- This is an excerpt from a story delivered exclusively to Business Insider Intelligence Digital Media Briefing subscribers.

- To receive the full story plus other insights each morning, click here.

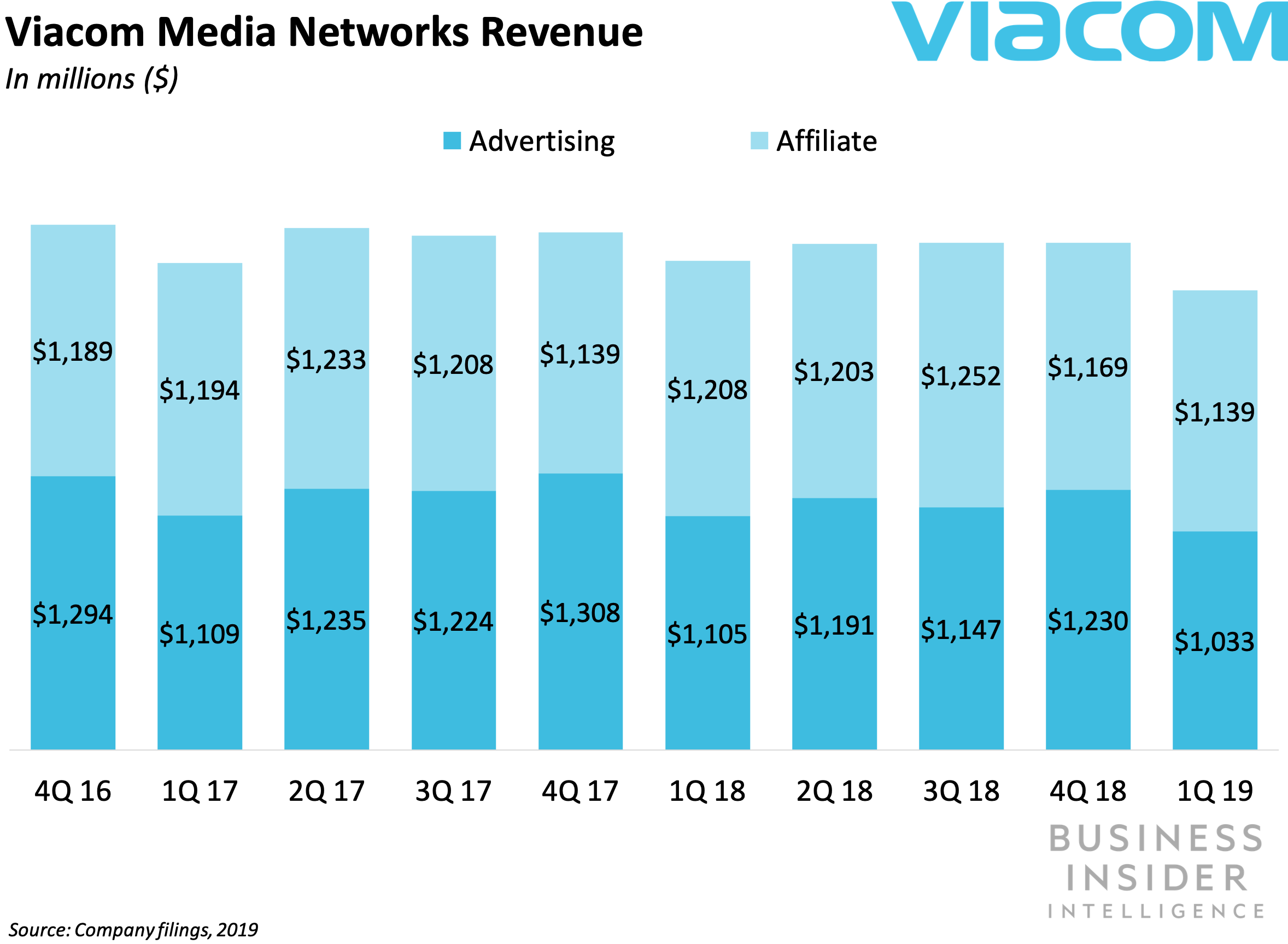

Viacom generated $2.96 billion in its fiscal second quarter (ended March 31, 2019), down 6% from $3.15 billion year-over-year (YoY). Those declines came as advertising revenue fell by 7% YoY to $1.03 billion and affiliate fees fell 6% to $1.14 billion – both of which are part of Viacom’s media networks segment.

The segment contributes the vast majority (77%) of Viacom’s business, with the remainder coming from filmed entertainment.

What it means: Viacom is pursuing a series of methods to expand streaming content distribution across various platforms and services – and reduce its reliance on the traditional cable business.

Here’s a rundown of the streaming strategies that Viacom is pursuing:

- Niche SVOD. Viacom doesn't have the scale of larger media conglomerates like Disney, for example, to build a direct-to-consumer offering that would be able to compete with rival services launching in the coming year. Instead, Viacom has favored niche SVOD services based around its core network brands or certain audience bases. For example, Noggin - the Nickelodeon-branded $8-a-month streaming service - now counts 2.5 million subs globally, and caters to preschool-aged children with popular kids programming like "Peppa Pig" and "Paw Patrol."

- Ad-supported VOD (AVOD). Viacom plans to distribute its programming across recently acquired AVOD platform Pluto TV, which now has 16 million monthly active users, up 31% since December 2018. Pluto TV could scale that usage further as it expands support for its connected-TV app, for example, through a recent deal with Comcast to include the app on its X1 platform. As Pluto TV scales usage, Viacom also gains another source of ad revenue.

- Streaming video distribution deals with pay-TV operators and mobile carriers - both domestic and international. Viacom has landed deals with pay-TV and mobile operators in Scandinavia and Latin America for its streaming video service Paramount+, which offers new and classic films from the studio as well as episodes from Viacom's other networks. In the US, Viacom struck a significant distribution dealwith T-Mobile for its networks to appear on the wireless carrier's forthcoming mobile video service, TVision.

- Expanded carriage on skinny bundles. Viacom has prioritized broadening streaming distribution of its linear networks through deals with skinny bundles. The company has historically suffered carriage disputes due to ratings declines across its predominantly youth-serving networks. But its networks are now carried on DirecTV Now, FuboTV, Charter Spectrum TV Essentials, and AT&T Watch.

- Licensed content to SVOD platforms. At a time when media conglomerates are pulling back on their willingness to license content to SVODs like Netflix, Viacom continues to make a business out of supplying content to them. That includes licensing shows, but also increasingly producing shows: For example, Paramount TV developed "13 Reasons Why" for Netflix and "Jack Ryan" for Amazon, while Viacom's digital studio AwesomenessTV produced "Pen15" for Hulu.

The bigger picture: These strategies could help insulate Viacom from headwinds related to viewing declines on traditional TV among younger audiences and ongoing cord-cutting. Between 2010 and 2018, traditional TV viewing has dropped 45% among kids ages 2-11 and 61% among viewers ages 12-17. That makes it harder for Viacom - whose core networks like Nickelodeon and MTV have primarily catered to those demographics - to achieve rate increases when seeking carriage renewal on traditional pay-TV services.

Meanwhile, cord-cutting continues to erode subscribers on all cable networks: Cord-cutting hit a record high in Q1 2019, with pay-TV sub losses of 1.4 million in Q1, up 75% YoY, according to MoffettNathanson.

Interested in getting the full story? Here are two ways to get access:

1. Sign up for the Digital Media Briefing to get it delivered to your inbox 6x a week. >> Get Started

2. Subscribe to a Premium pass to Business Insider Intelligence and gain immediate access to the Digital Media Briefing, plus more than 250 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now