Cost of goods sold (COGS): The amount spent on the production of the products or services sold. For a company like Apple it would include the glass to make the phone screen or the chips that go into the iPhone.

- Gross profit: This is the amount of money made, less the cost of goods sold. This will usually be calculated on the income statement by subtracting revenue minus cost of goods sold.

- Operating and non-operating expenses: Operating expenses are the cost to bring the product to the market. This could include things like marketing, payroll, and overhead expenses, such as insurance and rent. Non-operating expenses could include things that do not directly relate to core business functions. It may include things like contributions to pension plans or dividends to shareholders.

- Income before taxes: This is the total income before accounting for taxes paid.

- Depreciation: This is an accounting measure to account for the cost in the loss of value for tangible assets of the company.

- Earnings Before Interest,Taxes, Depreciation, and Amortization (EBITDA): This is a measure that's sometimes used instead of net income to gauge how profitable a company is.

- Net income: Net income (or loss) is known as the company's bottom line due to its position on the income statement. Simply put, this is the money that the company made or lost.

Income statement analysis

When analyzing income statements, there are two primary methods that are used: vertical analysis and horizontal analysis.

Vertical analysis shows each item on a financial statement as a percentage. An example of this would be the CIGS expressed as 35% of the total revenue. This type of analysis can be useful when comparing with other companies in the industry.

Horizontal analysis is used to review a company's performance over two or more periods by stacking each line item directly next to each other from the previous period. Instead of looking at one income statement at a time from different periods, horizontal analysis compares them side-by-side in one view.

How to read an income statement

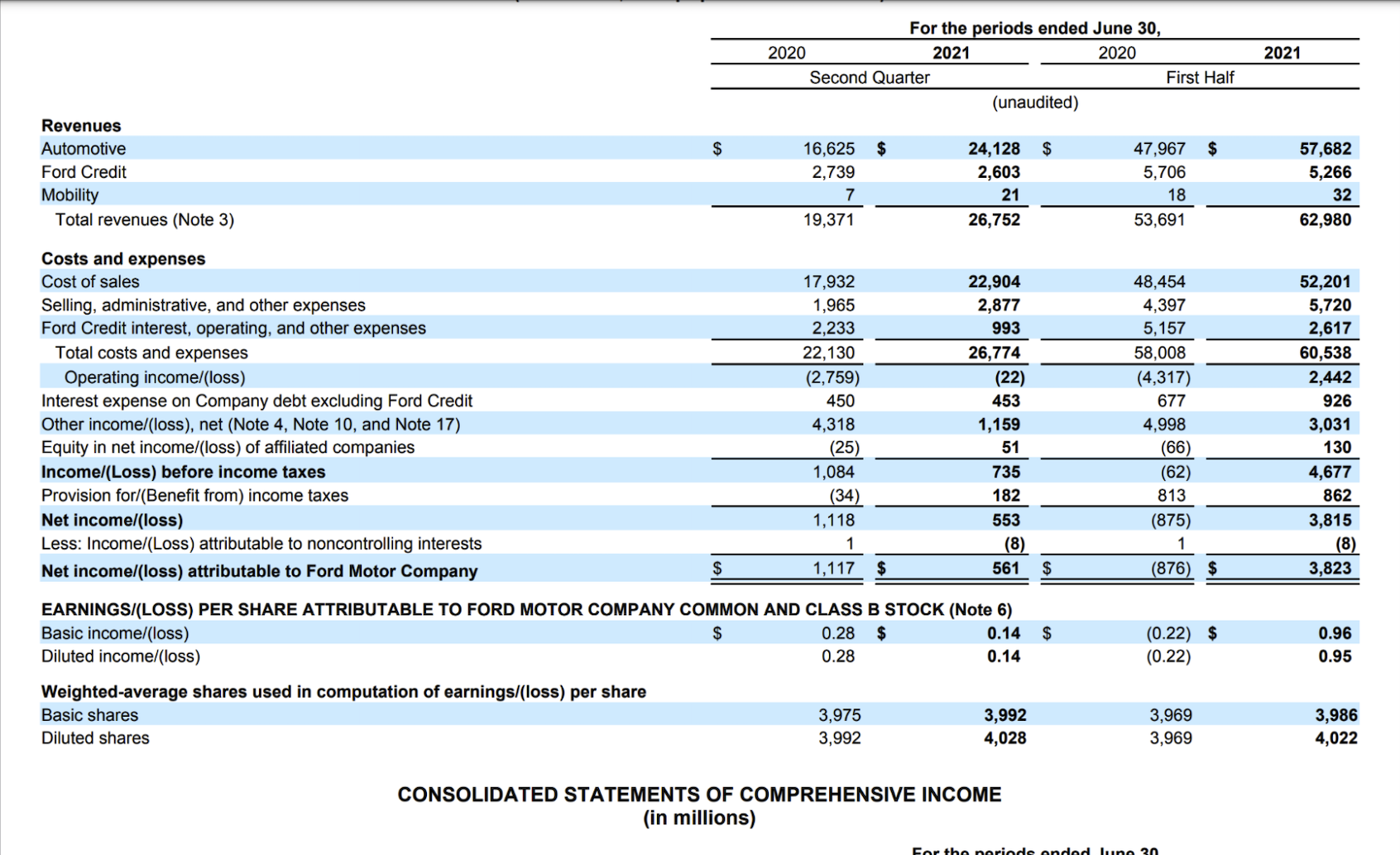

Below is the 2021 quarterly income statement from Ford's Form 10-Q. One of the first things that you will notice is that the report is using horizontal analysis. This is because the report is comparing the second quarter of 2020 to the second quarter of 2021 as well as the first half of 2020 and the first half of 2021.

In the first section under Revenues, you'll see each of Ford's major revenue streams, including car sales under Automotive, Ford Credit, and Mobility. In the notes section of the 10-Q, the Mobility line refers to Ford's autonomous vehicles and related business as well as its equity stake in Argo AI.

Next in the Cost and expenses section, you'll notice where Ford is spending its cash. The bulk of those expenses fall under cost of sales, which is another name for the cost of goods sold. You can also see that costs have increased from the second quarter of 2020 to the second quarter of 2021 resulting in a net income of $561 million during the second quarter and $3.8B during the first half of 2021 in the final column on the right.

Income statement vs. balance sheet

Both income statements and balance sheets provide important details about how a company uses its cash and other assets but there are a few key differences between the two. Think of an income statement like a financial timeline, whereas a balance sheet is a snapshot at one point in time. This is because income statements provide details on the amount of money made and spent during a period. The income statement essentially answers the following questions: How much money did the company make? How was that money spent? Did the company make a profit?

The balance sheet on the other hand tells you how much the company has in assets, liabilities and shareholder's equity. The balance sheet follows a simple formula:

Asset = Liabilities + Shareholder's equity

Like the name mentions, the figures on the balance sheet must match as any increases or decreases must be offset. Unlike the income statement it does not provide information on how much money the company has made or lost, it only provides the amount of debt, cash and other assets that the company owns at that point in time.

While these financial statements are different, both the income statement and balance sheet along with the cash flow statement are still linked and should be used together to determine a more holistic financial picture of a company.

| Income statement | Balance sheet |

|

|

The financial takeaway

The income statement is a good entry point to understand and evaluate a company's revenue and costs, but it's important to keep in mind that it's not a document that can tell the full story. "Financial statements are designed to work as a system and not as stand-alone statements," adds Badolato. "The Income Statement is only one piece in understanding the financial performance of a business. Using one financial statement without the others and other publicly available information - such as the footnotes in a financial filing - would be similar to betting before looking at one's cards."