Peter Macdiarmid/Getty Images

- A shipping crisis is sparking shortages across industries.

- Shipping experts say the crisis will continue through 2022.

- A drop in demand will help ease the shipping crisis.

- See more stories on Insider's business page.

I have unfortunate news. The world's shipping crisis that's making everything more expensive (or just impossible to find) is probably going to ruin your Christmas.

That's because industry experts and company executives say the shipping crisis will continue through 2022.

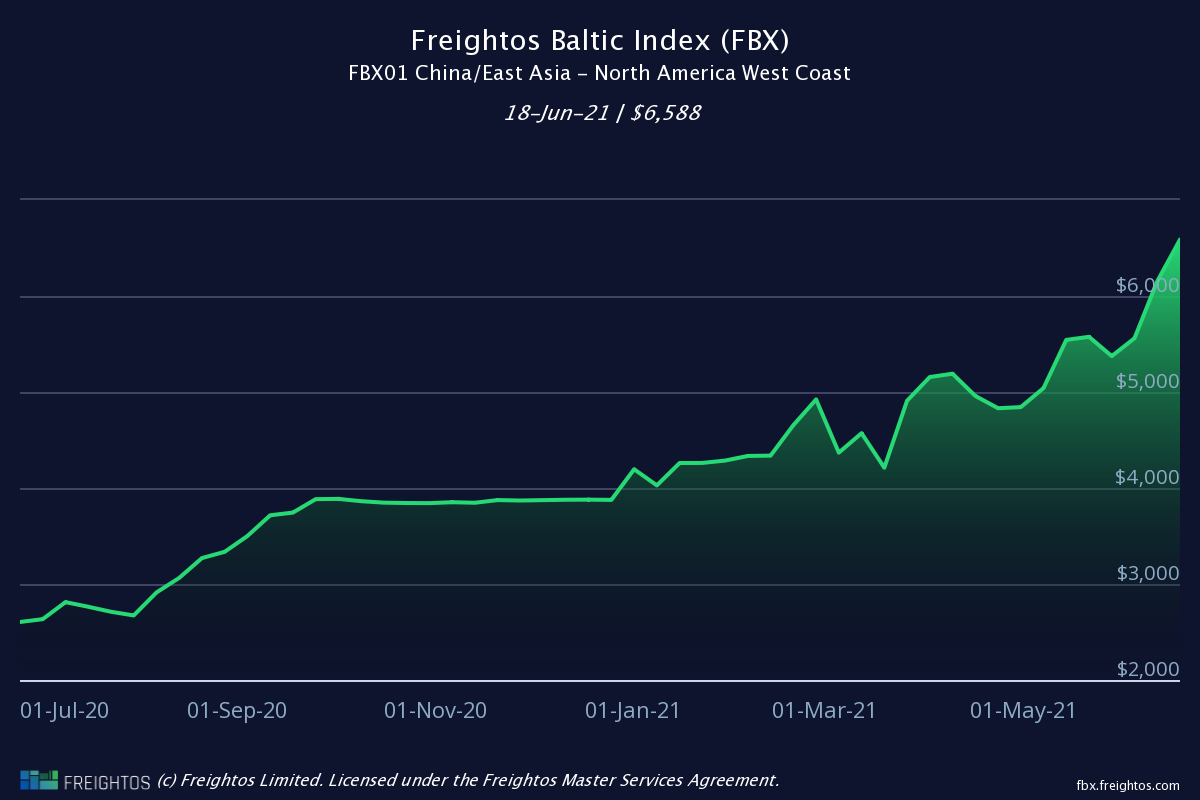

It's good news for ocean shipping magnates. Ocean rates are currently "spiking," according to Eytan Buchman, the chief marketing officer at global freight booking platform Freightos.com.

The price to send a shipping container from East Asia to the west coast of North America is nearly 1.8 times higher than it was at this time in 2019. To send one to the east coast, it's 2.1 times more expensive.

Freightos

But everyone else should prepare for several more months of frustration. We've already seen unexpected reverberations from the shipping crisis: skyrocketing freight rates have caused some pet food to vanish from shelves; a semiconductor shortage has idled auto factories; and chlorine shortages are disrupting pooltime dreams.

A quick and zesty explainer on our shipping calamity

Cargo ships move around 80% of global trade by volume. But a variety of factors is complicating the process in which containers full of factory-fresh goods - usually in Asia - are loaded onto ships, traverse the ocean, and are unloaded in, say, the ports of Los Angeles or Newark.

