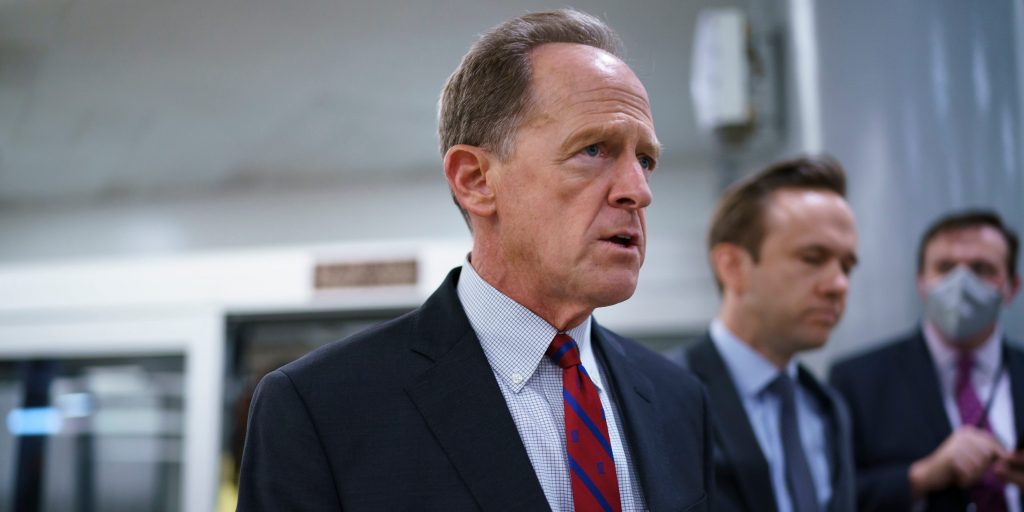

- Sen. Pat Toomey grilled Fed Chair Powell's view that inflation is transitory in a Tuesday hearing.

- "I know you believe this is transitory. But everything is transitory. Life is transitory," he said.

- The GOP blames Democrats' spending and criticizes the "transitory" outlook.

Things got existential during a Senate Banking Committee hearing on Tuesday.

The debate over US inflation continues to rage as the economy rebounds. The Biden administration and the Federal Reserve maintain that, over time, inflation will cool off and prove to be "transitory." The outlook has faced intense pushback as GOP lawmakers blame Democrats' spending agenda for the fastest price growth since 1990.

Senate Banking Committee Ranking Member Pat Toomey targeted the central bank's forecast in a Tuesday hearing with Fed Chair Jerome Powell and Treasury Secretary Janet Yellen. Inflation only got more intense in October, and the Fed's favorite term for pandemic-era inflation now seems wrong, he said.

"I know you believe this is transitory. But everything is transitory. Life is transitory," Toomey told Powell. "How long does inflation have to run above your target before the Fed decides maybe it's not so transitory?"

Criticism of the "transitory" outlook has forced the Fed to clarify its price-growth projections. Powell noted earlier in November that the word "attracted a lot of attention" and that the Fed is working to acknowledge "more uncertainty about 'transitory.'" Richmond Fed President Raphael Bostic joked in October that "transitory" is a "dirty word," and that he'd start putting $1 into a pseudo swear jar every time he used it.

The term "has different meanings to different people," and that's likely why some have lost faith in the Fed's outlook, Powell said in the Tuesday hearing.

"To many, it carries a sense of 'short-lived.' We use it to mean it won't leave a permanent mark in the form of higher inflation," he said. "I think it's probably a good time to retire that word and explain more clearly what it will mean."

While the Fed is rethinking its characterization of pandemic price growth, it's still sticking to its outlook. Powell reiterated his expectation for inflation to ease by the middle of 2022. Yellen shared a similar forecast in October, adding that policymakers "haven't lost control" of price growth.

Yellen's remarks haven't stopped GOP lawmakers from suggesting otherwise. Toomey criticized the Fed's continued asset purchases on Tuesday, noting the scheme risks eroding housing affordability even further. The central bank announced in early November it would start shrinking its purchases, but the pace of the pullback suggests the Fed will keep buying assets well into 2022.

Home prices soared at a record pace through much of 2021, and the Fed's continued purchases present more risks than benefits, Toomey said.

"Housing is leading the way, to the point where, in many markets, houses are just unaffordable for many people," he said. "I would strongly urge you to reconsider the pace of the tapering."

Senator Toomey's office did not respond to Insider's request for comment.