- Warren Buffett’s preferred stock-market gauge hit a 30-month high this week, signaling worldwide equities are overvalued and may be due for a correction.

- The global version of the “Buffett indicator” – which compares the value of the world’s stocks to global GDP – zoomed past 100% for the first time since February 2018.

- The landmark was first spotted by Welt market analyst Holger Zschaepitz on Twitter.

- Buffett said in 2001 that when the indicator hit a record high in the months before the dot-com crash, it “should have been a very strong warning signal.”

- Visit Business Insider’s homepage for more stories.

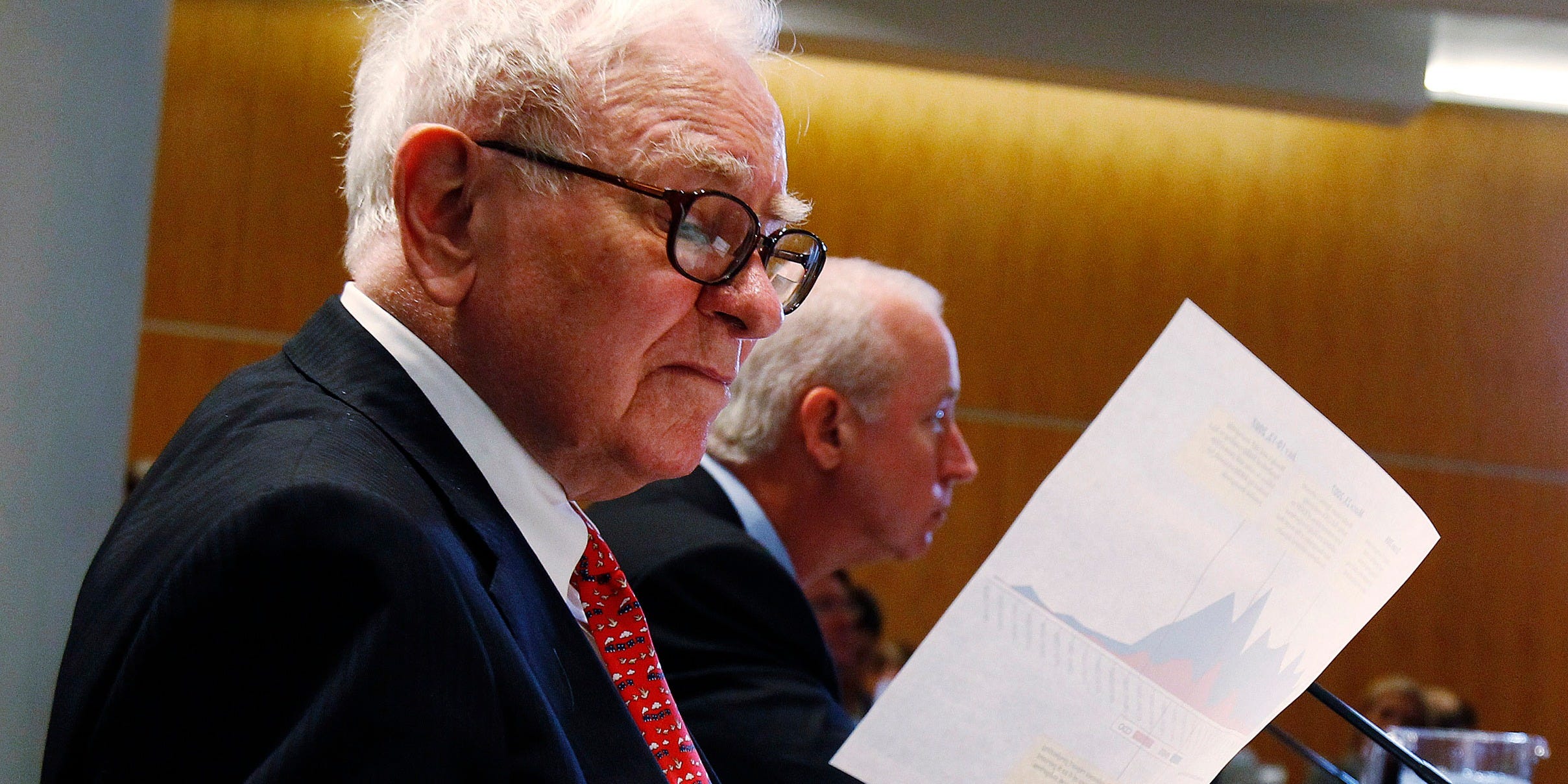

Warren Buffett’s favorite stock-market indicator climbed to a 30-month high this week, suggesting world stocks are overpriced and a correction may be around the corner.

The global version of the so-called Buffett indicator passed 100% this week for the first time since February 2018. The milestone was first highlighted by Welt market analyst Holger Zschaepitz on Twitter.

The gauge takes the combined market capitalizations of publicly traded stocks worldwide, and divides it by global GDP. A reading of more than 100% suggests the global stock market is overvalued relative to the world economy.

Buffett, the billionaire investor who runs Berkshire Hathaway, praised the indicator in a Fortune magazine article in 2001 as "probably the best single measure of where valuations stand at any given moment."

It "should have been a very strong warning signal" when the measure soared to a record high in the months before the dot-com bubble burst, he added.

However, the gauge has its fair share of flaws. For example, it compares current stock valuations to GDP last quarter, and not all countries provide regular, reliable GDP data.

The indicator's current level underlines the striking gap between sky-high stock valuations and depressed economic growth in countries around the world due to the coronavirus pandemic.

Stocks have benefited from aggressive intervention by governments and central banks to bail out companies and shore up markets.

Meanwhile, the global economy continues to suffer from authorities' efforts to combat the virus. Measures include shutting non-essential businesses, restricting travel, and encouraging people to stay at home.

The Buffett indicator for the US has also soared to an all-time high during the pandemic, as the main US stock indexes have almost fully rebounded from the coronavirus crash earlier this year, while GDP plummeted in the second quarter.

Here's the global version of the Buffett indicator: