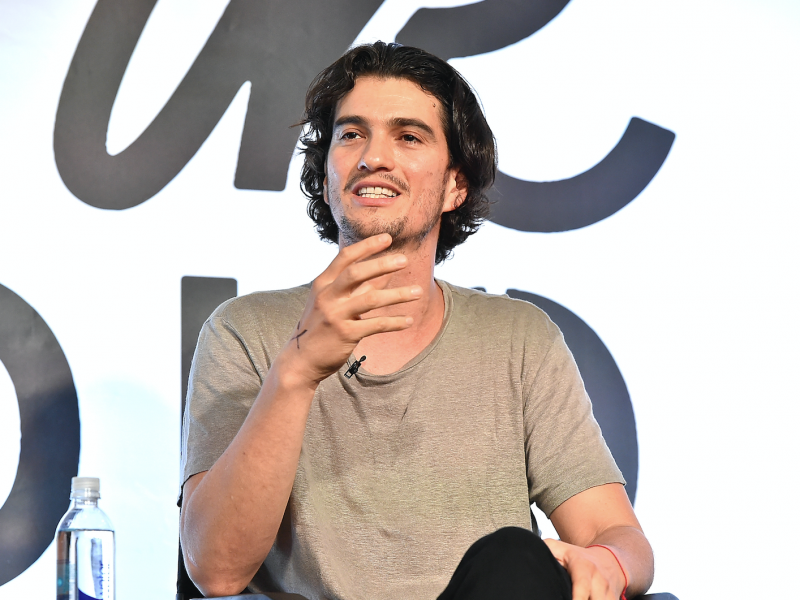

- WeWork cofounder Adam Neumann is expected to step down as chairman of the board after an IPO attempt that proved to be disastrous for the company.

- WeWork’s biggest investor, Softbank, is now reportedly taking over the company and giving Neumann $1.7 billion to step down from the board. Neumann had already stepped down as CEO in September.

- In its early days, WeWork started as one office space in the SoHo neighborhood of New York City. Now it has nearly 800 locations open or coming soon in 124 cities around the world.

- The We Company is composed of WeWork, WeLive (a co-living venture), WeGrow (a “conscious entrepreneurial school” set to close at the end of the academic year), and Rise by We (a “complete wellness experience”).

- Read all of Business Insider’s WeWork coverage here.

WeWork cofounder Adam Neumann is expected to step down as chairman of the board after giving up his CEO title in September.

WeWork’s biggest investor, Softbank, is taking over the troubled company and giving Neumann $1.7 billion ($1 billion for stock Neumann will sell, a $185 million consulting fee, and $500 million in credit) to step down, according to The Wall Street Journal.

The nine-year-old co-working-space startup publicly filed for its IPO in August as part of The We Company, and has been in turmoil since. Its IPO has been shelved, and two WeWork executives – Arthur Minson and Sebastian Gunningham – took over as co-CEOs after Neumann left his CEO post.

But before its IPO plans were plagued by uncertainty and intense scrutiny, co-founder Adam Neumann opened the first WeWork space in the SoHo neighborhood of New York City in 2010. Since then, the company has rebranded as The We Company and expanded into other ventures, including co-living subsidiary WeLive and the “conscious entrepreneurial school” WeGrow, among others.

Read on for the history of WeWork leading up to its first failed IPO attempt and the controversy surrounding Neumann.

Melia Robinson originally authored this post, which has since been updated. Additional reporting by Lisa Eadicicco.

Read more: WeWork isn't even close to being profitable - it loses $219,000 every hour of every day.

WeWork founders Adam Neumann and Miguel McKelvey met — where else? — at the office.

Neumann came to New York City in 2001, fresh off his service in the Israeli military. He started a company called Krawlers, which sold clothes with padded knees for crawling babies.

"We were working in the same building as my co-founder Miguel McKelvey, a lead architect at a small firm," Neumann told Business Insider's Maya Kosoff in 2015.

"At the time, I was misguided and putting my energy into all the wrong places," he added.

Source: Business Insider

Neumann also had an interest in real estate — he fell in love with a vacant warehouse on Water Street while he was working in Dumbo, Brooklyn.

In an interview with Fast Company, Neumann recalled approaching the landlord and asking for the building. The landlord said, "You're in baby clothes. What do you know about real estate?"

Neumann said he shot right back: "Your building is empty. What do you know about real estate?"

He and his new friend McKelvey struck a deal to start a real-estate business there: Green Desk, which still exists today.

Source: Fast Company

In 2008, Green Desk became an early incarnation of WeWork. The company offered sustainable co-working spaces featuring recycled furniture, free-trade coffee, and green office supplies.

http://instagr.am/p/BwFvEEdgQLu

Customers, called "members," could rent a desk or a private office month to month. Neumann and McKelvey made money by charging more for those spaces than their lease payments.

Green Desk offered most things individuals and small companies needed: fully furnished offices, conference rooms, high-speed internet access, utilities, printing, and a stocked kitchen.

