- Thomas Minter, 33, lived and worked abroad for over three years before relocating to the Bay Area and buying a small, one-bedroom condo.

- By increasing revenue streams, Thomas is on a mission to reach financial freedom before he turns 40. He writes about this journey on his blog, City for Millennials.

- For Business Insider’s “Real Money” series, Thomas shares how he spent his money during a week in August.

- Want to share a week of your spending? Email your [email protected].

I knew moving to the San Francisco Bay Area was going to be expensive. I was prepared…or so I thought.

My 20s were a decade of adventure, risk taking, and good fortune. During my last semester of graduate school, I applied for a job with this description:

“Must feel comfortable working long days in remote areas of the world. May work from helicopters, on boats, or walk many miles by foot. This position will require extensive travel, sometimes with only 24-hours notice.”

I got the job, and two weeks later, I was on a plane to Haiti, where I spent the next few months supporting a USAID earthquake response effort.

Later that year, the Deepwater Horizon Oil Spill occurred. I flew back to the US, and hopped on an airboat for a year. Saudi Arabia was next. Three years in-country, working on a large scale marsh restoration program.

I loved the adventure. I also loved the cash flow and tax minimization that came with living and working abroad.

During this time, I prepared my personal finances for an eventual move back to my home state of California. $80,000 of student loans eliminated. $75,000 invested. $30,000 home equity. $25,000 cash.

At 29, I felt financially ready to plant roots in the Bay Area. Boy, was I in for a surprise.

As mentioned, I knew the cost of living would be high. But, if I had known the magnitude, I may have done a few things differently.

I soon learned that the average income needed to afford a median-priced home in the San Francisco Bay Area is $187,000 ($334,000 in the city proper). In my search for a place to live, I came across listings that I thought were a joke. They weren't. So much cost for so little house.

Luckily, I landed a small 700-square-foot, one-bedroom condo in Oakland...for $441,000. An identical unit next to me just sold for $520,000.

In my 20s, I gallivanted around the world, making more money than I knew what to do with.

Now, I live frugally in one of the most expensive areas in the world. But I couldn't be happier.

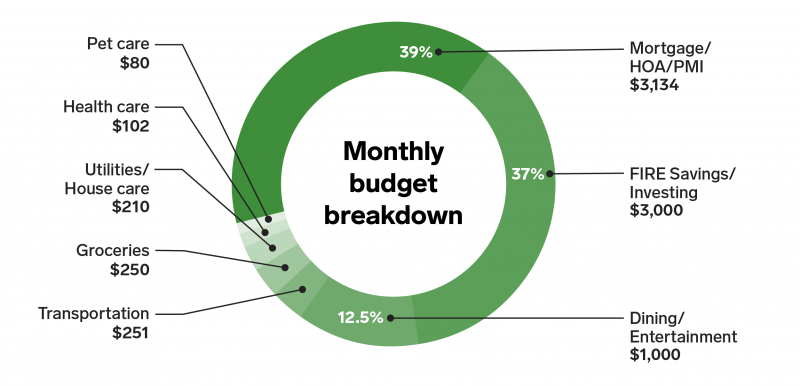

Here's a look at my monthly spending (not my including fiancée's spending or expenses), which totals around $8,027. My biggest expense is housing, followed by aggressive retirement contributions which I can cut back on if needed.

Yes, our situation could be worse. We are very lucky. My fiancée and I both have decent jobs - I'm a market strategist and operations manager at an engineering firm and she's an environmental planner. Our combined annual income is about $200,000 (before any bonuses). We also work multiple side hustles, including freelance writing and food delivery, and have the ability to save for our future retirement. But we work very hard to achieve this, and we have to be strategic with our spending.

According to theBureau of Labor Statistics, the average American spends over 60% of their income on housing, food, and transportation. When you add in healthcare, entertainment, and clothing expenditures, there is little to nothing left over to save, particularly if you live in a high cost of living area.

We decided to reduce the top three expenses (housing, food, and transportation) as much as we could. As you can see, housing is my single largest cost. Since I own our condo, we are building equity over time, as opposed spending money on rent. The mortgage is on par with the rental costs in the area.

Currently, we are evaluating a duplex purchase with the intention of moving into one of the units. We would cover half of the mortgage by renting out the other unit. This is called house hacking, and may reduce our housing costs over time. But for the time being, we are unable to reduce our housing costs any further.

Our monthly food costs fluctuate based on how often we eat out. We save over $500 by eating at home every day for a week during a month. This simple lifestyle adjustmentadds up over the year. Lastly, when we shop for groceries we take advantage of cash back and rewards apps which helps us reduce our food costs even further (and we split the total cost).

