Jose Luis Pelaez/Getty

- Stagflation is an economic condition that's caused by a combination of slow economic growth, high unemployment, and rising prices.

- Stagflation occurred in the 1970s as a result of monetary and fiscal policies and an oil embargo.

- Concern about stagflation has emerged as economic growth cools and inflation remains high amid the COVID-19 recovery.

- Visit Insider's Investing Reference library for more stories.

Stagflation is a combination of the words stagnation and inflation. It describes an economic condition characterized by slow growth and high unemployment (economic stagnation) mixed with rising prices (inflation).

The term appeared as early as 1965, when British Conservative Party politician Iain Macleod in a speech to the House of Commons said: "We now have the worst of both worlds – not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of 'stagflation' situation and history in modern terms is indeed being made."

Initially, many economists believed stagflation wasn't possible. After all, unemployment and inflation rates generally move in opposite directions. However, as the "Great Inflation" period of the 1970s ultimately proved, stagflation is real, and it can have a devastating effect on the economy.

Stagflation vs. inflation

Stagflation and inflation are related, but they shouldn't be confused. The term inflation refers to a sustained increase in the average price level of all goods and services, not just a few of them, in an economy over time. Inflation happens when the money supply grows at a faster rate than the economy can produce goods and services.

Stagflation happens when inflation exists in tandem with slow economic growth and high unemployment. Typically, these economic conditions don't occur together. Unemployment and inflation tend to be inversely correlated. So, as unemployment rates increase, inflation usually decreases and vice versa. Of course, as the stagflation of the 1970s illustrated, this relationship isn't always stable or predictable.

