- Steve Chen wasn’t happy when he saw all the deductions on his first paycheck.

- He began looking for alternate ways to add to his income and was eventually able to quit his job.

- He breaks down the exact ‘set it and forget it’ trading strategy he uses to supplement his income.

Steve Chen began his career as a math teacher for middle school students in 2014. Even though he had a decent monthly salary of about $5,000 a month before benefits according to the public employee-pay database Transparent California, taxes and living in an expensive city like Los Angeles were cutting into his pay.

As a result, he began thinking of ways he could increase his income, including through investing.

He said he spent a lot of time reading and watching YouTube explainers about trading since he didn’t know much about the stock market. And after reviewing numerous blog posts, he noticed a common theme: people who shared their experiences around buying short-term options were losing money.

“Instead of purchasing these short-term options, why don’t I do the opposite side of the trade, and sell short-term options?” Chen told Insider.

He said that’s how he became interested in options trading, specifically selling covered calls.

Here's how it works: An investor like Chen writes, or sells, the option to a buyer to purchase their shares by a specific date for a specific price, and in return receives a premium for the contract. The call is "covered" because the seller owns the stock they are agreeing to sell.

It's a lower-risk approach because if the stock's price doesn't move much, the investor still earns the option's premiums. And if the buyer decides to exercise the call option at the end of the contract, they'll have shares on hand to deliver.

This strategy allowed Chen to bring in above-average returns in 2020.

His trading in a Charles Schwab IRA earned him a 70% gain amounting to $47,359, according to a year-end statement prepared by the brokerage and viewed by Insider. He started with a balance of $65,073 and said he made no additional deposits into this account throughout the year.

Chen admitted that these profits were atypical for a single year and largely owed to the massive gains that big technology stocks saw during the pandemic. He said covered calls made up a majority of his trades.

His gains also reflect how options strategies can greatly amplify or diminish stock returns. The Invesco QQQ exchange-traded fund, which simply tracks the Nasdaq 100 Index, gained 46% last year. The S&P 500 has returned about 14% on average over the last 10 years, and it rose 16.3% in 2020.

Chen earned an additional $66,233 in gains from his Robinhood account, according to a Form 1099 from the broker viewed by Insider. He said he deposited about $73,000 into this account last year.

Chen said he was eventually able to quit his full-time teaching job in 2020, at the age of 33. He now generates income mainly from trading, tutoring, and teaching others how to trade options through his company Call To Leap.

He also has a TikTok page under the username calltoleap with more than 827,000 followers where he explains simple personal finance concepts. He does the same on Instagram for more than 200,000 followers.

While writing a contract for a covered call only takes him five to 15 minutes on a Monday morning, the thought process behind his approach took him years to reach. He shared with Insider four key aspects of the contract-writing process.

Picking stocks he plans to sell covered calls on

Chen likes to pick stocks that have steady growth potential and aren't volatile. This helps him select a strike price at which the underlying stock can be bought, and an expiration date that he's confident about.

Some of his top picks are Microsoft (MSFT) and Starbucks (SBUX) because they fit the below criteria.

Here's how he filters out what stocks to pick:

- He sticks to stocks in the S&P 500 and the Dow because they are the top US companies.

- He picks companies with strong fundamentals, which means the products or services sold are in demand and sustainable; the companies have increasing top-line revenues both year-to-year and quarter-to-quarter, with strong earnings outlooks.

- The company's historical stock chart has a strong upward trend, especially over the last five years.

- Finally, he usually prefers stocks that pay dividends because they are less likely to get sold off during volatile periods.

Chen added that he watches stocks that rally and then revert to trade flatly because buying covered calls on such stocks can earn the contract writer a premium. By making these trades repeatedly and collecting these premiums, he was eventually able to quit his nine-to-five job.

Chen said one example of an executed contract was when he purchased 100 Microsoft shares on January 11 for $216.87 each. He sold a covered call at a $225 strike price. The contract expired on January 29, when MSFT was trading at around $231.96. He collected a premium of $335, and made an additional $813 in capital gains when his shares were called away, or sold.

"Sometimes I don't end up selling the stock so I just collect the premium. I would then restart my covered call trade the next month and sell another contract on the same shares to collect another premium," Chen said.

One of the main risks with selling covered calls is holding on to the shares as the price of the underlying stock falls. Chen said this happened to him when he initially sold a cash-secured put to start his covered call trade. He bought 100 shares of Advanced Micro Devices (AMD) at $93.50 on February 19. The stock fell to $80.81 as of June 1, causing him to incur an unrealized loss of $1,269.

However, he was able to collect $940 in premiums. His strategy afterwards was to sell more calls and earn premiums while waiting for AMD's price to recover.

A second risk is missed opportunity cost. That happens if the share price rises above the strike price within the expiration date and the buyer executes the contract, taking Chen's shares away from him at a price lower than the market. But, Chen would still profit from the premium as well as the capital gain made from purchasing the shares at a lower price and selling them at a higher strike price.

How Chen sets expiration dates

The first thing he considers when setting an expiration date for a covered call is the market or stock trend. During a bull market, Chen says he selects contract expiry dates two to three weeks out. In a neutral market, he targets four-week contracts. And in a bearish market, he makes them five to six weeks out. This approach is based on a concept known as theta decay: options lose value the closer they get to expiry.

