The US dollar had a relatively strong September after months of declines.

“Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman, in commentary Friday.

“The Dollar Index is snapping a six-month decline, and the euro’s monthly advance since February is ending,” he added.

The US dollar index climbed to its highest level in over a month earlier in the week after Federal Reserve Chair Janet Yellen’s comments in Cleveland on Tuesday. Yellen suggested, “It would be imprudent to keep monetary policy on hold until inflation is back to 2 percent.”

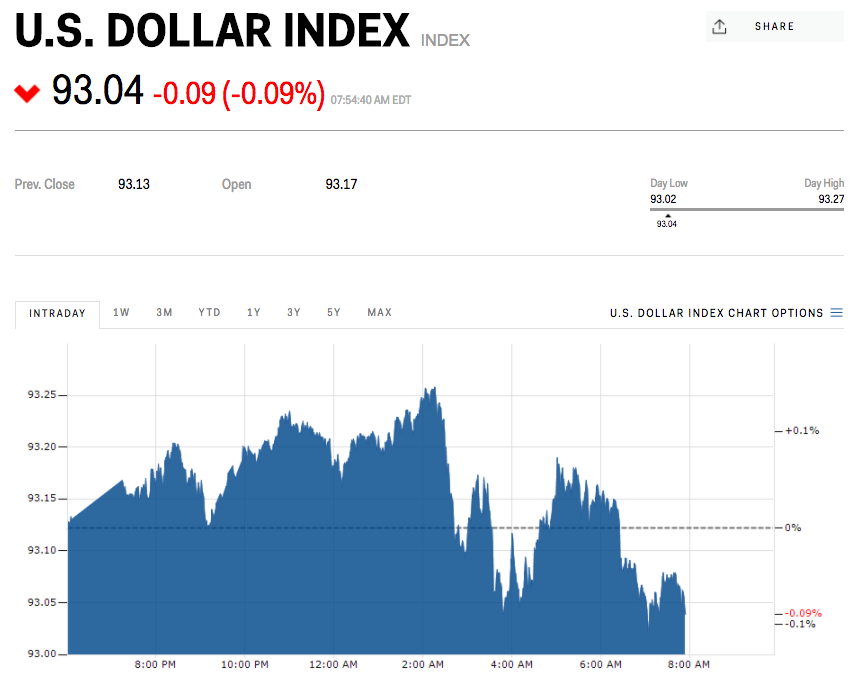

The index has since retraced some of those gains, but it remains higher for the week. It was little changed at 93.04 at 8:11 a.m. ET Friday.

The US dollar index is down 9.6% since President Donald Trump's January inauguration.

As for the rest of the world, here was the scoreboard at 8:14 a.m. ET:

- The euro was up by 0.2% at 1.806 against the dollar. Earlier data showed that eurozone CPI rose by 1.5% year-over-year in September, below expectations of 1.6%. Separately, Germany's unemployment change for September came in at -23,000, better than expectations of -5,000. The British pound was down by 0.4% at 1.3389 against the dollar. Earlier data showed that gross domestic product rose by 1.5% year-over-year in the second quarter, below expectations of a 1.7% advance. The Japanese yen was down by 0.2% at 112.53 per dollar. Consumer prices in Japan rose 0.7% year-over-year in August, their fastest since March 2015. The Indian rupee was little changed at 65.350 per dollar. The Russian ruble was little changed at 57.8326 per dollar.