Both the House and Senate passed the final version of the Republican tax bill on Wednesday, and a number of companies took the opportunity to announce special bonuses or pay hikes.

The bill reduces the corporate tax rate to 21% from 35% while allowing a one-time repatriation of overseas cash. Companies are mostly expected to buy back stock or pay down debt with their savings.

The pay hike and bonus announcements are sure to please Republican lawmakers, who have been pitching corporate tax cuts as a boost for American workers.

Here’s what has been announced so far:

AT&T

AT&T said Wednesday it will pay a $1,000 bonus to more than 200,000 US employees after the GOP tax bill is enacted.

"Once tax reform is signed into law, AT&T plans to invest an additional $1 billion in the United States in 2018 and pay a special $1,000 bonus to more than 200,000 AT&T US employees - all union-represented, non-management and front-line managers," a company press release said. "If the president signs the bill before Christmas, employees will receive the bonus over the holidays."

At a White House event on Wednesday afternoon, President Donald Trump called AT&T's plan "pretty good."

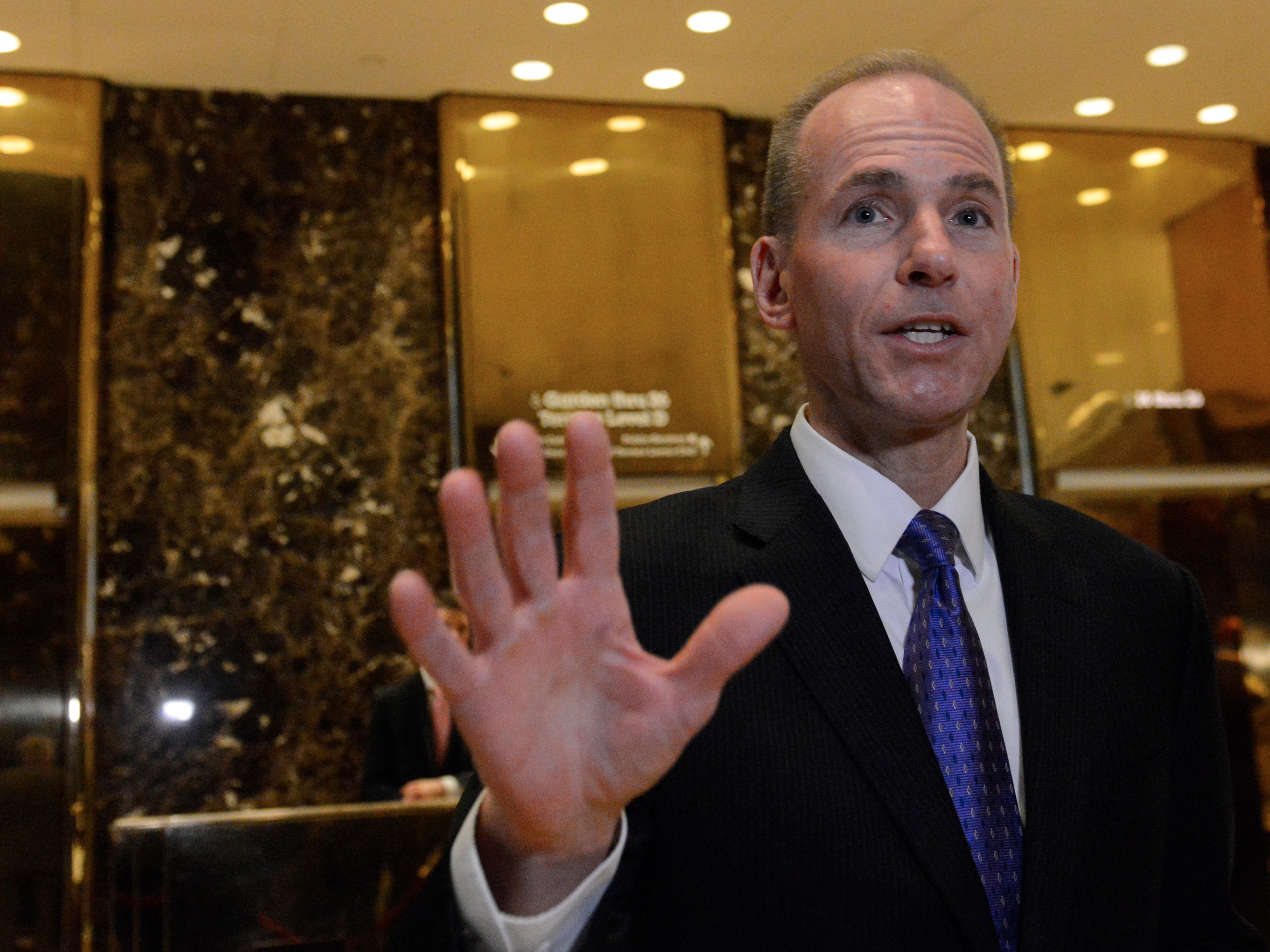

Boeing

Boeing released a statement announcing "immediate commitments for an additional $300 million in investments that will move forward as a result of the new tax law."

They are:

"$100 million for corporate giving, with funds used to support demand for employee gift-match programs and for investments in Boeing's focus areas for charitable giving: in education, in our communities, and for veterans and military personnel.

"$100 million for workforce development in the form of training, education, and other capabilities development to meet the scale needed for rapidly evolving technologies and expanding markets.

"$100 million for "workplace of the future" facilities and infrastructure enhancements for Boeing employees.

Boeing CEO Dennis Muilenburg said:

"For Boeing, the reforms enable us to better compete on the world stage and give us a stronger foundation for the investment in innovation, facilities and skills that will support our long-term growth."

Fifth Third Bancorp

Fifth Third Bancorp said it would raise its minimum hourly wage for all employees to $15, with 3,000 hourly employees benefiting from the hike. The bank also said it would distribute a one-time bonus of $1,000 to about 75% of its employees.

