- America operates on a progressive tax system. That means as a person earns more and progresses through tax brackets, their tax rate increases for each level of income.

- Rep. Alexandria Ocasio-Cortez of New York has touted a plan that would tax Americans earning more than $10 million at a rate as high as 70%.

- Under America’s progressive tax system, that means Americans earning more than $10 million wouldn’t owe 70% of their total income on taxes; they would owe 70% of the income they earned only after a certain point.

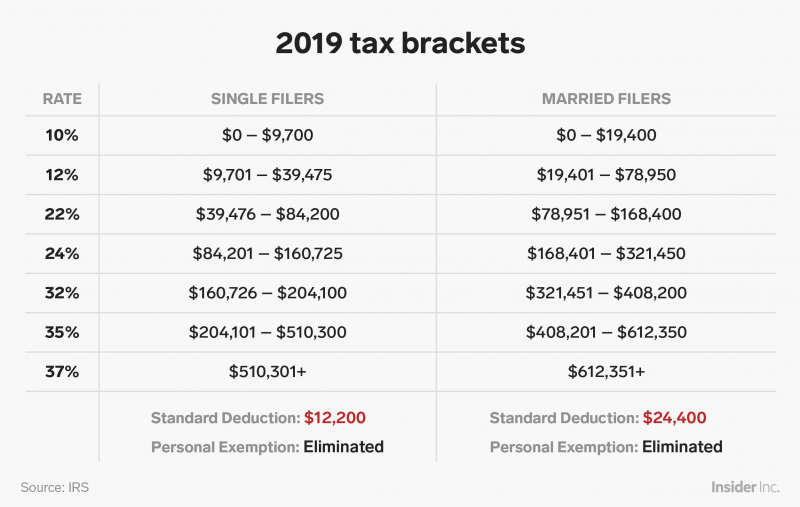

- The highest tax bracket is 37% for single filers earning more than $510,301 and married filers earning more than $612,351.

Rep. Alexandria Ocasio-Cortez of New York appeared on “60 Minutes” Sunday night and touted a plan that would tax the richest Americans at a rate as high as 70%.

“Once you get to the tippy-tops, on your 10 millionth dollar, sometimes you see tax rates as high as 60% or 70%,” Ocasio-Cortez said. “That doesn’t mean all $10 million are taxed at an extremely high rate. But it means that as you climb up this ladder, you should be contributing more.”

As Dion Rabouin of Axios said, some people believe Ocasio-Cortez is proposing a flat tax rate of 70%, but that’s not how it works under our progressive tax system.

Slavery is when your owner takes 100% of your production.

Democrat congresswoman Ocasio-Cortez wants 70% (according to CNN)

What is the word for 70% expropriation?— Grover Norquist (@GroverNorquist) January 5, 2019

How much you pay in taxes depends on several factors, including whether you're single or married, and, of course, how much you earn. President Donald Trump's tax plan went into effect in January 2018, mandating new income tax brackets for nearly all American taxpayers. The IRS has released new tax brackets for income earned in 2019, updated for inflation.

If you earn $40,000 a year as a single filer, that puts you in the 22% tax bracket in 2019 - but while 22% of $40,000 is $8,800, you're not paying $8,800 in taxes.

Your tax bracket applies to only the amount you earn above the minimum income threshold for that bracket. For income below that limit, you pay the same amount of federal income taxes as everyone else, even if they earn less overall.

Here's how the calculation works for a single taxpayer in 2019:

- Figure out your taxable income: annual salary minus deduction(s).

- Everyone pays a 10% federal-income tax rate on their first $9,700 of taxable income.

- Everyone pays a 12% federal-income tax rate on their next $9,701 to $39,475 of taxable income.

- Everyone pays a 22% federal-income tax rate on their next $39,476 to $84,200 of taxable income.

- And so on and so forth.

One notable thing about this kind of tax setup is that the amount of taxes owed by someone steadily increases as that person's amount of income increases. It's not a monumental change when people jump from one tax bracket to another.

Read more: Everything you should be doing to prepare for tax season

Let's run through how this would work for an imaginary person: John, who earns $40,000. To keep it simple, let's say he makes all his money from his work salary and has no dependents.

For his 2019 taxes, John would subtract the standard deduction ($12,200) and take zero personal exemptions, since they were eliminated with the GOP tax law.

That makes his taxable income $27,800, putting him in the 12% tax bracket.

Here's how to estimate how much he would owe in taxes:

- The first $9,700 of his $27,800 total taxable income is taxed at a 10% rate, yielding $970 in taxes.

- Then, his income between $9,700 and $27,800 - a total of $18,100 - is taxed at a 12% rate, yielding $2,172 in taxes.

- So, adding $970 to $2,172, John might owe about $3,141 in taxes, rather than the $3,336 he would owe if his entire taxable income were evaluated at the 12% rate.

Elena Holodny contributed to an earlier version of this article.