Hi. I'm Aaron Weinman. I want to highlight a conversation I had with Dr. Anthony C. Hood, an executive vice president and chief diversity officer at First Horizon Bank.

Dr. Hood is pretty frank when it comes to banks addressing (or not addressing) their DEI initiatives, and he sat down with me to run through it all.

Shall we?

If this was forwarded to you, sign up here. Download Insider's app here.

Financial institutions and corporations overcomplicate the matter of diversity, equity, and inclusion. That's the view of Dr. Anthony C. Hood, the chief DEI officer at First Horizon, a Southeastern regional bank that's being acquired by Toronto-Dominion Bank.

"If it were easy, we'd have already addressed it," Dr. Hood told Insider. "But we have a tendency to overcomplicate it."

In financial services, companies don't apply DEI programs with the same "rigor and vigor" as they do with financial performance, Dr. Hood said.

"We do forecasting for loan growth, deposits, credit worthiness, you name it. Oftentimes, when it comes to DEI, that's where it stops," he said.

It's no easy feat. Both Wall Street and Main Street finance tend to be very white, male-dominated. Big financial institutions love Ivy League schools, and for many poorer high-school students, those expensive schools are often a pipe dream.

But Dr. Hood is applying what he believes is a simple, transparent process to an age-old problem in banking.

He wants to take data analytics and insights and apply them to talent searches. Questions like: What percentage of people across different races and genders progress through First Horizon's pipeline?

"Are we presenting that data on a monthly basis to our leaders in the same way we're presenting data on deposits and things like that? That's the focus we're taking now, because we want to present our leaders with DEI data in the same way they're accustomed to looking at financial performance," he said.

Dr. Hood also wants more diverse groups of people being provided pathways to better-paying jobs in banking like credit analysis, portfolio management, and commercial-banking roles.

"You find a lot of diversity at the entry level, particularly retail banking. But how do we be more intentional about opportunities in commercial banking? It's about being intentional about the pathways and pipelines for employees," he said.

He's also a big advocate for historically Black colleges and universities as sources of greater talent pools. And he believes that First Horizon, headquartered in Memphis, Tennessee, needs to be on the front foot. The state has the 10th highest number of Black Americans (17%) in the US, according to the World Population Review, and boasts well-known HBCUs like Fisk University and Tennessee State.

"First Horizon operates where you have the largest concentration of HBCUs and Hispanic Serving Institutions. Having those partnerships with those institutions creates pipelines to bring in new talent," he said.

Here's more about DEI on Wall Street:

- Meet Harold Butler, the 17-year Citi banker who leads the firm's diverse financial-institutions.

- How Black-owned private-equity firm Red Arts Capital spreads the wealth from supply-chain investments.

- Social bonds are on the rise, but issuers and investors are still learning the merits of this new-age debt instrument.

- Meet seven bankers from minority-owned investment banks that are proving they can lead deals like Wall Street's biggest lenders.

In other news:

