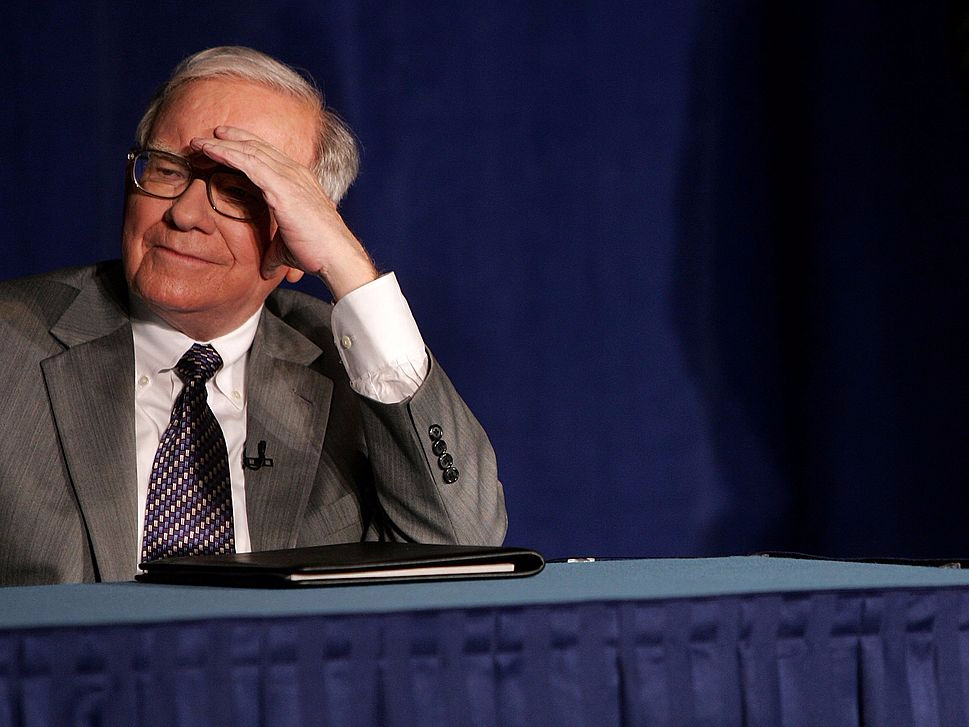

One of the most quoted Warren Buffett-isms is “be fearful when others are greedy and greedy only when others are fearful.“

And in the most recent annual letter to shareholders from Berkshire Hathaway, the billionaire investor once again touches on that theme a couple of times.

“Charlie [Munger] and I have no magic plan to add earnings except to dream big and to be prepared mentally and financially to act fast when opportunities present themselves,” he writes in a section detailing what Berkshire Hathaway hopes to accomplish going forward.

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.”

Later in the letter, he details that line of thinking in broader terms, relative to the broader American economy.

He writes in the letter [emphasis ours]:

"American business - and consequently a basket of stocks - is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. [... Nevertheless] many companies, of course, will fall behind, and some will fail. Winnowing of that sort is a product of market dynamism. Moreover, the years ahead will occasionally deliver major market declines - even panics - that will affect virtually all stocks. No one can tell you when these traumas will occur - not me, not Charlie, not economists, not the media. [...]

During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted. Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well."

For what it's worth, Buffett is not the only person who has articulated this line of thinking over the course of history.

Napoleon once said that: "Men are moved by two levers only: fear and self-interest."

And, he defined "military genius" as "a man who can do the average thing when all those around him are going crazy." As some have pointed out, the same can be said of investing.