- Uber filed to go public Thursday, publishing a 300-page prospectus for would-be investors.

- The document contains a standard acknowledgement: Uber says it may never be profitable.

- It’s not unusual. Firms like Lyft and Snap have issued similar warnings in their legal boilerplate.

- But it is a sign of a larger, more important shift in the IPO market: A large share of today’s companies are going public without any profits to speak of, with tech firms leading the charge.

- It serves as a chilling reminder of the dot-com crash, which claimed several high-profile companies and put 200,000 tech workers out of a job.

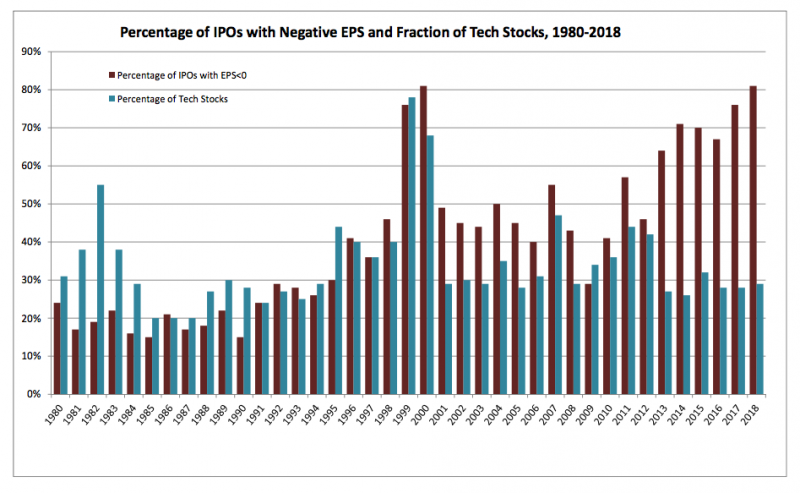

- Profitless IPOs are now back up at the same level they were right before the 2000 crash, according to data from University of Florida finance professor Jay Ritter.

- Visit BusinessInsider.com for more stories.

Uber filed to go public Thursday, dumping a 300-page prospectus on would-be investors about its sprawling $11.3 billion business. Bloomberg’s Shira Ovide described it as the “most complex S-1 I’ve ever read.”

Among the revelations contained in this tome were details of Uber’s love-hate relationship with its former CEO Travis Kalanick, revelations about who will get rich when Uber joins Wall Street, insight on its battle to maintain drivers as contractors rather than employees, and information on its relationship with Google.

But also within the pages of the prospectus was an acknowledgement that laypersons might find startling: Uber says it may never be profitable. “We expect our operating expenses to increase significantly in the foreseeable future, and we may not achieve profitability,” said the ride-hailing company, which posted a $3 billion operating loss last year.

Read more: Google just beat Amazon to launching one of the first drone delivery services

The document goes on to list a litany of risk factors, which are standard prior to IPOs. These include its huge spending on things like drivers, "unproven" revenue lines, and the danger of unrealized cost savings from its Careem acquisition as well as the fact that Uber Eats (Uber's food-delivery business) makes a loss on some of its partnerships with big chains like McDonald's.

"We will need to generate and sustain increased revenue levels and decrease proportionate expenses in future periods to achieve profitability in many of our largest markets, including in the United States, and even if we do, we may not be able to maintain or increase profitability," Uber said.

A reminder of the dot-com crash

The acknowledgement is far from unusual in today's market for initial public offerings. Lyft's S-1 contained very similar language - "we have a history of net losses and we may not be able to achieve or maintain profitability in the future" - while Snap also said it "may never achieve or maintain profitability" when it went public in 2017. Two years on, Snap is still loss-making.

Investors may well ignore the disclosures because they are betting on future growth, and future profits, which Uber's finances show are well within the company's ability to generate.

But the disclosure is also part of a pattern: More and more companies are going public without profits.

According to research from the University of Florida finance professor Jay Ritter - illustrated well here in Recode - 81% of US companies floated as loss-making entities last year. The graph below, produced by Ritter, shows the percentage of IPOs with negative earnings per share since 1980.

For tech firms, it was even higher at 84%, driven largely by biotech companies raising money. In fact, the last time that large a percentage of tech firms were going public without making money was in 1999 and 2000, when 86% of the internet companies that turned to Wall Street were unprofitable.

The turn of the millennium was, of course, the year the dot-com bubble burst, leading to the death of companies like Pets.com, Kozmo.com, a gruelling recession, and the loss of about 200,000 jobs in Silicon Valley.

Uber is likely to be the biggest IPO of 2019, with forecasts pegging its value at about $100 billion. That being the case, it will probably serve as the yardstick against which to measure this year's expected IPO bonanza, in which firms such as Pinterest and Airbnb are also set to go public. It may also be the canary in the coal mine if things turn ugly.

Uber has been honest about its profit-making potential, but it need not look far for an example of success. Amazon was the prince of no profit when it first arrived on Wall Street in 1997, with Quartz pointing out that it lost $2.8 billion over the first 17 quarters after its IPO. Now, Amazon makes more than $3 billion a quarter - as much money as Uber lost all of last year.