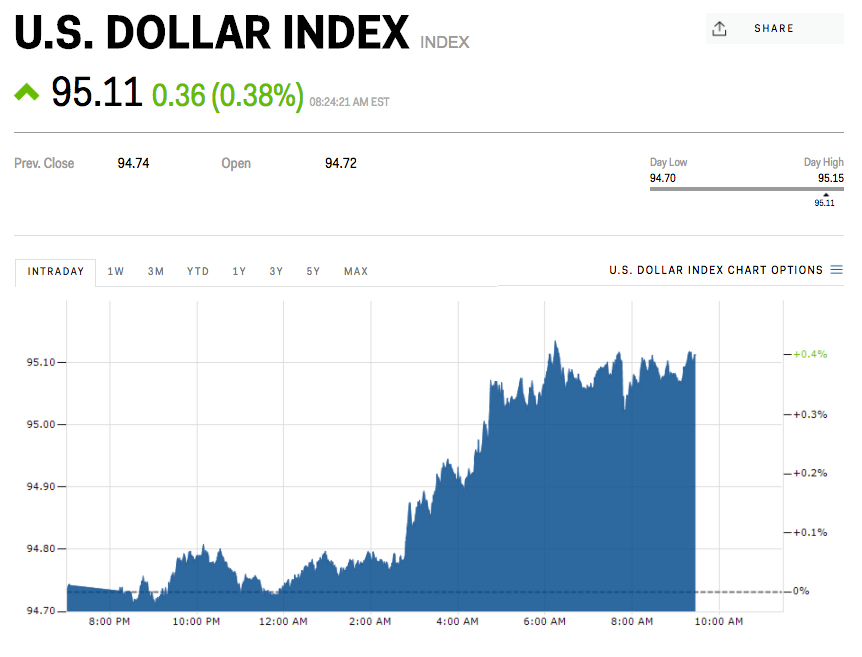

The dollar is higher, nearing its best level in four months.

The US dollar index was up by 0.4% at 95.11 at 8:41 a.m. ET.

Later on Tuesday, we will hear from two Federal Reserve policy makers: outgoing chair Janet Yellen and Randal Quarles, who recently joined the board of governors.

Yellen’s speech comes less than one week after President Donald Trump’s announcement that he will replace her with Jerome Powell at the end of her term in February 2018. As for Quarles, he will be taking part in a discussion on financial regulation in what will be his first extensive comments since taking up the job.

"Typically it would be Yellen's comments that would be of most interest but under the circumstances, it may be Quarles that most are interested in hearing from," Craig Erlam, senior market analyst at OANDA, said in emailed comments. "Yellen's term will end in February and a rate hike in December is almost entirely priced in, leaving us with little to potentially take from her message, especially given the number of positions still to be filled on the board."

As for the rest of the world, here was the scoreboard at 8:47 a.m. ET:

- The euro is down by 0.4% at 1.1564 against the dollar. Earlier, German industrial production fell by 1.6% month-over-month in September, compared to expectations of a 0.8% drop. The British pound is down by 0.4% at 1.3125 against the dollar after UK retail sales disappointed. The Russian ruble is up by 0.4% at 58.8651 per dollar, while Brent crude oil, the international benchmark, is down by 0.4% at $64.05 per barrel. The Indian rupee is weaker by 0.6% at 65.005 per dollar. The Japanese yen is lower by 0.3% at 114.09 per dollar The Canadian dollar is down by 0.6% at 1.2776 per dollar