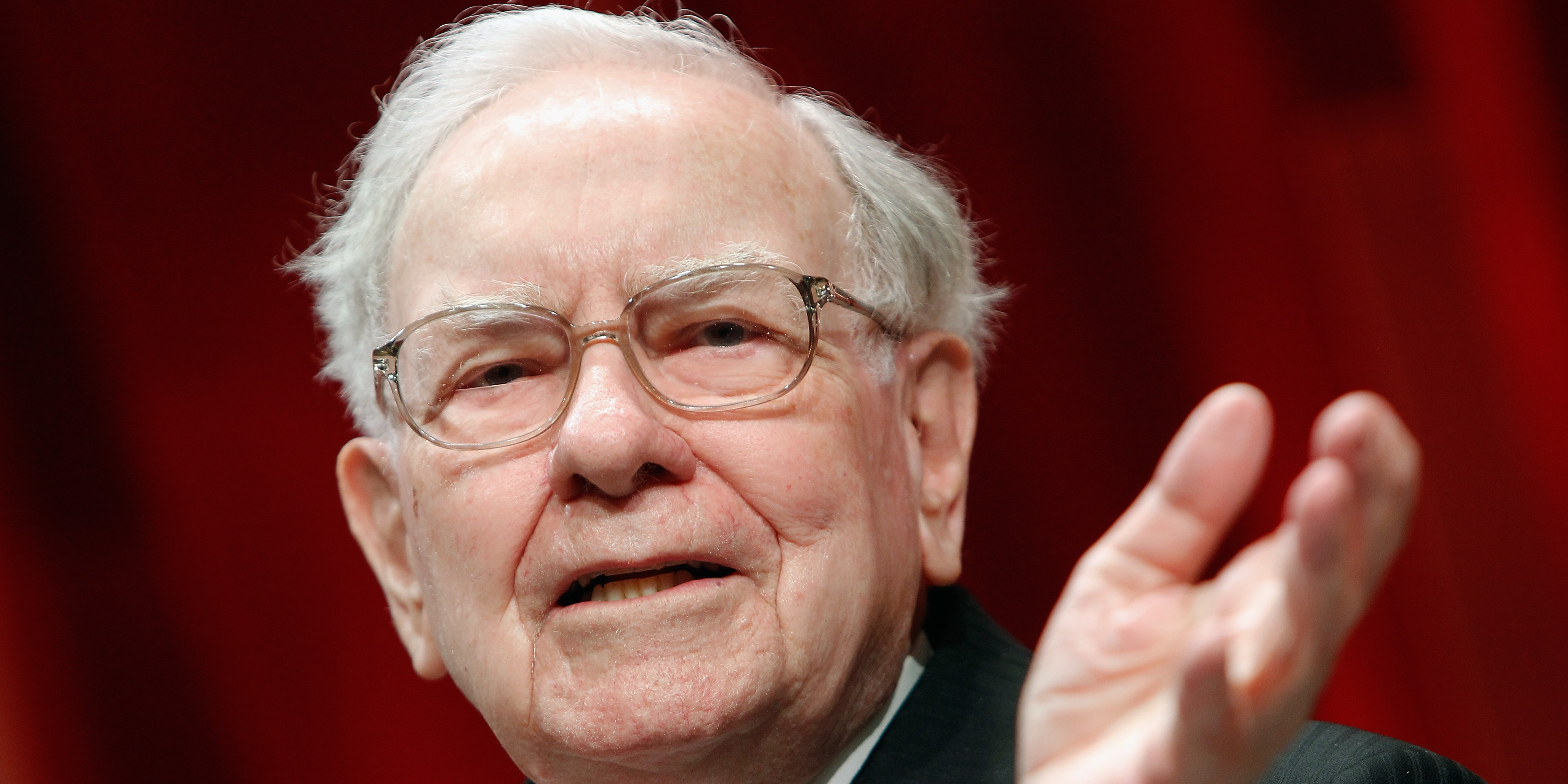

- Warren Buffett’s Berkshire Hathaway sold the “big four” airline stocks in April, the famed investor revealed at Berkshire Hathaway’s annual meeting on Saturday.

- “It turned out I was wrong,” Buffett said about his decision to invest in them.

- Berkshire’s first-quarter earnings revealed that it sold $6.1 billion in stock in April, and Buffett attributed that figure to its exit from the airlines.

- Buffett said that carriers could be left with “too many planes” if people fly less than they did before, and they would have to repay some of their recent government loans.

- Visit Business Insider’s homepage for more stories.

Warren Buffett’s Berkshire Hathaway sold the “big four” airline stocks in April, the famed investor revealed at Berkshire Hathaway’s annual meeting on Saturday.

“It turned out I was wrong,” Buffett said about his decision to invest in the airlines. The companies are well managed and the CEOs “did a lot of things right,” he continued, but “the airline business … changed in a very major way.”

Berkshire’s first-quarter earnings revealed that it sold $6.1 billion in stock in April, without detailing what it sold. Buffett attributed that figure to Berkshire’s exit from the airlines.

Buffett explained the move by highlighting the airlines' bailout deals with the US government. Their agreements include billions of dollars in loans that they will have to repay, as well as warrants that the Treasury can exercise to acquire their shares at a discount in the future. The warrant part of the deal was inspired by Buffett's bailouts of Goldman Sachs and other companies during the financial crisis.

The investor also questioned whether people will fly as much in the next two or three years as they did last year. Even if passenger volumes bounce back to 70% or 80% of their pre-coronavirus levels, he said, the carriers will be left with "too many planes."

"The future is much less clear to me," Buffett said about the airline business.