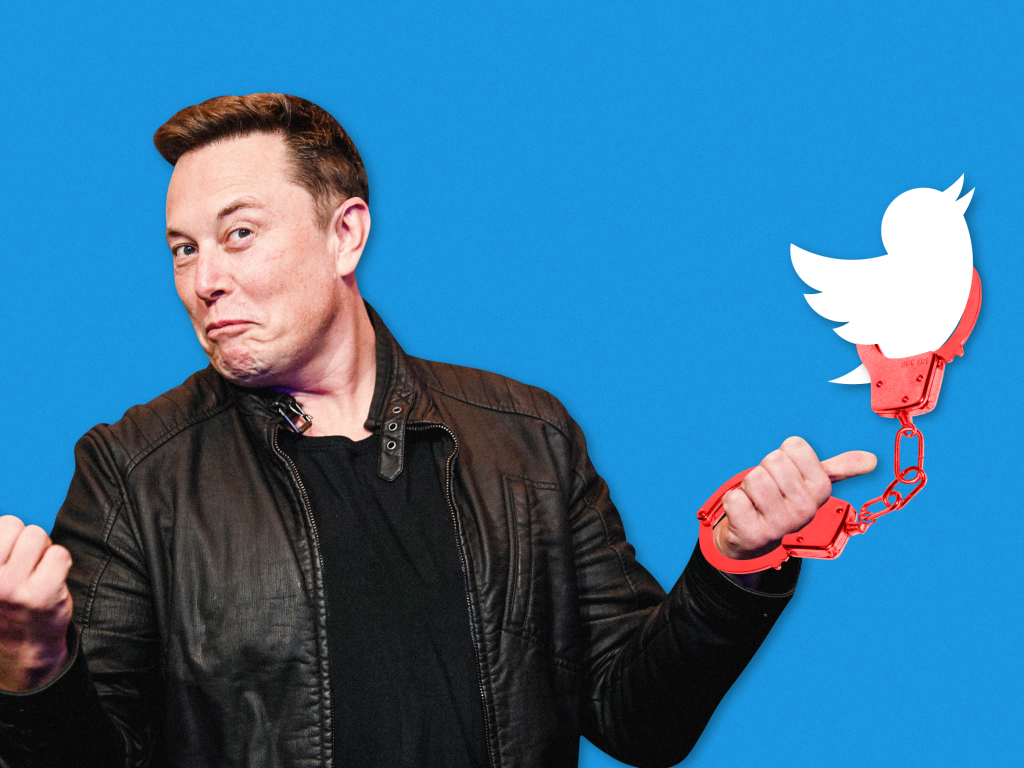

2. Elon Musk has teased a new website, "X.com," as a potential Twitter competitor. If the site were to become an alternative to Twitter — which Musk agreed to buy for $44 billion in April, but now doesn't want — he would likely focus on eradicating bots and minimizing censorship.

3. Bank of America plans to start fresh talks with investors next week over a $15 billion debt financing to support the buyout of Citrix Systems. Vista Equity Partners and Elliott Investment Management agreed to buy Citrix in January, but the debt — underwritten by BofA, Credit Suisse, and Goldman Sachs — has been difficult to sell amid volatile public markets, Bloomberg reported.

4. Ken Griffin spent $43 million to buy a rare copy of the US Constitution, according to this story from the Wall Street Journal. Go inside the Citadel founder's decision to outbid crypto investors for the document, one of just two in private hands.

5. Wendy's deals a blow to SoftBank-backed Reef as the burger chain cuts its ghost-kitchen-expansion plans. The company has reduced the number of Reef locations after reevaluating the operation.

6. The US Securities and Exchange Commission has proposed a rule to improve the quality of disclosures from large hedge funds. The rule is part of a broader regulatory effort to increase transparency of private funds amid worries that the industry is a growing source of systemic risk, Reuters reported.

7. Fix-and-flip loans can go bad even in good markets. One residential lender just got fined by the SEC for trying to hide delinquencies of loans in a $90 million bond deal.

8. Citi has hired Bari Spielfogel as its head of global inflation products, according to Bloomberg. Spielfogel previously worked at the securities unit of UBS and in 2017 was one of Insider's rising stars among Wall Streeters aged 35 and younger.

9. Investors have poured $548 million into neuroscience biotechs this year. Meet the 10 startups that have raised the most cash.

10. JPMorgan gold traders were found guilty in a Chicago spoofing trial, according to Bloomberg. A jury found Michael Nowak, the former head of precious-metals trading for the bank, used bogus orders to manipulate prices.

Done deals:

- Carlyle has partnered with Tillman Global Holdings and committed up to $1 billion to invest in US internet and telecommunications towers. Greenberg Traurig was legal advisor to Carlyle. Sullivan & Cromwell and TAP Advisors worked with Tillman.

- KKR has acquired two industrial properties, one in Georgia and one in Texas, for about $300 million. The Georgia-based property is in Burford and comprises four warehouses. The Texas-based property consists of two warehouses in Dallas.

Curated by Aaron Weinman in New York. Tips? Email [email protected] or tweet @aaronw11. Edited by Hallam Bullock (tweet @hallam_bullock) in London.