- The US added 978,000 private payrolls in May, ADP said in its monthly employment report.

- Economists expected a 650,000-payroll jump. The reading marks five straight months of job additions

- The data suggests hiring fared better last month following April's hugely disappointing jobs report.

- See more stories on Insider's business page.

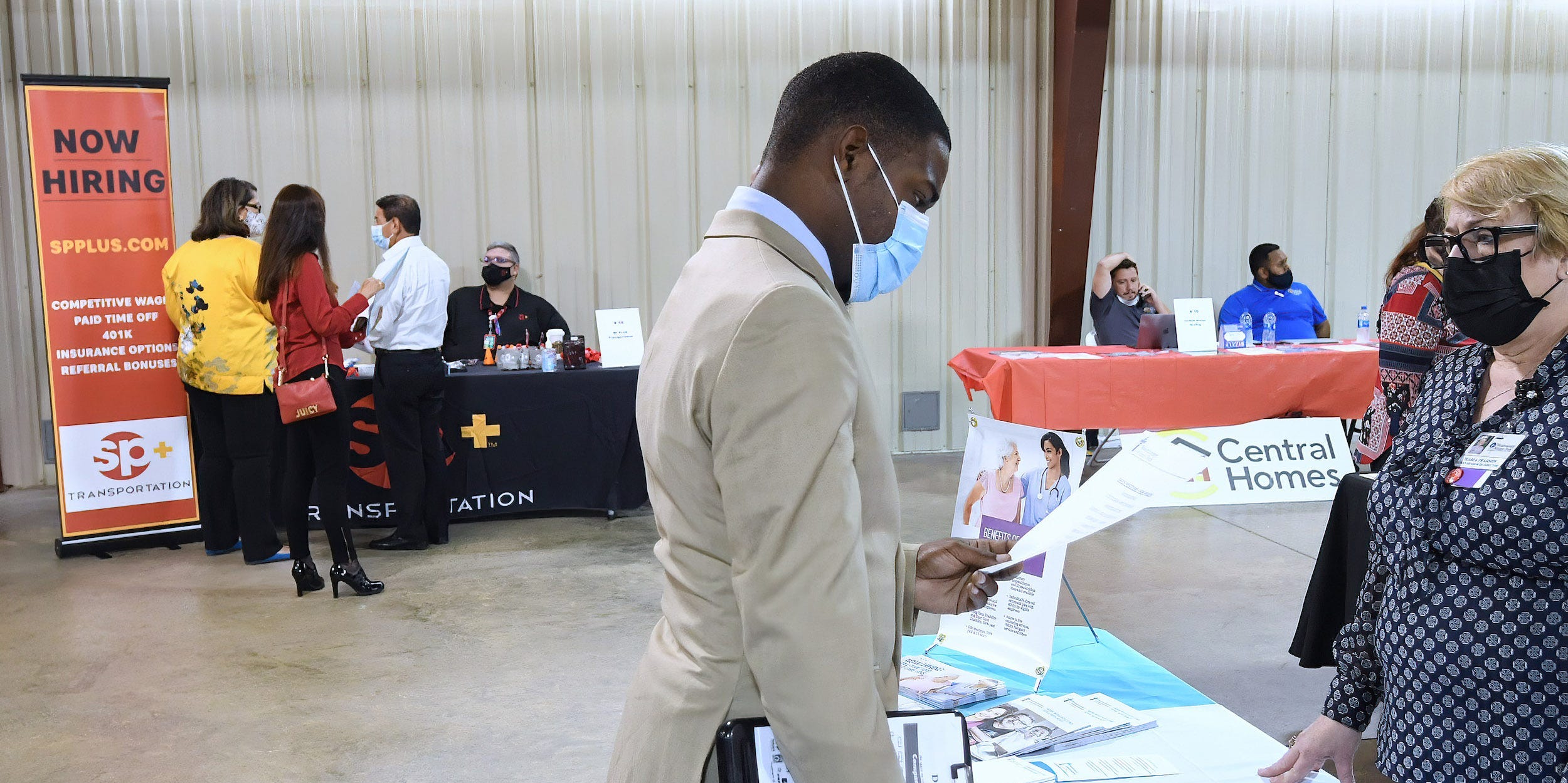

Private-sector employment in the US picked up in May as continued reopening and a resurgence of economic activity powered strong hiring.

Private payrolls climbed by 978,000 last month, ADP said in its monthly employment report. The median estimate from economists surveyed by Bloomberg was for a 650,000-payroll gain. The prior month's jump was revised to 654,000 from 742,000.

The May leap marks a fifth straight month of job additions and the largest one-month jump since June 2020. Private payrolls have now recovered roughly 63% of their pandemic-era decline. And while job creation briefly slowed as virus cases spiked in the winter, the rate of growth has accelerated through the spring.

The leisure and hospitality and education and health services sectors added the most jobs through last month, with gains of 440,000 and 139,000 payrolls, respectively. The information sector shed 3,000 jobs in May.

"Private payrolls showed a marked improvement from recent months and the strongest gain since the early days of the recovery," Nela Richardson, chief economist at ADP, said. "Companies of all sizes experienced an uptick in job growth, reflecting the improving nature of the pandemic and economy."

ADP is only the opening act

The Thursday data previews a highly anticipated jobs report from the Bureau of Labor Statistics. The Friday release follows a disappointing April report and will reveal whether hiring rebounded or slumped further throughout last month.

Economists are largely bullish. The median estimate for US nonfarm payroll additions sits at 655,000, well above the 266,000 added in April. Still, the sum sits below growth seen in March. And after April's read came in at roughly one-quarter the additions expected, there's potential for a huge upset.

The labor-market indicators also come as states split on when to end the federal expansion to unemployment insurance. Half of all US states have elected to prematurely end the $300-per-week benefit before it's officially slated to lapse in September. The move - carried out by GOP-led states - is set to cut unemployment benefits for roughly 4 million unemployed Americans.

Republicans have argued that, with vaccinations continuing, cases dropping, and the country reopening, it's high time to end the benefit. They've also blamed bolstered UI for labor shortages dotted throughout the economy, claiming the benefit disincentivizes Americans from finding work.

Democrats have countered by noting the economy is far from fully healed. Millions of Americans remain jobless, and factors such as childcare costs and COVID-19 fears might also be keeping people from seeking jobs.

While the bank didn't explicitly take a side, JPMorgan noted in a May 25 note that states' early cancellation of the federal benefit is "tied to politics, not economics." Only some of the participating GOP-led states have tight labor markets, and many others are still far from completely recovered, the bank added.