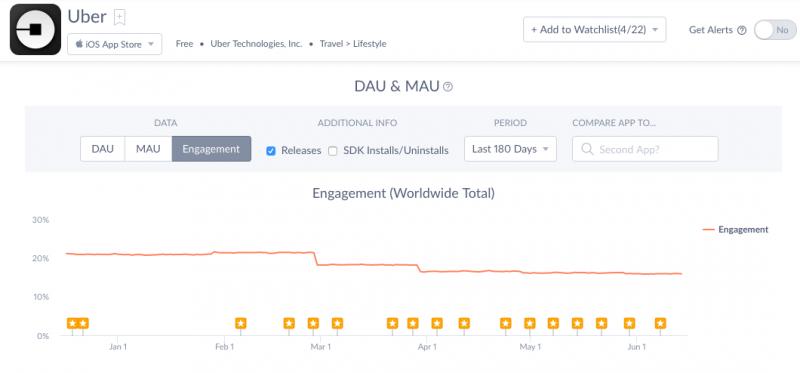

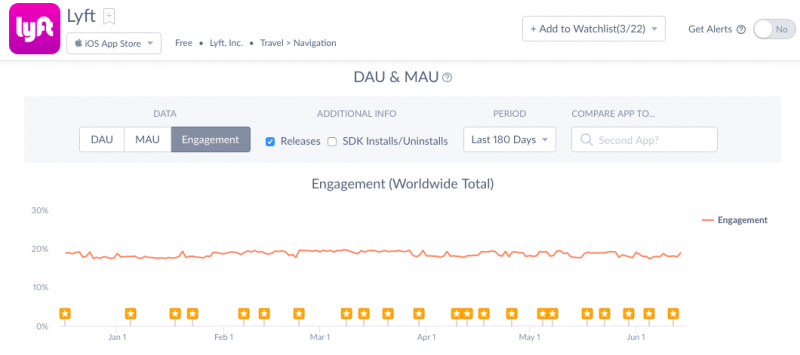

- Uber’s brand has been hit, while Lyft is gaining steam, experts say. Lyft has been ramping up its marketing as well as community engagement efforts. App engagement for Uber has fallen to 16%, while Lyft has remained consistent at 18%, according to Apptopia.

As Uber flounders amid a spate of branding disasters, rival Lyft is surging.

After a trying few months, it’s been a particularly brutal week for the ride-hailing app. Tuesday saw the release of the results of an intensive, monthslong investigation into its culture, followed by CEO Travis Kalanick announcing his leave of absence and a board member resigning. And on Thursday, a woman who was raped in India by one of its drivers slapped the company with a lawsuit for defamation, intrusion of privacy, and public disclosure of private facts.

Meanwhile, Lyft has embarked on an aggressive campaign to position itself as a socially conscious alternative in a crowded field, and is ramping up it marketing as well as community engagement efforts. It has not only committed to reduce its carbon emissions dramatically by 2025, but has also been pushing its “Round Up & Donate” program to get riders to donate to favorite causes.

“We are continuing to operate as we have from day one, focused on our mission of improving lives through the world’s best transportation,” said Alexandra LaManna, a spokesperson for Lyft. “Now that Lyft has reached its current scale and can compete aggressively on price point and pickup times, it comes down to brand — what that brand stands for — and the experience.”

Lyft seems to have some momentum: it raised $600 million from investors back in April, and recently teamed up with Waymo to work on self-driving cars. It has also been winning consumer accolades, say branding and crisis reputation management experts.

"Uber projects an image that is careless, self-obsessed, sexist and profiteering, aloof and uncaring, while Lyft appears be benevolent and puts its values front and center," Susan Cantor, CEO at branding firm Red Peak, told Business Insider "A focus on causes and social good always plays well with Gen Y and Gen Z, who see altruism as a must. So Lyft is well-positioned and clearly capitalizing on Uber's missteps."

Andrew Gilman, CEO at crisis communications firm CommCore Consulting Group, agreed, saying that Uber's aggressive, go-fast culture may have propelled it forward initially, but is the very thing that is bringing it down now.

"When that culture turns into a stampede and almost every corporate action violates people's personal beliefs, the tide will turn and people will vote with their fingers and pick other apps," he said. "That is what is happening now."

Data shows that Uber has taken a serious hit, while Lyft has been steadily gaining steam. Lyft has been closing the gap with Uber in terms of app downloads, according to app analytics firm App Annie, MarketWatch reported on Tuesday.

Lyft has also overtaken Uber in terms of user engagement, according to app analytics firm Apptopia. The percentage of Uber's total monthly active users that use the app everyday has been dropping considerably, from 20% in February to 18% in March, to 17% in April, and down to 16% in May. On the other hand, Lyft's usage has been consistent at 18% over the same time period.

Further, American consumer favorability of Uber has also hit a record low, according to Morning Consult Brand Intelligence, a brand survey firm, MarketWatch reported. The firm found that just 40% of the respondents had a favorable impression of Uber as of this week, the lowest that number has been since the survey began in 2016.

Lyft users took 70.4 million rides in the first quarter of 2017 compared to 29 million rides in 2016, which represents a year-over-year growth of approximately 140 percent, according to the company. This also equals an increase of 36% quarter-over-quarter, with users taking 52.6 million rides in the fourth quarter of 2016. Its drivers seem to be happier compared to Uber drivers as well, with 76% of Lyft drivers saying that they were satisfied with their experience driving for Lyft, versus 49% of Uber drivers, according to Campbells, as reported by The Verge.

Not only has Lyft been able to "lift" its brand by capitalizing on Uber's mistakes, it has done so without directly attacking Uber. This would help it go a long way, said Ben Ricciardi CEO of branding agency Times10.

"It's genius how Lyft has been able to do it without directly calling Uber out," he said. "Rather, they have chosen to do the opposite of what Uber is doing, further connecting with their patrons and positioning themselves as 'the good guys.'"

To be sure, Lyft is undoubtedly the underdog, and it is still a long way from overtaking Uber. Uber's first-quarter revenue was $3.4 billion, up 18% from 2016's fourth-quarter. Lyft, on the other hand told prospective investors in March that it expected $800 million in first-quarter gross bookings, Bloomberg reported. Further, Uber trumps Lyft in the number of downloads too, according to Apptopia, with 16 million downloads in May 2017 as opposed to 1.3 million of Lyft.

Ultimately, Lyft will need to keep focusing on partnerships, as well as attracting more drivers to keep the momentum going, said experts.

"Lyft's next step should be expanding its corporate and community-relations efforts and empowering its front-line workforce" said Chris Allieri, the founder and principal of the public-relations firm Mulberry & Astor. "Together with recently won-over Lyft customers, Lyft's drivers can be the front line-of-attack for Lyft's brand expansion."