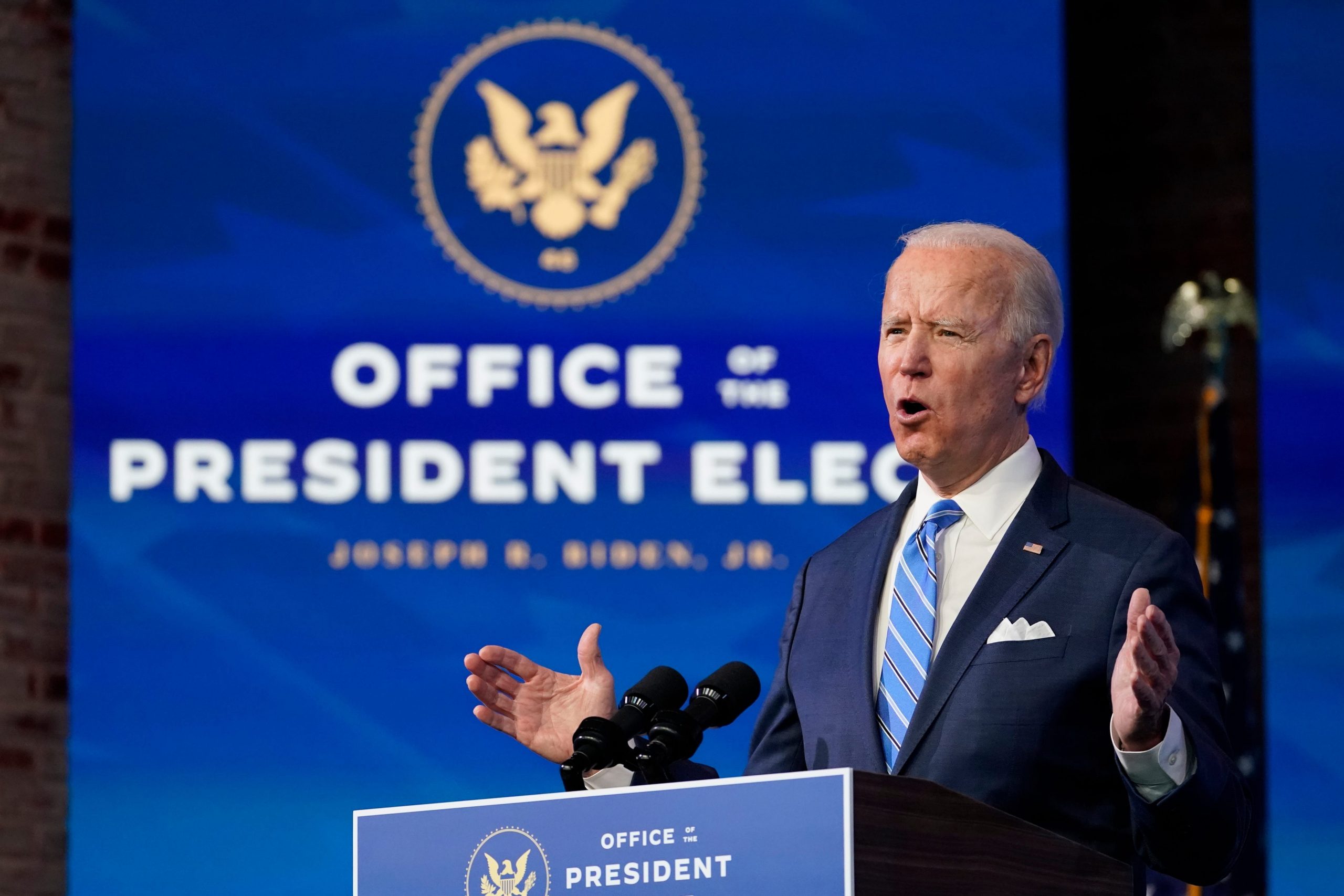

Matt Slocum/AP

- US stock futures fall despite Joe Biden unveiling a $1.9 trillion stimulus plan.

- Bonds and the dollar rose as investors moved into safer assets.

- US Federal Reserve chair Jay Powell sought to calm worries about bond-buying.

US stocks were set to end the week on a downbeat note, despite President-elect Joe Biden laying out plans for a $1.9 trillion stimulus injection, with bonds and the dollar rising as investors sought safer assets, such as gold.

The S&P 500 was on track fall at the opening bell, with futures down 0.22%. Dow Jones futures were 0.25% lower and Nasdaq futures were off by 0.13%.

US stocks also dipped on Thursday, with the S&P 500 closing down 0.38%, the Dow Jones 0.22% and the Nasdaq 0.12%. The Russell 2000 index of smaller companies jumped 2.05%, however, to a new all-time high.

A major speech from Biden outlining his plan to kickstart the flagging US economy has met with a toned-down response on Wall Street, judging by futures, and exchanges around the world.

Many analysts said markets had already priced in a big stimulus boost, sending the S&P 500 up around 10% since Biden's victory in the presidential election in November.

Asian stocks were mixed overnight, with worries about rising coronavirus cases in focus. China's CSI 300 slipped 0.23% while South Korea's KOSPI tumbled 2.03%. Hong Kong's Hang Seng inched 0.27% higher.

European stocks opened lower, with the continent-wide Stoxx 600 falling 0.5%. The UK's FTSE 100 fell 0.73% after data showed the British economy shrank 2.6% in November after 6 months of growth, putting it on track for a double-dip recession.

Biden on Thursday laid out a major stimulus plan and implored Congress to act fast to help the slowing US economy.

"A crisis of deep human suffering is in plain sight, and there's no time to waste," Biden said in Wilmington, Delaware. "We have to act and we have to act now."

His $1.9 trillion plan - which equates to around 9% of US GDP - includes direct payments to Americans of up to $1,400.

Biden also pressed Congress to increase the minimum wage to $15 an hour and called for aid to state and local governments. Republicans, and some more centrist Democrats, are likely to oppose these measures, complicating the effort to pass the bill.

Paul Ashworth, chief US economist at consultancy Capital Economics, said: "We suspect that, even though the Democrats now narrowly control the Senate too, any package eventually passed by Congress will be half that size or less."

Government bond yields fell on Friday in Europe, as investors moved away from riskier assets such as shares.

The yield on the US 10-year Treasury note - which moves inversely to the price - fell 1.5 basis points to 1.114%. That was still close to the highest level since March, however.

The dollar rose 0.14% against a basket of other currency to 90.37 on its index as investors moved into the safe-haven currency.

US Federal Reserve chair Jay Powell yesterday sought to calm market anxieties that the central bank would cut back on stimulus amid expectations of stronger growth.

Powell said that "now is not the time to be talking about [an] exit" from bond purchases, which currently amount to $120 billion a month. "A lesson of the global financial crisis is be careful not to exit too early," he said.

Bond yields have risen sharply in recent weeks as investors bet on more issuance and higher growth and inflation.

Some analysts have said higher yields could cause problems for equity markets. Michael Brown, chief market analyst at CaxtonFX said: "I'm looking at the bond market, I think that is likely to be the source of any sort of jolt, particularly if yields continue to rise."

"Higher yields normally result in indigestion for risk assets. I see very little reason why this time should be any different," he said in a video market recap on Twitter.

With risk appetite running low, gold rose 0.1% to around $1,853 an ounce. Even with the rise in Treasury yields and the dollar, gold is still on track to post a gain of 1% this week - its largest weekly increase in a month.