What's causing our shipping crisis include sweeping trends and more quotidian factors. A decades-long movement in the ship-building industry to make massive ships is clashing with the fact that many of our ports can't accommodate these behemoths. Since early last year, when consumers worldwide were trapped at home, demand for durable goods skyrocketed - we started buying more stuff because we couldn't go out to eat or travel.

Jacques Langevin/Sygma/Sygma via Getty Images

And shipping containers are also a hot commodity right now. As Chris Stauber, vice president of product at transportation visibility platform FourKites, explained to me, the makers of shipping containers decreased their output in 2019, a slow year for trade, and early 2020, when the coronavirus squeezed industrial production. Now we need more containers than ever, and manufacturers are struggling to catch up with demand.

Labor trends are also making the shipping crisis even more challenging. At the port of Yantian, one of the largest in the world, a coronavirus outbreak stymied work for weeks. Supply Chain Dive reported on Thursday that 67 vessels were waiting to dock there earlier this week. Now resuming normal operations, the port has a massive backlog of 160,000 containers to process.

Thanks to these delays, which cause even more delays down the line, ocean vessels are waiting days at ports around the world just to get unloaded. For example, wait times at Yantian surged from 0.5 days to 16 days this month.

Please stop buying stuff

Of course, one cannot snap their fingers and see smaller ships or much-improved ports within a year (or even several years). New containers or widespread vaccination could ease our shipping crisis a bit quicker, but the timeframe would still be a problem for your Christmas shopping.

Instead, experts point to another factor that untangle the shipping chaos: Less demand.

Retailers' inventories, which are the goods a business has in its warehouses to restock the shelves, do not match how much consumers are buying right now - even though inventories are back up to pre-pandemic levels. Companies have the same amount of goods in their stockrooms as before the pandemic, but even that isn't enough to keep up with how much stuff people are buying.

Per the latest monthly US Census Bureau data, all retailers (excluding motor vehicle and part dealers) are seeing an inventory-to-sales ratio of 1.04. In previous years, retailers had a wider margin between their inventories and how much consumers were buying; in April 2017-2019, the ratio hovered around 1.22.

Throughout the next few months, retailers typically stock back up on what they need for the holiday shopping season. In 2019, as Michigan State's Jason Miller, an associate professor of supply chain management, wrote in an analysis shared in American Shipper, retailers increased inventories by $35.12 billion from April to October. This year, Miller wrote that retailers need to add $65.11 billion to be ready for this year's peak season - nearly twice as much!

It's this stock-up that makes experts say that the shipping crisis won't clean up this year.

As Paul Bingham, director of transportation consulting at IHS Markit told American Shipper, "We're too far into the year without having recovered (inventories) to get out of this in 2021. We have to look to 2022 for any hope. So many portions of the supply chain are so far behind that it's not going to happen in the next six months."

What about next year?

There are plenty of caveats, but the folks who run Big Shipping believe the insanity will slow down by next year.

Forecasters believe folks will buy less stuff as the world re-opens and vaccination rates climb, instead spending their money on services like travel and dining out. This will give importers and exporters a chance to catch up on orders.

Johannes EISELE / AFP

Lunar New Year, which typically occurs in January or February, should also provide a respite. During that holiday, many factories in Asia shutter as workers travel home to celebrate. Trade volumes fell by one third during the 2020 Lunar New Year in February.

Triton International claims 28% of all leased shipping containers, making them the No. 1 player in the container leasing space. Triton CEO Brian Sondey told investors on an April earnings call that a slowdown in trade volumes is needed to untangle the shipping crisis. He expects that to hit after the Christmas inventory build-up in 2021.

"What we hear is that most customers don't think these bottlenecks are going to evaporate quickly, but they also don't think they're necessarily permanent," Sodney said.

He added, "I think our general view is it likely continues until trade slows and that - who knows exactly when that's going to be, but I think probably the betting is sometime end of this year, early next year when maybe the trade world starts to get back towards normal."

In other words: Once we stop buying so much stuff, we should see the shipping crisis abate. But to prevent another catastrophe, government leaders will have to take the hint and start building better ports.

When do you think the shipping crisis will end? How has the crisis affected your business or in-store experiences? Email [email protected].