- Vaccine developer GreenLight Biosciences is going public through a $1.5 billion SPAC deal, according to a Wall Street Journal report.

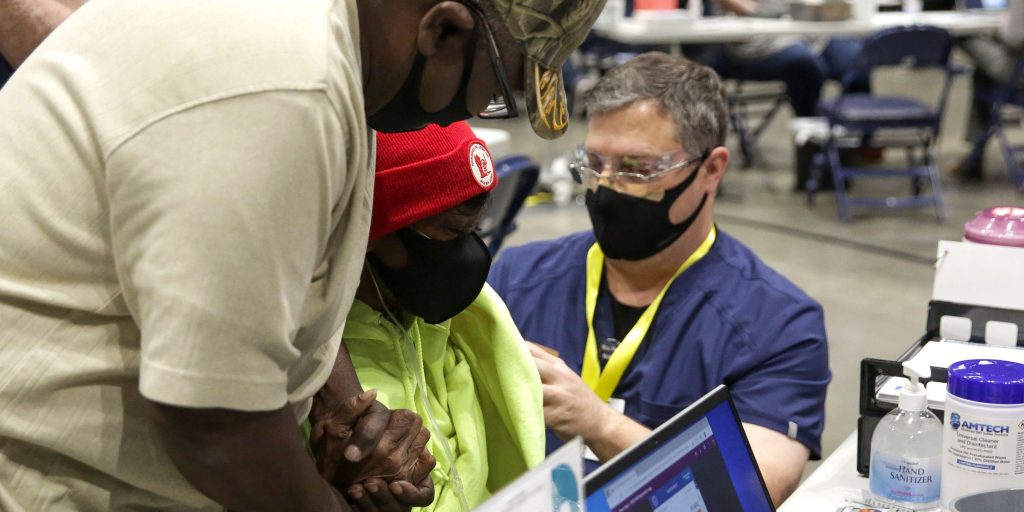

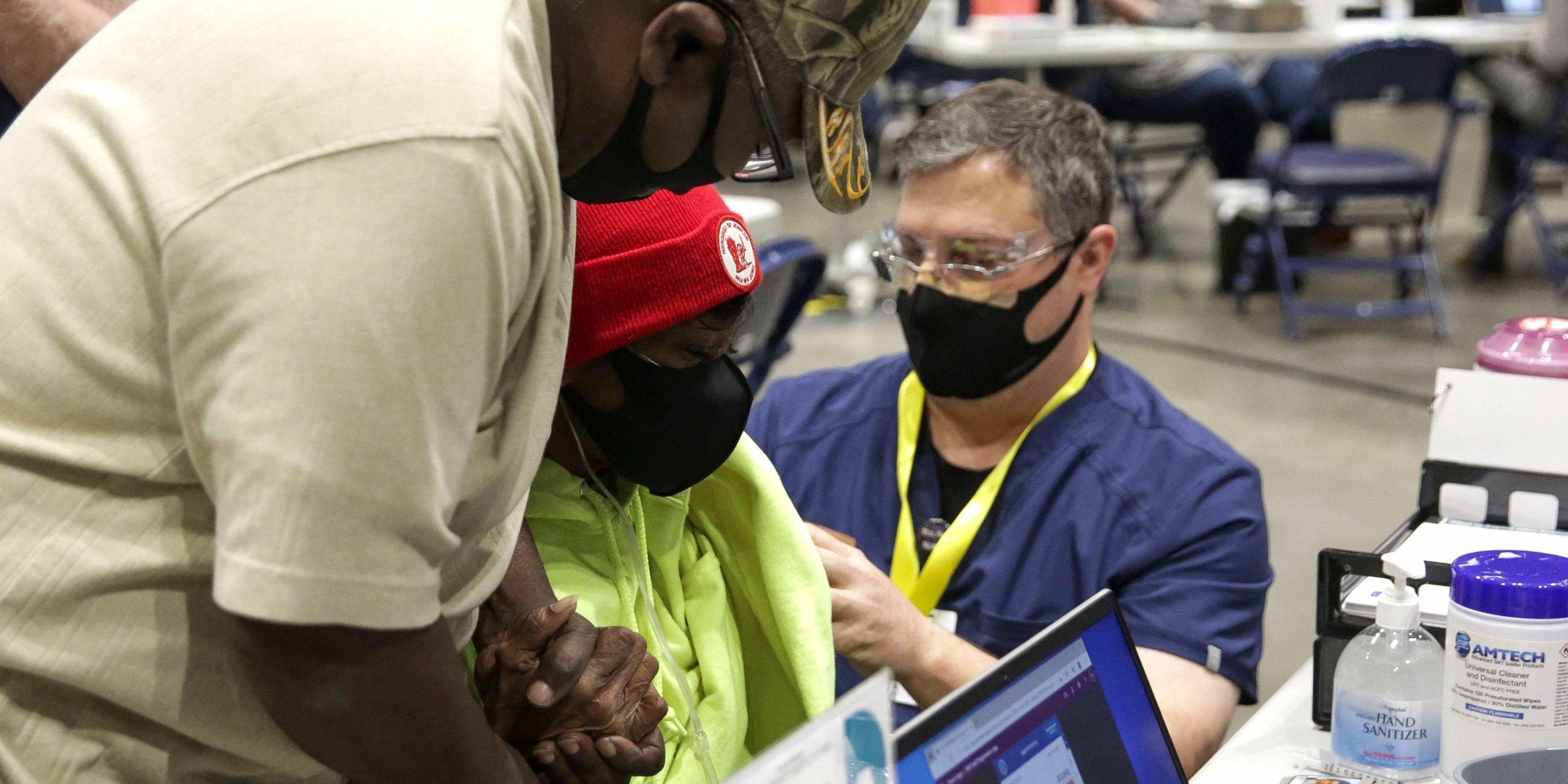

- The company is developing its own COVID-19 vaccine for clinical trials in Africa next year.

- The SPAC deal comes as interest in such blank-check arrangements has diminished in recent months.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Vaccine developer GreenLight Biosciences is going public through a $1.5 billion SPAC deal, according to a new report by The Wall Street Journal.

GreenLight works with RNA technology, the sort underpinning the Pfizer–BioNTech and Moderna vaccines. Investors in the deal, which involves GreenLight combining with a SPAC called Environmental Impact Acquisition Corp., include BNP Paribas and an environmental trust owned by Jeremy Grantham.

"This is a company we believe will be transformative," CEO Andrey Zarur told the Journal.

GreenLight is developing its own COVID-19 vaccine for clinical trials in Africa next year, on the theory that vaccine deployment bottlenecks will require the participation of a wide array of biotech companies.

"It is in the self-interest of biotechnology and pharmaceutical companies to cooperate on the production of COVID-19 vaccines," Zarur wrote in a January op-ed. Although the largest ones stand to profit handsomely under the current set up, if they don't move quickly enough … these companies will be quickly transformed from heroes to villains."

GreenLight is also working on other RNA-based products such as pesticides and herbicides, marketing them as more environmentally sustainable. The company is also eyeing a messenger RNA flu shot, an area of growing interest for pharma companies given the success of the mRNA COVID-19 vaccines.

The SPAC deal comes as interest in such blank-check arrangements has diminished in recent months. As some high-profile SPACs have imploded or fallen afoul of regulators, investors have increasingly shied away from the space.