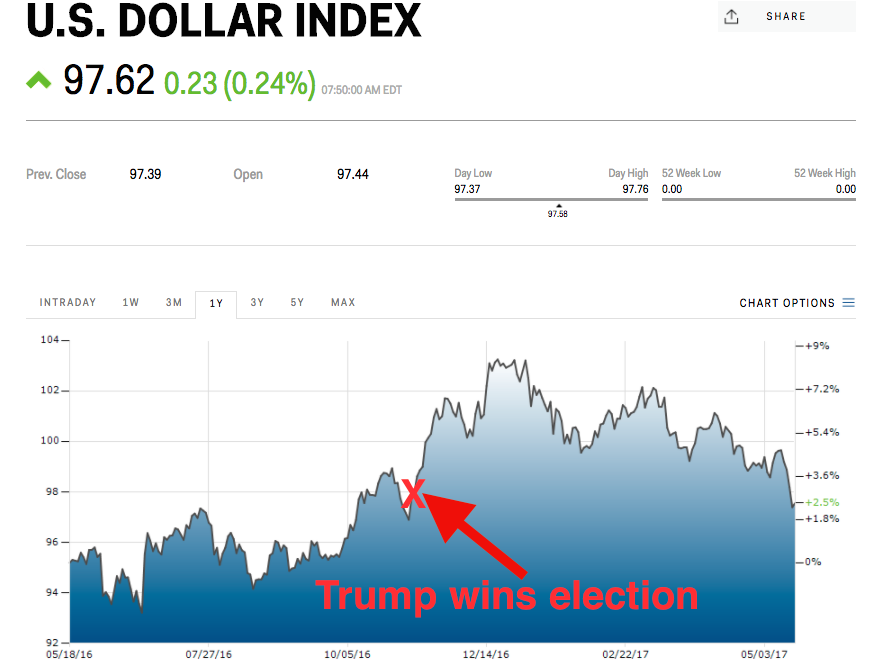

The dollar has officially given up all its postelection gains.

The US dollar index was little changed at 97.62 as of 8:01 a.m. ET on Thursday.

The index closed at 97.861 on November 8, the day of the US presidential election.

Still, the dollar appears to be taking a breather Thursday after weakening Wednesday.

“Yesterday’s dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI’s investigation into Russia’s attempt to influence the US election appears to have acted a circuit breaker of sorts,” Marc Chandler, the global head of currency strategy at Brown Brothers Harriman, said.

"It is not sufficient to boost confidence that the Trump Administration's economic program is back [on] the front burners, but it is sufficient to stem the time for the moment."

The greenback climbed to a 13-year high after US President Donald Trump won the election in early November, and it hit 103.01 in December. At least part of that appreciation was attributed to markets reacting to Trump's proposed fiscal-policy initiatives. But the index has been slowly giving up those gains over the past few months.

As for the rest of the world, here's the scoreboard as of 8:08 a.m. ET:

- The euro is lower by 0.3% at 1.1126 against the dollar. The British pound is up by 0.5% at 1.3034 against the dollar. The Japanese yen is stronger by 0.2% at 110.66 per dollar. The Russian ruble is down 1.6% at 57.9887 per dollar.