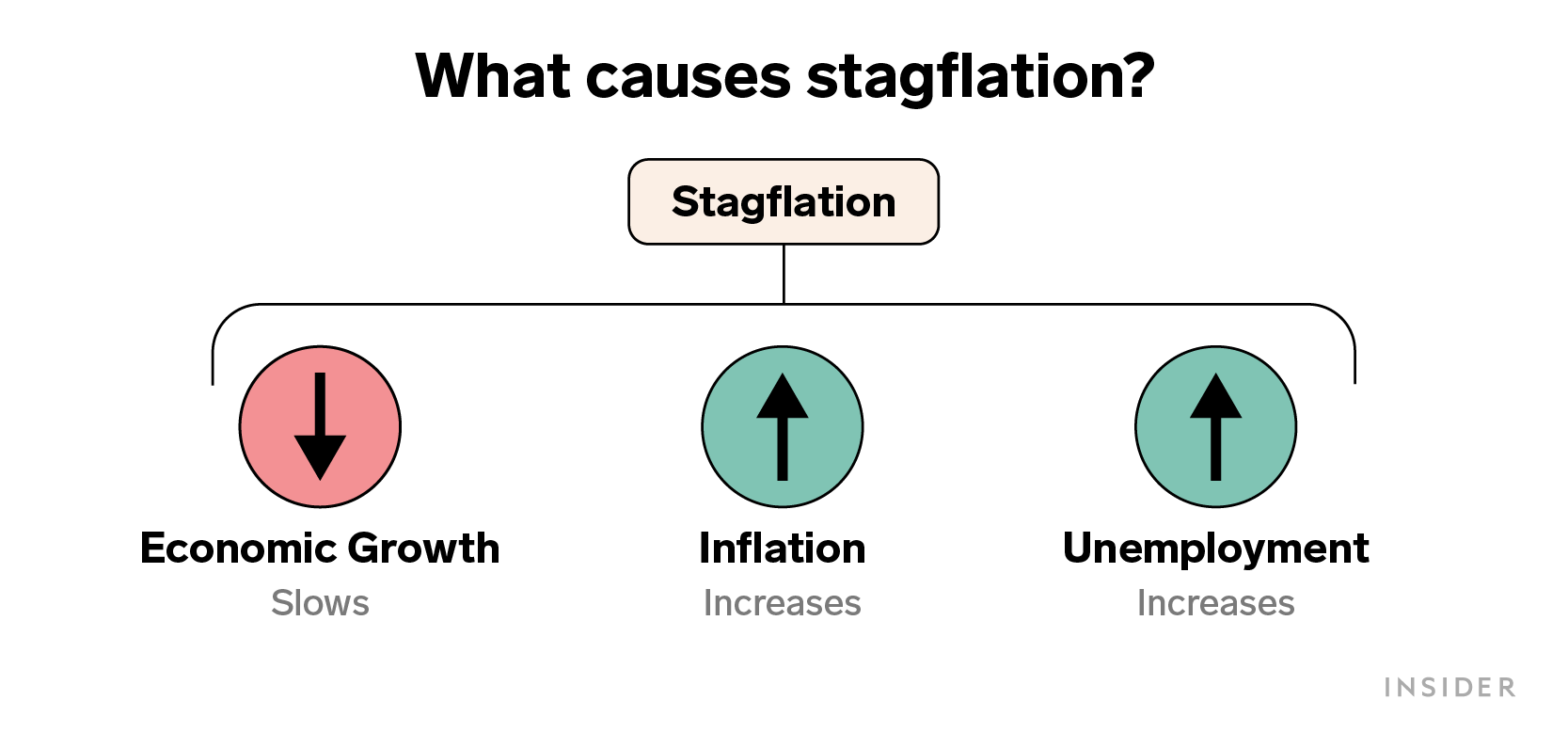

What causes stagflation?

Stagflation is a perfect storm of economic ills: slow economic growth, high unemployment, and high prices. The two root causes of stagflation economists generally agree upon are supply shocks and fiscal and monetary policies.

A supply shock is anything that reduces the economy's capacity to produce goods and services at given prices. For example, throughout the pandemic, there have been supply shocks in:

- Labor, with fewer people working

- Goods, for example, semiconductor shortages, which started even before the pandemic

- Services, as people postponed elective surgeries and other health-care procedures

Poor fiscal and monetary decisions also prompt stagflation. "Many things contribute to stagflation, but excess growth in the money supply is most important," says Richard J. DeKaser, EVP and chief corporate economist at Wells Fargo & Co.

"During the 1970s, for example, Fed Chairman Arthur Burns responded to soaring commodity prices with inappropriately easy monetary policy that allowed inflation to persist and get firmly entrenched in expectations," says DeKaser. "The record now shows that, to some degree, this was because he succumbed to political pressure at the time."

What are the consequences of stagflation?

The trifecta of slow growth, high unemployment, and fast inflation puts significant pressure on the economy.

"Stagflation is unambiguously harmful to the economy, as high inflation and inflation uncertainty distort investment decisions," says DeKaser. "It is also damaging to-fixed income markets, as rising interest rates push bond prices lower and depress equity valuations."

For households, stagflation means people are earning less money while spending more on everything from food and medicine to housing and consumer products. As consumer spending slows, corporate revenue declines, exacerbating the overall effect on the economy.

Stagflation in the 1970s

By the late 1960s, the post-World War II economic boom began to fade. As the US faced greater international competition, a drop in manufacturing jobs, and a massively expensive war in Vietnam, unemployment rates and inflation climbed.

Then, in 1971, former president Richard Nixon undertook a series of measures intended to create better jobs, remedy inflation, and protect the US dollar:

- A 90-day freeze on wages and prices

- A 10% tariff on imports

- The removal of the US from the gold standard

Now known as the "Nixon Shock," these moves ultimately became the primary catalyst for the stagflation of the 1970s. Federal Reserve attempts to fight stagflation using monetary policy only worsened it. Between 1971 and 1978, the Federal Reserve raised the federal funds rate to fight inflation, then lowered it to fight the recession. The stop-and-go measures confused households and businesses and ultimately drove inflation higher.

But the US had even more difficulties. An Organization of Petroleum Exporting Countries (OPEC) oil embargo on the US starting in 1973 caused prices to skyrocket. Businesses passed those costs on to consumers, but they also cut back on production (increasing unemployment) as the supply shock made goods more scarce. The price of oil per barrel initially doubled, then quadrupled, pushing inflation higher and further straining an already struggling US economy.

"The worst part of the experience from the 1970s was the aftermath," says DeKaser. "To reverse the momentum of ever-higher inflation, a severe recession was required (1981-82), and it took over a decade to wring out the fears of an inflation resurgence. It wasn't until the 1990s that investors began to seriously discount such a threat."

The financial takeaway

Stagflation weighed heavily on the US through the 1970s, and there have been concerns that it may reemerge as the economy recovers from the pandemic-induced recession.

Economists are closely watching the trends in growth, unemployment, and inflation along with the potential catalysts that could trigger stagflation including supply disruptions and central bank policies. Persistently high energy prices have caused particular concern among some.

While DeKaser says he's not especially worried about stagflation and sees the recent spike in inflation as temporary, he points to two main risks that could lead to it.

"First, if the Federal Reserve is too complacent about inflation, it may let the money supply get too big," he says. "Second, if the situation of temporarily elevated inflation persists for long - say, two years or more - they may get baked into expectations and lead to a cycle of self-fulfillment."