As the economy buckled under the weight of a failing real-estate market, Green Desk thrived. Neumann hypothesized that people liked being part of a community. Some who were laid off during the financial crisis started new businesses out of Green Desk.

http://instagr.am/p/BNcJo7Uj3Bj

Source: Fast Company

Something clicked for Neumann and McKelvey. They saw that it was the focus on community, not sustainability, that drove people to Green Desk. In 2010, they sold their stake and began WeWork.

Neumann and McKelvey had $300,000 between them, low credit scores, and no building. Still, they convinced a landlord to rent them one floor of a building on a trial basis.

Source: Forbes

The first WeWork location was just 3,000 square feet in a tenement-style building in SoHo. It had creaky floorboards and exposed brick, which the founders power-washed clean.

Source: Forbes

Early on, Neumann and McKelvey imagined office rentals as part of an ecosystem, complete with apartments, gyms, and even barber shops, that served the concept of a communal life.

"It was always thought of, 'How can we support this person who wants to live more collectively, live lighter - who wants to have less stuff, who wants to pursue their passion, pursue a life of meaning, rather than looking for just material success?'" McKelvey told Business Insider.

Source: Business Insider

They used their flagship location in Soho (which reportedly turned a profit one month after launch) to host developers and investors and grow the WeWork brand.

Source: Forbes

WeWork opened four more locations in the next two years. It caught the attention of Benchmark, a top venture capital firm that made early bets on Twitter and Uber.

Benchmark led a Series A funding round of $17 million, pushing WeWork further into growth mode. WeWork shot up to 1.5 million square feet of space and 10,000 members by 2014.

As even more venture funding flowed in, the number of WeWork locations skyrocketed.

Source: Business Insider, Forbes

WeWork opened its first international office in 2014 in London.

Source: Built In NYC

In an effort to diversify its revenue streams, WeWork got into residential real estate in 2016. WeLive provides fully furnished micro-apartments. People can join these communities and instantly tap into amenities like free internet, maid service, and new friends.

"In the big picture, we see WeLive as a huge opportunity, as big as WeWork, for sure," McKelvey told Business Insider. "I think we're lucky to have a good foundation in place where people trust us and are interested in the product."

Source: Business Insider

In 2017, WeWork announced its WeGrow endeavor, a "conscious entrepreneurial school" for children 2 to 11-years-old.

Sources: WeGrow, Business Insider, Business Insider

WeWork bought Lord & Taylor's flagship store building in New York City in October 2017 for $850 million.

Sources: Business Insider, WeWork

Also in October 2017, WeWork opened its first gym. Rise by We is located at 85 Broad Street in New York City. It offers yoga, boxing classes, and a "superspa."

Source: Business Insider, Business Insider

WeWork confidentially filed IPO paperwork in December 2018 as The We Company. Neumann announced the filing four months later in April 2019.

Source: Business Insider

The We Company publicly filed its S-1 IPO paperwork in August with a $47 billion valuation.

The filing provides the first in-depth look at WeWork's financial results. The document shows spiraling losses over the last 3 years, with the firm posting a loss of $1.6 billion 2018 on revenue of $1.8 billion.

It also reveals that CEO Adam Neumann volunteered to forgo a salary for 2018.

Source: Business Insider

After the filing, WeWork faced intense scrutiny of its finances and leadership from investors and the media.

There were concerns about WeWork's path to profitability and its leader, CEO and cofounder Adam Neumann. As a result, investor interest was weak, and the company considered cutting its valuation by more than 50%.

In early September, The Wall Street Journal and Bloomberg had reported that The We Company was considering a valuation around $20 billion for its IPO. By mid-September, Reuters reported that the We Company was considering a valuation as low as $10 billion for its IPO.

Sources: Business Insider, Business Insider, The Wall Street Journal, Bloomberg, Reuters

Read more: WeWork just filed to go public - here's how its billionaire CEO spends his money

WeWork delayed its IPO on September 16.

Source: Business Insider

After the delay, attention shifted to the management style of Adam and Rebekah Neumann.

Reports were written about Adam smoking weed on a private jet, serving employees tequila shots after discussing layoffs, and trademarking the term "We" and then forcing WeWork to buy it for $5.9 million.

Rebekah reportedly demanded employees be fired within minutes of meeting them because she disliked their "energy."

Neumann stepped down as WeWork's CEO on September 24.

WeWork named two of its executives, Sebastian Gunningham and Artie Minson, as co-chief executives. Neumann would continue as chairman of the company.

It became clear WeWork was in financial trouble.

WeWork spiraled from a $47 billion valuation to talk of bankruptcy in just 6 weeks.

WeWork began selling off businesses it had acquired and planning employee layoffs. Its bonds plummeted to records lows. It announced the forthcoming closure of its WeGrow school.

By early October, WeWork was looking for multi-billion dollar lifelines from JPMorgan and Softbank.

WeWork's biggest investor, Softbank, is now reportedly taking over the company and giving Neumann $1.7 billion to step down as chairman.

According to the The Wall Street Journal, the breakdown of SoftBank's package to Neumann looks like: $1 billion for stock Neumann will sell, a $185 million consulting fee, and $500 million in credit.

Meghan Morris contributed to this report.

WeWork declined to comment for this article.