As for transportation, we only use the car one day a week. We ride our bikes most places. Great savings and amazing exercise - especially on the hills of San Francisco!

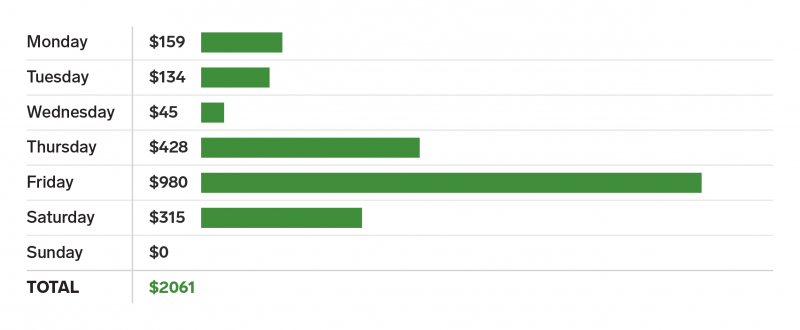

During a recent week in August, I spent about one-fourth of my typical monthly spend, including one $0 day.

August may be the best month to spend outside in the Bay Area.Karl the Fogtypically goes on vacation, so the skies are clear, and the views are incredible.

My favorite activities include cycling around the Marin Headlands, hiking in the East Bay Regional Parks, or watching our dog gallop along the sandy beaches.

Unfortunately, nearly every activity comes with a high price tag in the San Francisco Bay Area. For those trying to reachfinancial freedom while living in an expensive city, you need to get creative to spend less and make more.

Since we are getting married at the end of the month, I have not been doing the best job at spending less.

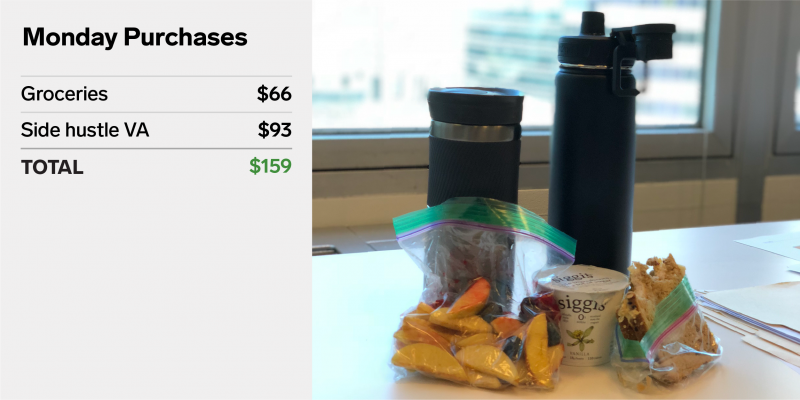

On Monday, I was determined to start the week off right and save money by bringing my lunch to work.

I work in Downtown Oakland. The San Francisco culinary influence stretches across the SF Bay, and with it, the big-city prices. On average, if I eat lunch out during the weekday, I prepare for a $15 bill.

In an attempt to save money on weekly food costs, my fiancée, Rachael, and I try and bring our lunches to work during the week.

Today, I brought my lunch to work and ate both breakfast and dinner at home.

To optimize our evenings together, Rachael and I order our groceries online with Amazon Prime Now. This frees up time for some exercise after work before we start working on our side gigs.

We have our food for the week delivered on Mondays. Our total grocery bill added up to $134.58 today (of which I paid half, $66.29).

My largest expense today was $93.33 to a virtual assistant who helps manage my blog's social media presence.

We are social on Tuesdays and typically go to our favorite running club. This week, we also went to our wine club.

Transportation costs in the Bay Area can be a concern. There are multiple tolls, and traffic is brutal. I made the decision to live close enough to bike to work in order to avoid high commuting costs.

Unfortunately, I had to drive to a satellite office today (60 miles round trip). Typically, we can go a whole month on a single tank of gas. Today, however, that tank was empty so we spent $40.37 on gas.

Recently, electric scooters have flooded the streets to help solve micro-commute problems in big cities. Did you know you can make extra cash by charging these shared vehicles? I started charging these scooters overnight to make additional cash.

My fiancée is a social butterfly. She is also an amazing athlete. After work, we ran to our Tuesday night run club ($10 beer, plus 2-mile run). Next, we ran to our wine club pick up party ($75 wine case, 3-mile run, and a $6.18 Lyft ride home).