"We want to invest in our most important asset - our people," said Fifth Third President and CEO Greg Carmichael. "Our employees drive our reputation, our business and our success."

From the release:

"Newly passed tax legislation includes a reduction in corporate tax rates designed to spur economic growth. Carmichael said the tax cut allowed the Bank the opportunity to reevaluate its compensation structure and share some of those benefits with its talented and dedicated workforce."

Wells Fargo

Wells Fargo said it would raise its hourly minimum wage 11% to $15 from $13.50. Additionally, the bank plans to donate $400 million to community and nonprofit organizations in 2018 and will target 2% of its after-tax profits for corporate philanthropy beginning in 2019.

"We believe tax reform is good for our U.S. economy and are pleased to take these immediate steps to invest in our team members, communities, small businesses, and homeowners," said President and CEO Tim Sloan in a company release.

"We look forward to identifying additional opportunities for Wells Fargo to invest, as we continue to execute our business strategies and provide long-term value to all our stakeholders. As the nation's largest small business lender and residential mortgage provider, we understand our significant role in helping grow the economy."

Comcast NBC Universal

Brian Roberts, CEO of Comcast NBC Universal, said the company would award $1,000 special bonuses to more than 100,000 eligible frontline and non-executive employees following tax reform and the repeal of net neutrality.

Roberts also pledged to spend $50 billion over the next five years investing in infrastructure, saying that the investments would "add thousands of new direct and indirect jobs."

Sinclair Broadcast Group

Sinclair Broadcast Group announced in a Friday press release that it will award almost 9,000 employees a special $1,000 bonus.

"We are grateful to our President and legislature for passing the landmark Tax Cuts and Jobs Act and are excited about the benefits it will provide for our country's economy, our Company, and our employees," Sinclair President and CEO Chris Ripley said in a statement "We recognize that our employees are our most valuable resource, truly appreciate their combined achievements for our Company and look forward to a very bright future."

SEE ALSO:

Trump's tax plan could bring $250 billion into the US - here are the companies set to benefit most