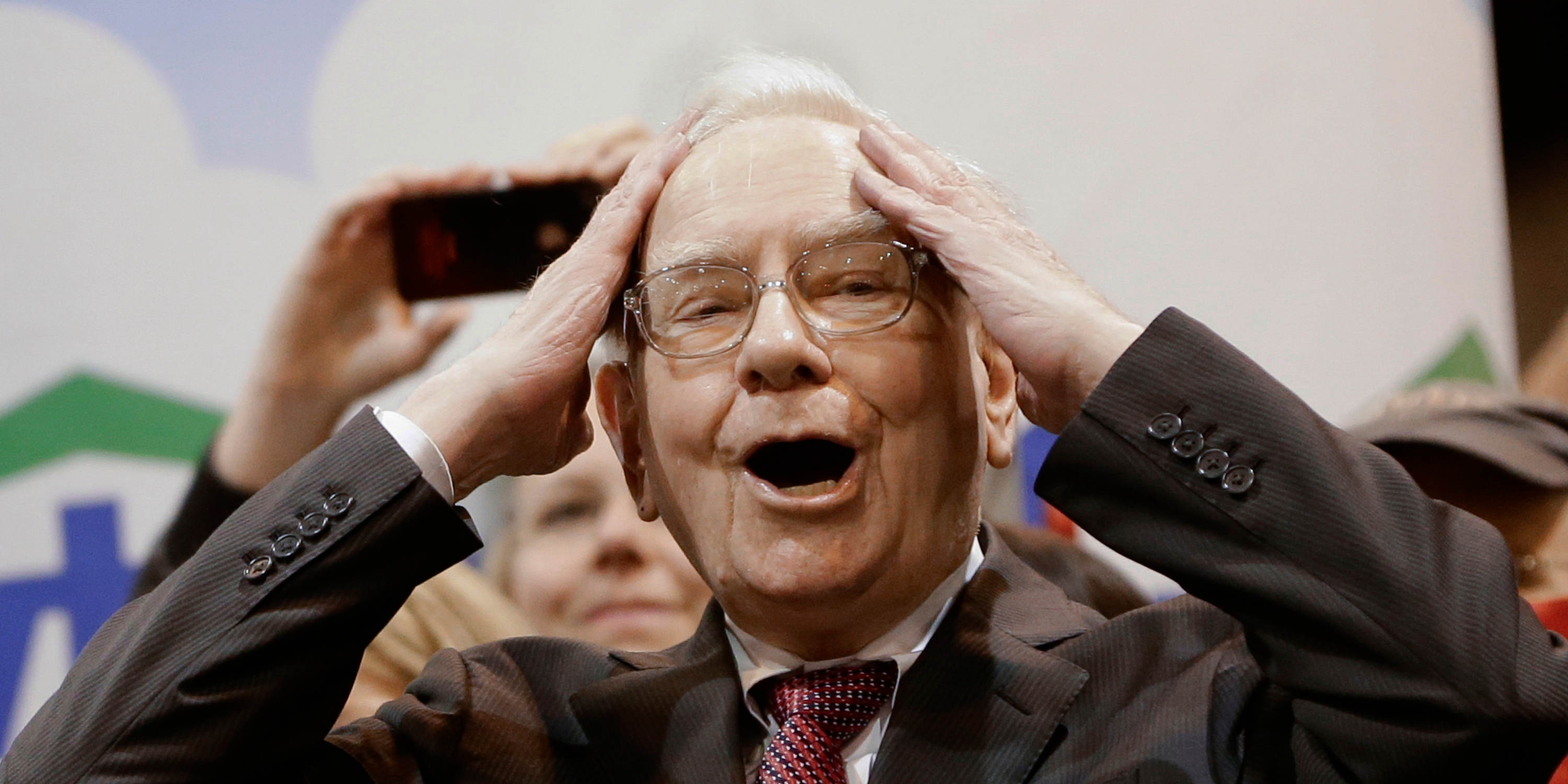

- Warren Buffett’s preferred market gauge has jumped to its highest level since October 2007, suggesting worldwide stocks are the most overvalued since the financial crisis.

- “Buffett indicator sounds the alarm,” Welt market analyst Holger Zschaepitz tweeted. “Global stock mkt cap has now topped 120% of global GDP, and thus the same level as before the crash in 2008.”

- Buffett described the indicator in 2001 as “probably the best single measure of where valuations stand at any given moment.”

- The famed investor said it “should have been a very strong warning signal” when the indicator hit a fresh high before the dot-com bubble burst.

- Visit Business Insider’s homepage for more stories.

Warren Buffett’s favorite market indicator surged to a 13-year high on Sunday, signaling global stocks are the most overvalued since the financial crisis and ripe for a correction.

The global version of the “Buffett indicator” takes the combined market capitalizations of publicly traded stocks worldwide and divides it by global GDP. A reading north of 100% suggests the global stock market is overvalued relative to the world economy.

The gauge climbed past 121% last weekend, Bloomberg data shows, marking its highest reading since October 2007. Welt market analyst Holger Zschaepitz flagged the worrying milestone in a tweet.

"Buffett indicator sounds the alarm," he said. "Global stock mkt cap has now topped 120% of global GDP, and thus the same level as before the crash in 2008."

Buffett trumpeted the indicator in a Fortune article in 2001. The billionaire investor and Berkshire Hathaway CEO described it as "probably the best single measure of where valuations stand at any given moment."

It "should have been a very strong warning signal" when the gauge soared to a record high shortly before the dot-com crash, he added.

However, the gauge is far from perfect. For example, it compares current stock valuations to GDP last quarter, and there is significant variation in the quality and frequency of GDP data across different countries.

Moreover, the coronavirus pandemic has sparked widespread economic restrictions that have artificially depressed GDP in recent months. Stocks have also benefited from extraordinary stimulus efforts by governments seeking to shore up their economies as they weather the current crisis.

Here's the global version of the Buffett indicator: