Prime Minister Theresa May is pushing Britain into a “hard Brexit,” which will see the UK leaves the European Union without a trade deal.

May has justified this by saying that “Brexit means Brexit” and stressing that the will of the people is to reclaim control of Britain’s borders even if it means giving up access to the EU’s single market.

There may be some truth in that. But an audio recording leaked to The Guardian shows that May knows that this plan is doomed to fail economically.

In the recording, dated May 26, the then-home secretary who is now the prime minister warned Goldman bankers about the potential consequences of a Brexit. Every point she made demolished the case for leaving the EU:

- Brexit fallout – “I think the economic arguments are clear. I think being part of a 500-million trading bloc is significant for us. I think, as I was saying to you a little earlier, that one of the issues is that a lot of people will invest here in the UK because it is the UK in Europe.” Businesses leaving – “If we were not in Europe, I think there would be firms and companies who would be looking to say, do they need to develop a mainland Europe presence rather than a UK presence? So I think there are definite benefits for us in economic terms.” Britain’s security – “There are definitely things we can do as members of the European Union that I think keep us more safe.” Question becoming prime minister sidestepped – “That is one of my messages in terms of the issue of the referendum – actually we shouldn’t be voting to try to recreate the past, we should be voting for what is right for the future.”

I think being part of a 500-million trading bloc is significant for us

The biggest issue with these comments is not that we have a closet Remain supporter in charge of transitioning the country out of the EU. It is the fact that her government is pushing for a deal that she knows will be a huge failure for Britain – a “hard Brexit.”

May has said that the government won't give "a running commentary" on how Brexit negotiations are going (they haven't started yet and won't until Article 50 is triggered) but we have been given pretty clear signals that Britain is careening towards a "hard Brexit."

The Conservative-led government is prioritising immigration in the nation's Brexit deal, with Simon Wells and his team of economists at HSBC saying in a note to clients that: "Immigration control appears a higher priority than full Single Market access."

Why we have to worry about not getting a trade deal

That is the explicit choice the UK faces if it wants to regain control of its borders. German Chancellor Angela Merkel, her counterpart in France, Francois Hollande, and many other EU officials have clearly said Britain cannot opt out of EU immigration agreements if it wants to remain in the single market.

Taking greater control of immigration by opting out the Freedom of Movement Act, which allows any EU citizen to enter the country, and that means Briatin will have to relinquish its single market membership, like Turkey.

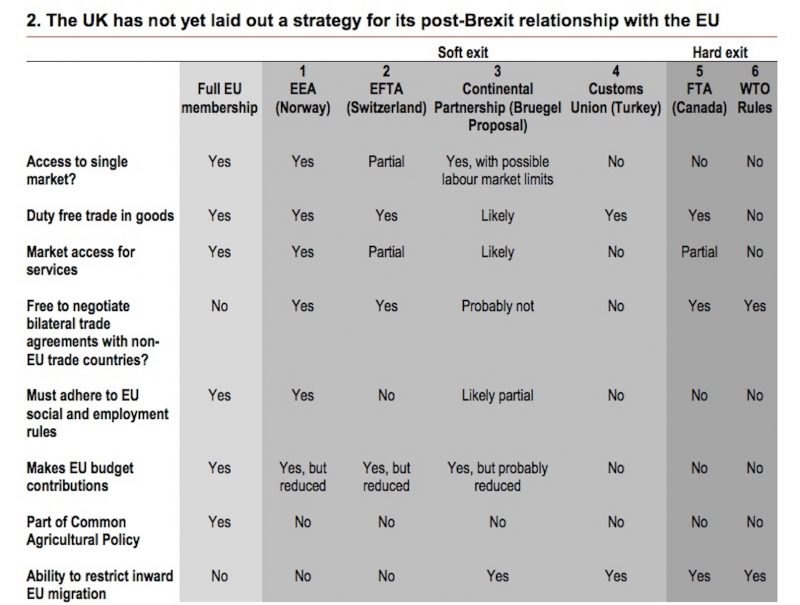

HSBC highlighted this in its client note earlier in October with the following table, giving a clear comparative chart of what being outside the EU single market could look like:

Pro-Brexit ministers argue that leaving the single market isn't a big deal - Britain can still trade under World Trade Organization rules and simply negotiate a new deal with the EU.

But we already from the collapse of the EU and Canada trade deal that getting any kind of decent deal outside of the single market is fragile and highly-prone to fail. That agreement to 7 years to negotiate and was scuppered by one region of Belgium that failed to ratify it.

The WTO isn't so hot either. The Treasury expects both trade and foreign investment in Britain to be around a fifth lower than it otherwise would have been if the UK relies on WTO rules for trade. This would also have a knock-on negative effect for productivity. All in all, the Treasury estimates it could cost the UK £66 billion ($81.2 billion) a year.

May knew this. Look at what May said in that audio recording. It is clear that before she had the responsibility of prime minister, she was pretty bearish on how post-Brexit Britain would look, especially outside of the single market - Britain would be worse off outside the trading bloc and businesses would pull back investments. She said: "I think the economic arguments are clear."

The World Trade Organisation is currently trying to stop everyone freaking out because the Treasury's assessment makes WTO trading conditions look like the world's consolation prize.

On Wednesday, the head of the WTO Roberto Azevedo told Sky News that the Brexit vote is not "anti-trade," and "trade will not stop, it will continue and members negotiate the legal basis under which that trade is going to happen. But it doesn't mean that we'll have a vacuum or a disruption."

But the fact that Canada went to the trouble of spending 7 years negotiating a trade deal shows that an agreement is better than simply working through WTO rules.

We're already seeing the signs of businesses of Brexit hitting investment and jobs

May's second warning shot in that secret recording - "If we were not in Europe, I think there would be firms and companies who would be looking to say, do they need to develop a mainland Europe presence rather than a UK presence?" - is already coming true.

If we were not in Europe, I think there would be firms and companies who would be looking to say, do they need to develop a mainland Europe presence rather than a UK presence?

Here are just a few recent examples from the banking world over the last month alone:

- The boss of the British Bankers' Association (BBA) claims that banks are poised to move operations out of the UK as soon as Christmas, amid fears that Britain could lose its financial passporting rights in Brexit negotiations. The US Chamber of Commerce, which represents US companies with $590 billion invested in the UK, warned that post-Brexit Britain would need "unfettered access" to the European single market to maintain US companies' investment in the UK economy. The biggest financial centres in Europe outside of London are so convinced that London is going to lose top talent and passporting rights that they are upping their game when it comes to attracting the business that the City. Growth in financial jobs in London is already waning and more and more people are competing for spots.

Meanwhile, on top of all that, HSBC and JP Morgan are among the banks that could send UK-based staff elsewhere in the aftermath of Brexit. Many other huge financial firms have also voiced similar views.

We were warned about all this before. That is probably why May was in the Remain camp before she became prime minister. She may still be in the Remain camp right now. However, her job has changed and she has made it explicitly clear that she will move the country out of the EU and will trigger Article 50 in the first quarter of next year.

The terrifying thing we know now is that even if she does not publicly admit it, she knows her government is pushing the country into a Brexit deal that will ultimately hurt the country's economy more than help it.