- Warren Buffett and his right-hand man Charlie Munger advised Coca-Cola not to enter the cannabis business.

- Buffett’s Berkshire Hathaway is the largest investor in the soft-drink maker, owning a $19.5 billion stake.

- Coca-Cola earlier this year held talks with the cannabis producer Aurora Cannabis about teaming up to make CBD-infused beverages. The talks ultimately failed.

- Watch Coca-Cola trade live.

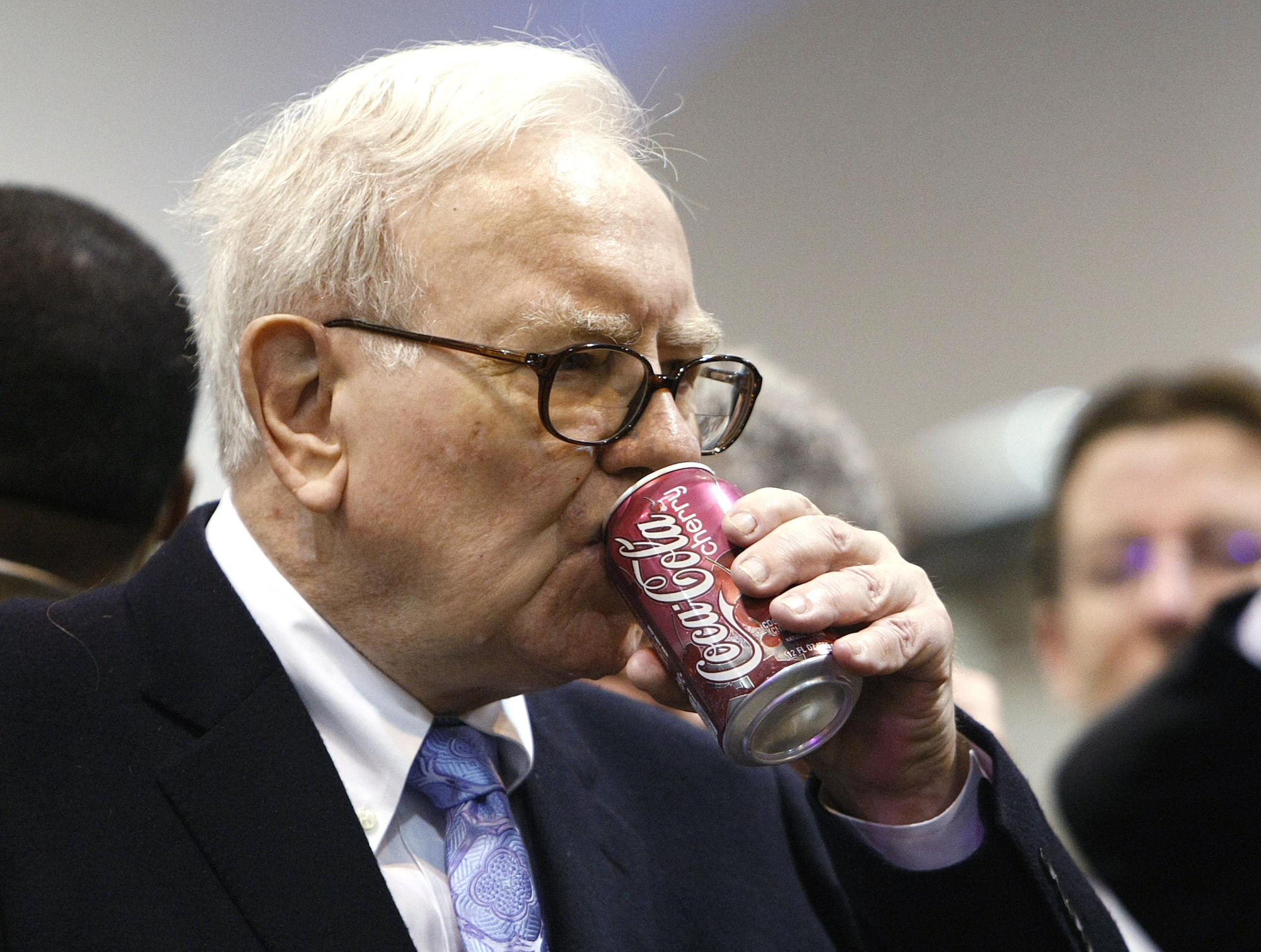

Warren Buffett loves Coca-Cola.

So much so that he drinks five cans of the product a day. Additionally, his company, Berkshire Hathaway, is the largest shareholder of the soft-drink giant, owning a nearly 10% stake worth $19.5 billion.

So let’s just say that when Buffett talks about Coca-Cola, its management likely listens. And they might not like what he and his right-hand man, Charlie Munger, had to say on Friday.

“It would be a mistake for Coca-Cola to get into the marijuana – cannabis business,” the duo told Fox Business News’ Liz Claman. “They have a wholesome image and that would be detrimental to it.” Coca-Cola did not immediately respond to Markets Insider’s request for comment.

In September, Bloomberg reported Coca-Cola had its eye on entering the cannabis space after the beverage makers Constellation Brands and Molson Coors announced their own investments in the industry.

Talks with Aurora Cannabis to produce CBD-infused beverages ended a month later without a deal coming to fruition and executives have said that the company does not plan on getting into the cannabis space anytime soon.

But, Coca-Cola could be missing out on a huge opportunity if it heeds Buffett's advice. The burgeoning CBD market in the US alone is expected to explode from $1 billion in 2019 to $16 billion by 2025, according to Cowen analyst Vivien Azer. And the market is already rapidy expanding.

Given the potential, Coca-Cola may have to ignore Buffett and Munger to take advantage of an opportunity the company can't afford to miss.