The second thing he considers is the premium tied to the contract length. The further out an expiry date is set, the higher the premium paid on the contract. But Chen says it's usually more optimal to sell four separate one-month calls rather than one call that's four-months long. This is because the extrinsic value of a call does not increase linearly to its one-month premium.

For example, selling a covered call one month out at $200 won't mean that a four-month contract would be sold at $800. Instead, it could be around $600.

The third thing he considers is the ex-dividend dates. Chen says he sometimes avoids weeks where dividends are dispersed because they increase the probability the contract buyer may choose to purchase the shares sooner to take advantage of the dividend payments. He usually sets his date a week or two after.

The fourth thing he considers is the company's earnings release date. Chen sometimes avoids setting expiration dates close to earnings because a stock might become more volatile as investors speculate on the results.

Setting strike prices based on the market trend

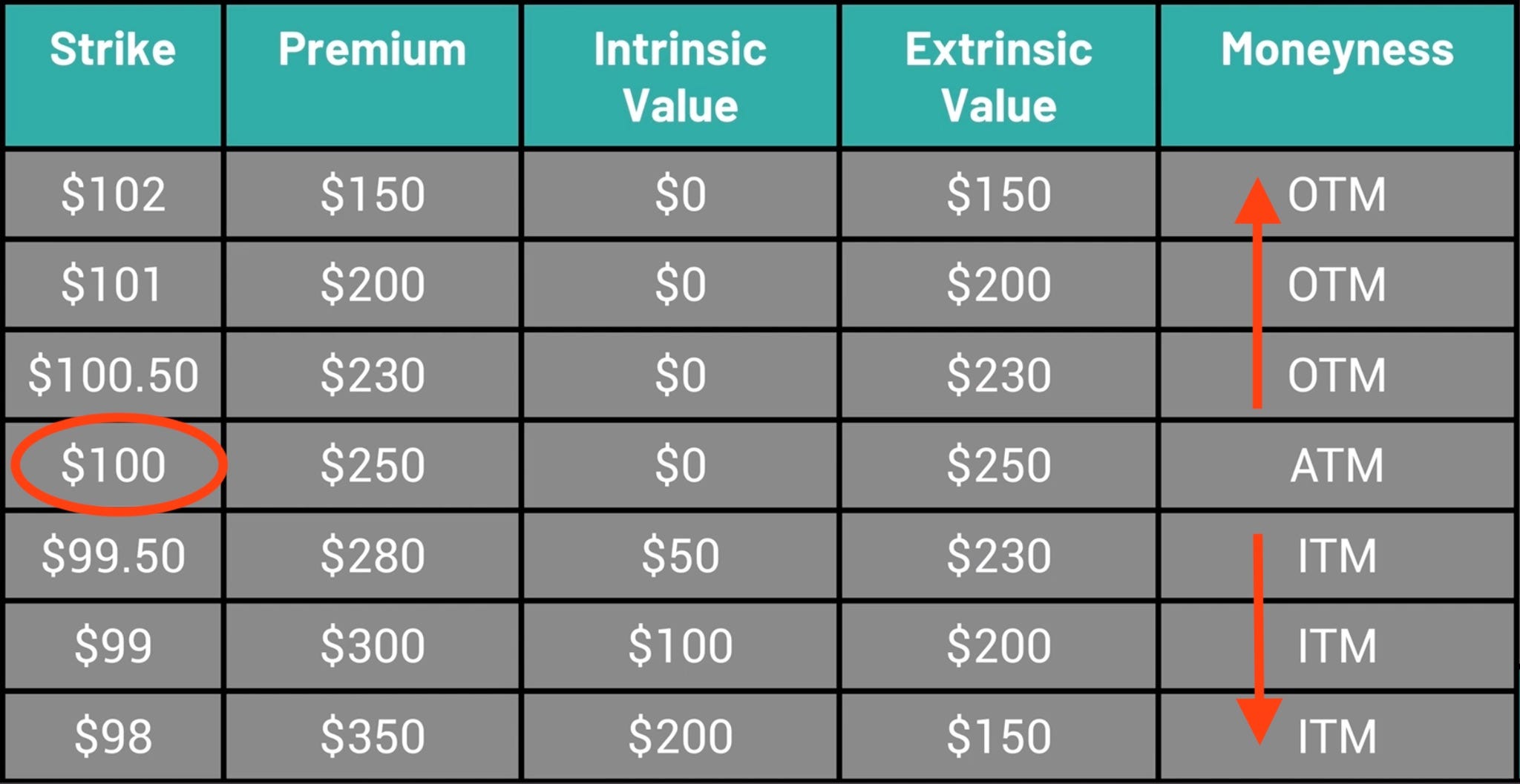

Chen says if the stock is in a bullish trend, he will set an Out of The Money strike (OTM). In a neutral market, it will be a Near The Money (NTM) or At The Money (ATM) strike price. And, if the stock is bearish, he will select an In The Money (ITM) strike price.

These are all terms that mean either above, at, or below the current share purchase price. This approach is based on the options moneyness concept.

Courtesy of Call To Leap, screenshot from tutorial video

Finally, Chen writes his contracts every Monday morning as they expire on a rotating basis.

How Chen mitigates risk

Chen said when he started investing, he used money that he didn't have an immediate need for. This meant additional income from his paycheck, as well as money he made from tutoring students.

Since his portfolio has grown, he told Insider he now recycles the profits earned off his premiums back into his portfolio, allowing him to buy both long-term investments as well as covered calls.