The dollar tumbled Tuesday to its lowest level since January 2015, extending losses that began last week as traders turned to safe-haven assets.

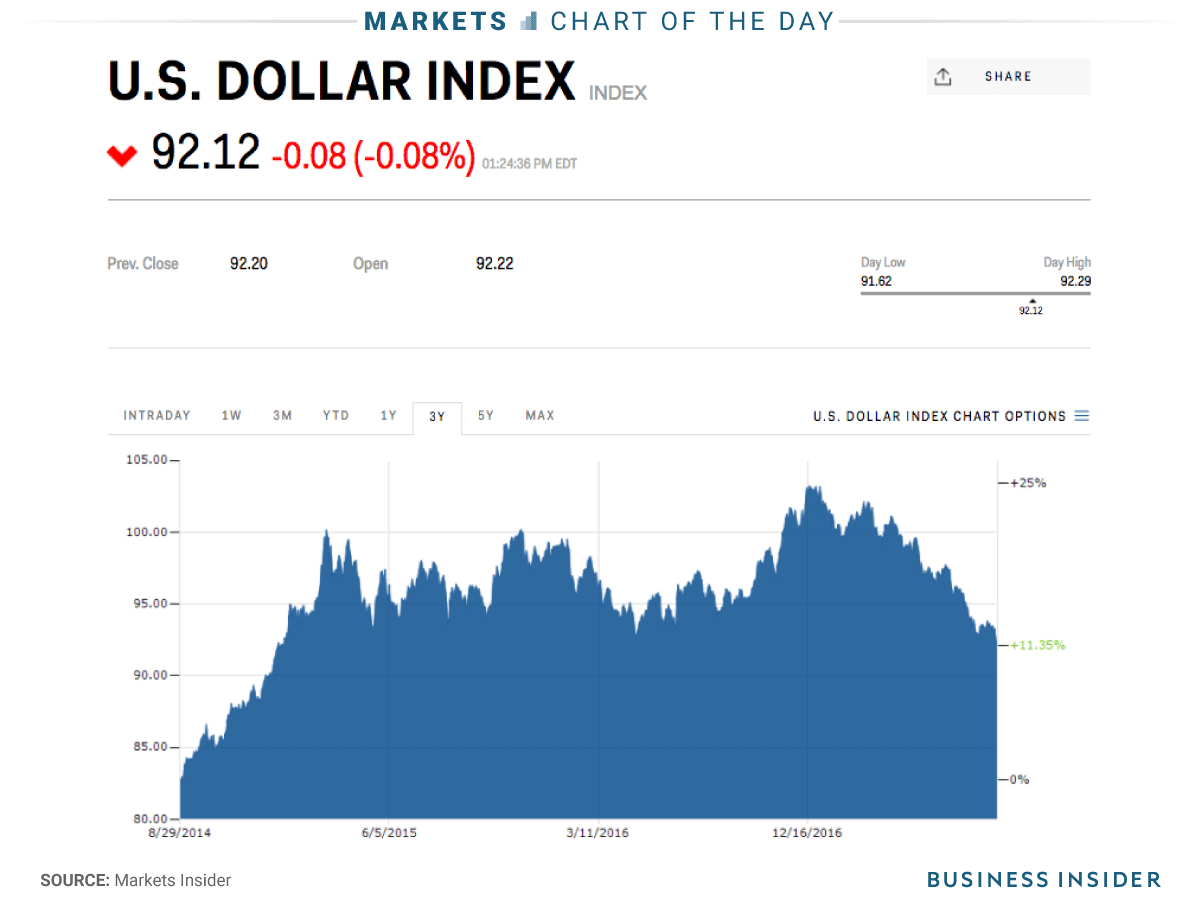

The US dollar index was down by 0.5% at 91.77 around 8 a.m. ET. It has since retraced some of its steps and is down by about 0.2% around 12:31 p.m. ET.

The index has now fallen by over 10% since US President Donald Trump’s inauguration.

Tuesday’s dip follows North Korea’s latest launching of a missile, which flew over the northern Japanese island of Hokkaido at 5:58 a.m. local time on Tuesday, according to Japanese government officials.

“North Korea is back on the radar, and the spike in geopolitical tensions have supported demand for safe havens like CHF and JPY,” Mark McCormick, the North American head of FX strategy at TD Securities, said in e-mailed comments.

"USD is underperforming on the risk off move, which is likely a function of the negative Washington risk premium that continues to grip the dollar."

The greenback's Tuesday drop continues the sell-off that began last week, said Marc Chandler, the global head of currency strategy at Brown Brothers Harriman.

"Coming out of Jackson Hole, the consensus scenario of ECB tapering and Fed allowing its balance sheet to begin shrinking, and fading prospects of tax reform and an infrastructure initiative in the US, the greenback was vulnerable," he said. "In our assessment both fundamental and technical conditions had aligned that warned that the dollar's recent consolidation was over and a new leg lower had begun."

"North Korea's provocations have added to fuel to the fire that was already burning," he added.