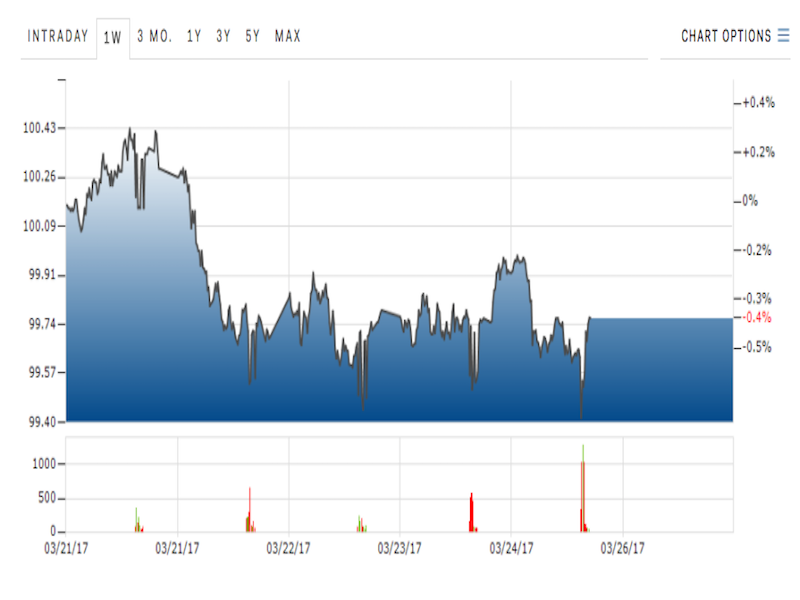

The dollar has weakened to a four-month low.

The US dollar index is down by 0.6% at 99.02 as of 8:06 a.m. ET. The last time it was at this level was in mid-November.

The index is down by about 3% since the start of 2017.

“Although there are conflicting impulses, interest rate differentials continue to appear to be the single most important factor in considering currency movement presently,” Marc Chandler, the global head of currency strategy at Brown Brothers Harriman, wrote. “The question of the dollar is in good measure a question of the direction of interest rates.”

Separately, Dallas Fed manufacturing will be out at 10:30 a.m. ET.

As for the rest of the world, here's the scoreboard as of 7:51 a.m. ET:

- The British pound is up by 1% at 1.2593 against the dollar. UK Prime Minister Theresa May said she will trigger Article 50 on Wednesday. Meanwhile, a survey released Monday conducted by the analytics firm Markit showed that just 29% of respondents thought the UK economy would fare better over the next 10 years - a sharp decrease from July's 39%. The euro is up by 0.8% at 1.0880 against the dollar. Earlier, Germany's Ifo Business Climate survey climbed to 112.3 in March, the highest level since July 2011, up from the prior reading of 111.1. "The upswing in the German economy is gaining impetus," Prof. Dr. Clemens Fuest, the president of the Ifo Institute, wrote. The Russian ruble is higher by 0.2% at 56.7894 per dollar, while Brent crude oil, the international benchmark, is down by 0.5% at $50.66 per barrel. On Sunday, thousands of people gathered across Russian cities to protest against official corruption in what observers said appear to be some of the largest anti-government demonstrations since 2012. The South African rand is weaker by 1.1% at 12.5842 per dollar after earlier being down by as much as 1.7%. The move came after South African President Jacob Zuma instructed Finance Minister Pravin Gordhan to return immediately from an investor roadshow to Britain and the US "without giving a reason for the decision," according to Reuters. The Japanese yen is stronger by 1.1% at 110.20 per dollar. The Mexican peso is down 0.3% at 18.8068 per dollar.