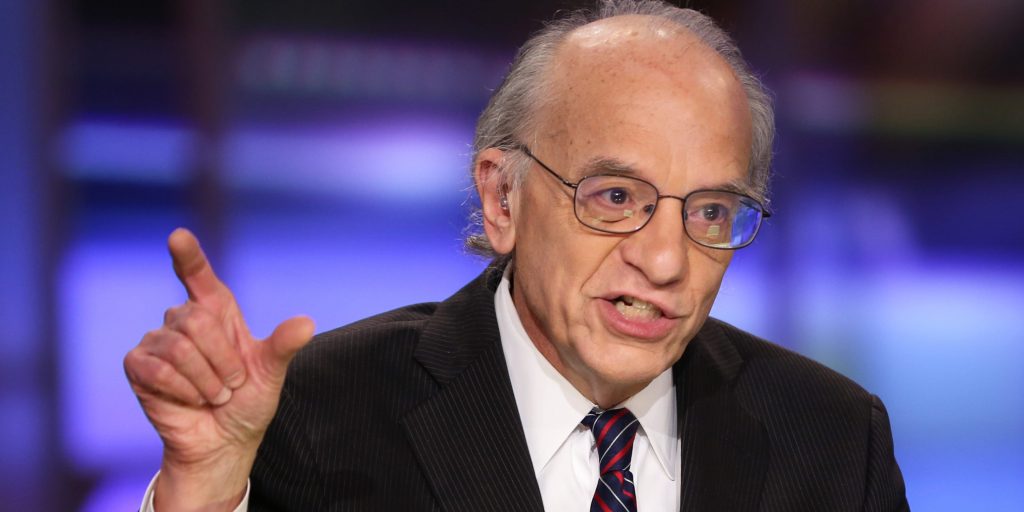

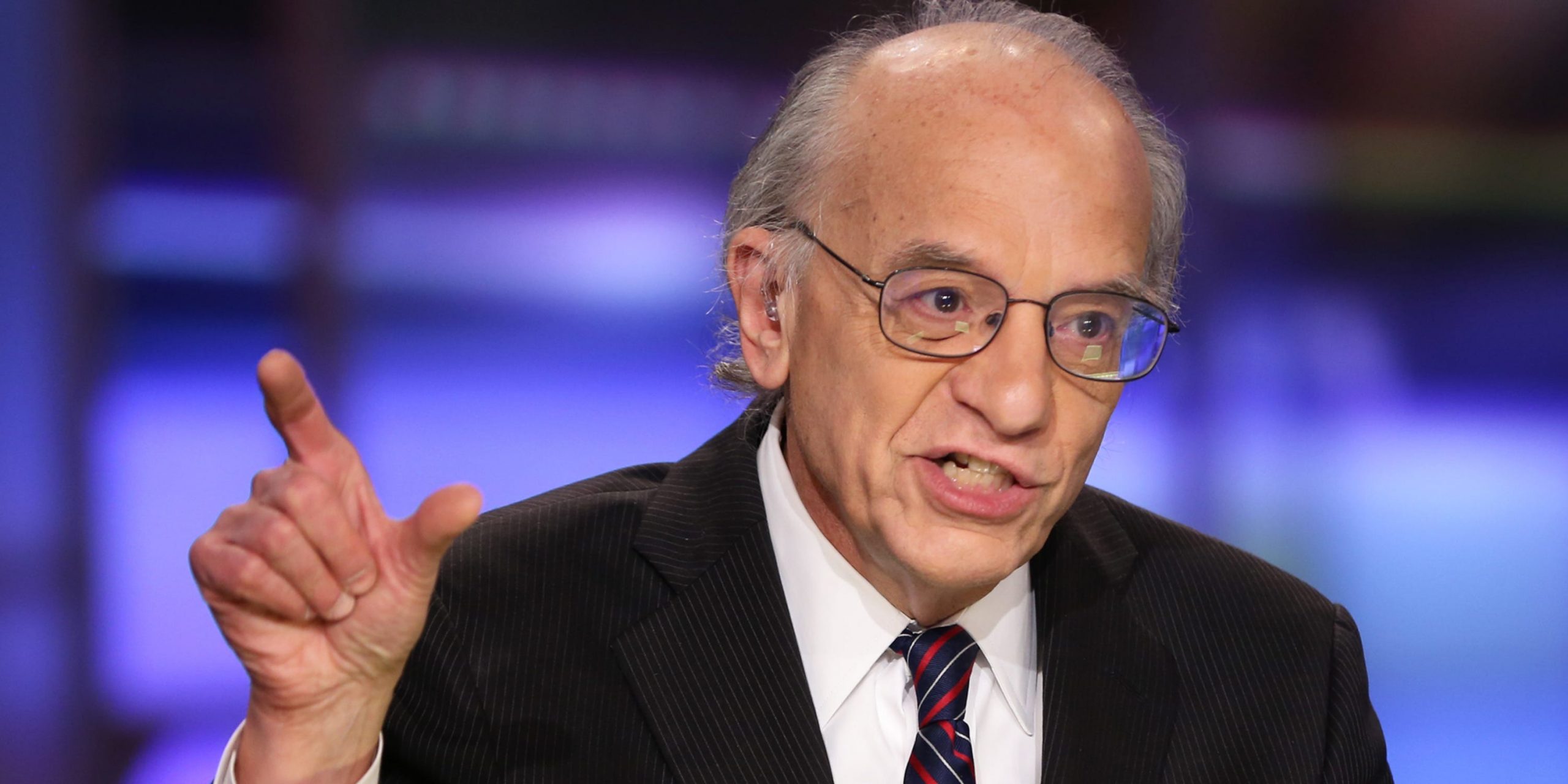

- Don't panic if stocks tumble another 10%, Wharton professor Jeremy Siegel said Monday.

- Siegel expects US inflation to run higher than the current 7% print, prompting a more aggressive Fed.

- He shared he's positioned towards value stocks that will resist rate hikes better than long-duration stocks.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Investors shouldn't worry too much about another sell-off in the stock market, according to Wharton professor Jeremy Siegel.

"I don't think anyone should panic, even if we have another five or 10% [drop]," he told CNBC's "Squawk Box" on Monday.

US shares overall have had a volatile January, with the tech-heavy Nasdaq 100 narrowly avoiding its largest drop in the first month of the year on record. The biggest theme in markets last month was undoubtedly the Federal Reserve's hawkish pivot to back-to-back interest rate hikes, in response to persistently high inflation.

The benchmark S&P 500 is down 5.2% and the Dow has fallen 3.3% so far this year, while the Nasdaq has lost 14.6%.

Siegel, who expects red-hot inflation to run even higher, warned further bold steps by the Fed are yet to come. US consumer price inflation is currently at 7%, the highest in four decades. That's well above the central bank's 2% target.

"I don't think the stock market is fully prepared for that and that's why I think there's going to be some more rocky times ahead," he said.

Even so, the finance professor said he hasn't sold any of his stocks — and will add to his portfolio if the market slides further.

"I'm going to make it work and position more towards the value stocks that I think are going to resist the rate hikes better than the long-duration stocks," he said.

In fact, he said he's waiting for the market to slide further so he can increase his exposure.

"I'm waiting for a bit more, maybe 5% to 10," he said. "I do not try to do short-term manipulation of the market. I kind of look at long-term valuation, and I see long-term valuations have been reasonable."

Siegel said last week he wouldn't be surprised if the Nasdaq falls into a bear market, a period in which the index falls by at least 20% from its historical average.

But he still has an overall positive outlook for equities.

"I'm not bearish about the stock market long-term," he said. "I still think it's very fairly valued. I just think that we got to be prepared for a much more aggressive Federal Reserve."

He's previously predicted a 9% rise for the S&P 500 this year, and suggested investors should own dividend-paying stocks to protect against rate hikes.