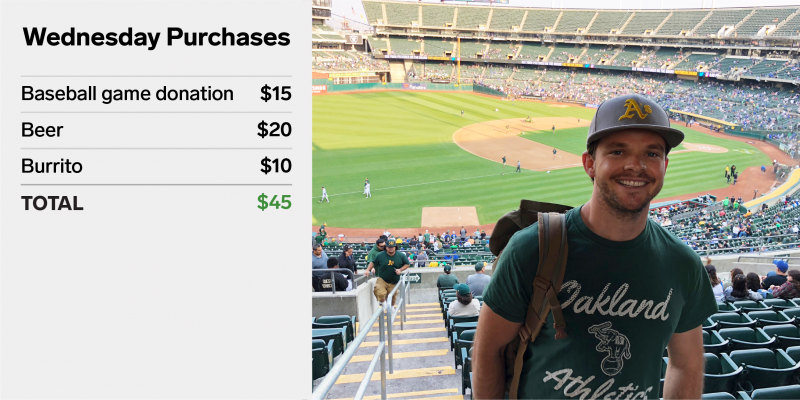

Wednesday was all about baseball, beers, burritos, and birthdays.

I grew up a Dodgers fan in Los Angeles, but I am also a closet Oakland A's fan. Shh! So when they played each other in Oakland, I was quite conflicted.

On Wednesday, I decided to support the A's by sporting some green and yellow. I attended a friend's birthday party in a box suite at the stadium. Luckily, my buddy and his partner fronted the bill in exchange for donations to a cycling event that supports both the San Francisco Aids Foundation and the Los Angeles LGBT Center.

Next year will be my third time biking from San Francisco to Los Angeles to raise money for the AIDS/Lifecycle. Tonight, I donated $15 to the birthday boy to support his ride.

I'm a sucker for Mexican food, so I had to splurge on a $10 stadium burrito. Typically, it's all hot dogs and peanuts at baseball games, but not this Wednesday (mistake, it was awful).

The beers were $10 each. I had two. Cheaper than at Giants games (or many Bay Area bars for that matter).

The A's won, by the way.

Thomas' Taco Thursday and a little bit of Salsa... or was it Tango? A $60 dance class was well worth it.

I woke up on Thursday a little disappointed with my spending during the A's game. Thus, I decided to make all of my meals at home today.

Our 75-square foot kitchen takes up a little over 10% of our 700-square-foot condo. In total, our monthly housing expenses are $3,134, which means we spend over $300/month for our kitchen.

The way I see it, if our kitchen costs this much, we may as well use it! If we can save $300 per month by avoiding restaurant costs, the kitchen pays for itself.

Thomas' (Homemade) Taco Thursday was amazing.And so was dancing. Rachael and I are getting married at the end of August, so we are practicing for our first dance. While we both like to shake our booties on the dance floor, it was clear after our $60 class that we needed the lesson. Our first dance will be much more magical with the skills we picked up.

We continued to practice at home later that evening.

Friday was date night, which included an hour-long wait for our reservation, of course (it's the Bay, after all).

We like to budget for at least two dinner date nights a month. We wish we could splurge more often, however, even the smallest meal plus drinks will cost over $100.

Tonight we went to our favorite local hot spot. This renovated, industrial warehouse offers eclectic small plates, cocktails, and songs spun by a DJ. It is always crowded. Tonight we waited over an hour for our table. Typical for the Bay.

We ordered their famous no-cheese mac & cheese, roasted brussels sprouts, fried chick, and a soft shell crab po' boy. All are small plates, but come with a large bill. Add two glasses of wine and we walked out of there $108.86 poorer. I ate a snack at home later that evening.

Saturday was an exciting, yet expensive day, filled with quality family time...

Oh, and some shopping - I really hate shopping.

The day started with a bang! (literally), the 5k race gun went off at 8 a.m. My sister was in town, and we joined up with our running club, along with others from the community to run in support of a local nonprofit. All proceeds will go towards running shoes for young kids in the community. I donated $45, which included food and fun.

Afterwards, we went wedding craft supply shopping ($192.80). Shopping and crafting are not my strong suits, so I opted to pick up some coffee ($8.85) and snacks ($10.04) for the girls. I found a Starbucks in the Target across the street, and took my time on the way back.

We concluded our busy day by hosting our neighbors for dinner and wine ($58.07).

Sunday was craft day... and I didn't spend a dime!

I managed to avoid spending any money by eating leftovers and staying in. Minus walking our dog, Princess Daphne, I didn't leave the condo. Sometimes you have to hide out to avoid spending money in the San Francisco Bay Area!

Sunday was fun, however. I learned that I actually like crafting when it is for our wedding.

Don't get me started on how much it costs to plan a wedding in the Bay Area. Yikes!