Longer dated US Treasury yields are at their highest level since May following Thursday’s better than expected pending home sales for September. Data released by the National Association of Realtors showed pending home sales rose 1.5% month-over-month, outpacing the 1.0% gain that economists were expecting.

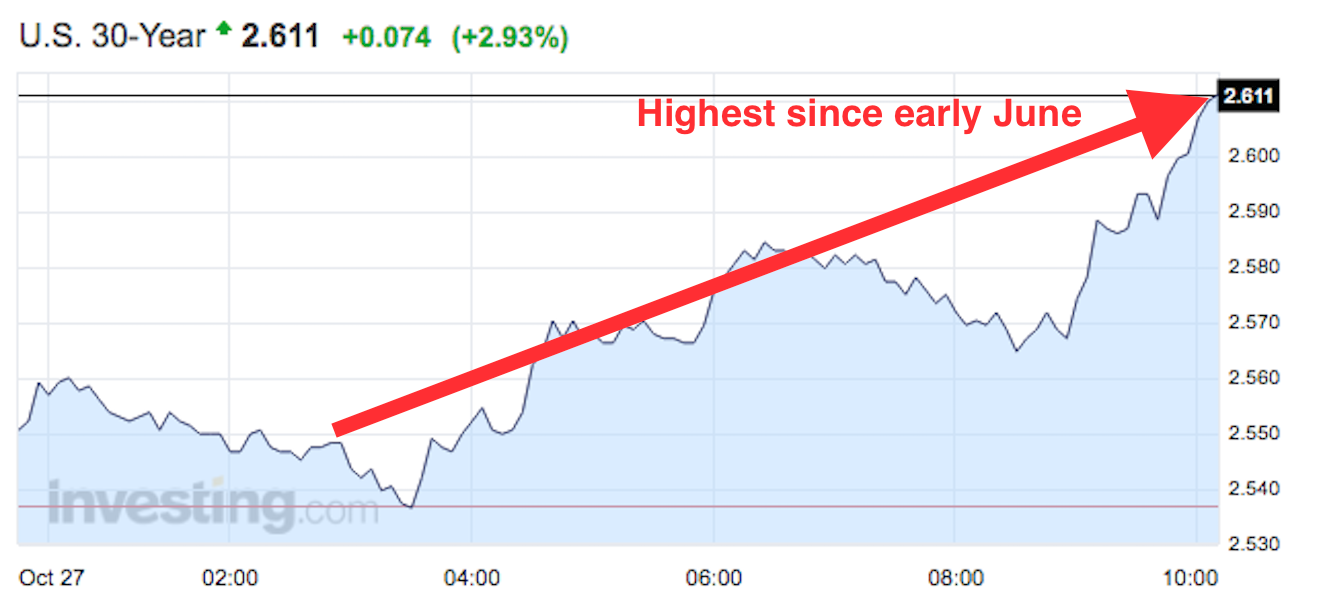

Thursday’s selling is having the biggest impact on the long end of the yield curve where yields are higher by more than 6 basis points. Here’s a look at the scoreboard as of 10:05 a.m. ET:

- 2-year +1.2 bps at 88.0 bps 3-year +2.4 bps at 1.08% 5-year +4.2 bps at 1.342% 7-year +5.1 bps at 1.636% 10-year +5.3 bps at 1.847% 30-year +6.3 bps at 2.604%

Selling at the long end of the curve since the post-Brexit lows set back in July has run the 30-year yield up more than 50 basis points as traders continue to price in the possibility of a Fed rate hike later this year. Currently, fed funds futures data compiled by Bloomberg suggests a 19.3% change of a November rate hike and a 73.1% probability of a rate hike before the end of the year.

Thursday’s selling has swung the yield curve steeper by nearly 5 bps with the 2-10-year spread trading at 97 bps.