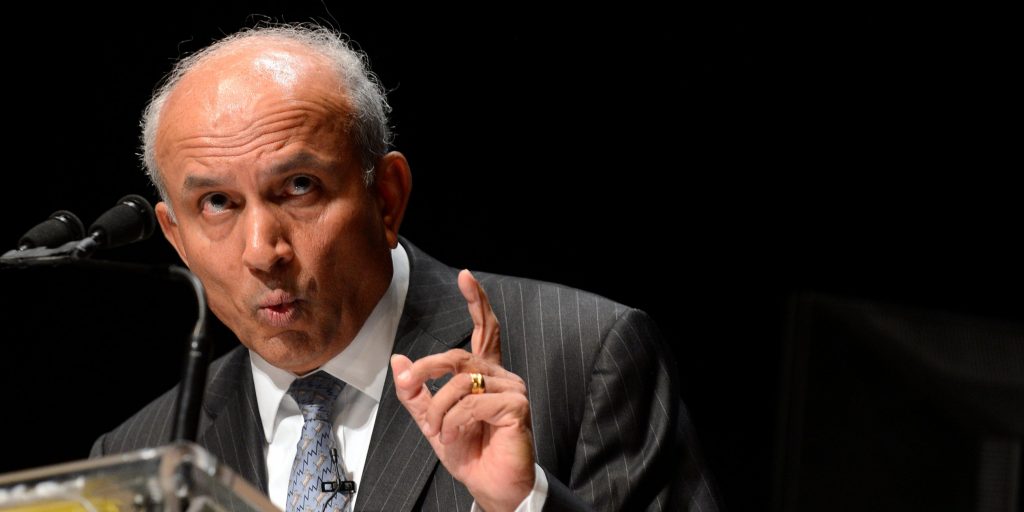

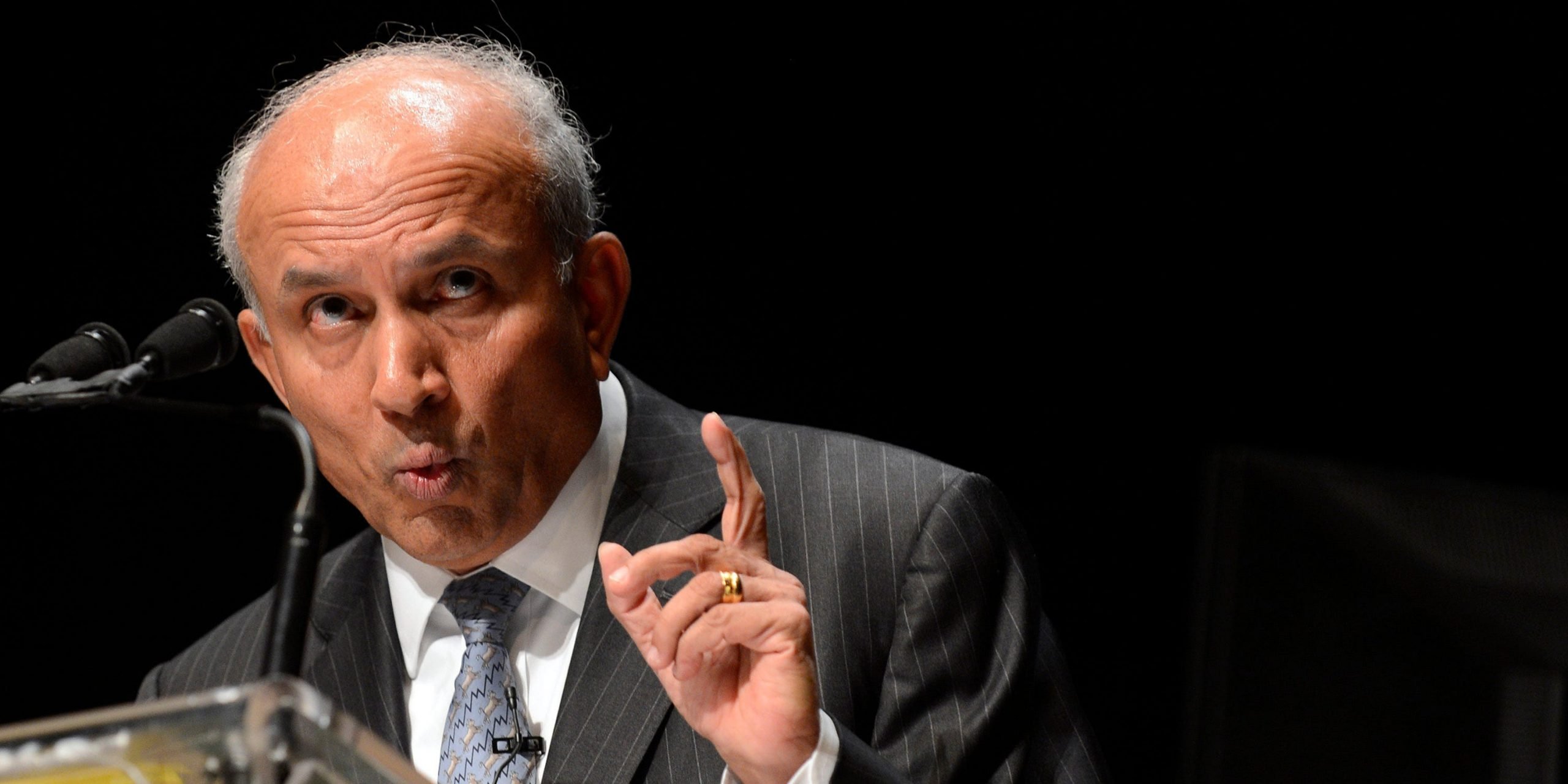

REUTERS/Aaron Harris

- The "Warren Buffett of Canada" could profit hugely from BlackBerry's stock surge.

- Prem Watsa's Fairfax Financial owns BlackBerry stock and convertible bonds.

- The firm's potential 16% stake was worth as much as $2 billion on Thursday.

- See more stories on Insider's business page.

A billionaire investor hailed as the "Warren Buffett of Canada" stands to make a fortune on BlackBerry after an agonizing seven-year wait, thanks to day traders pumping its stock price higher this week.

Prem Watsa is the founder and CEO of Fairfax Financial, an insurance conglomerate he modeled on Buffett's Berkshire Hathaway. Fairfax owns 46.7 million shares of BlackBerry as of March 31, giving it a 8% stake in the enterprise-software group. BlackBerry is its second-largest holding, accounting for 14% of its US stock portfolio.

Fairfax also holds BlackBerry bonds that it can convert into 55 million shares at a cost of $6 a share. If it converts all of those bonds, it would have 102 million shares or more than 16% of BlackBerry's outstanding shares.

Watsa, who sits on BlackBerry's board, disclosed on an earnings call in April that the bet cost him $10 a share. He tried to buy the entire company for $4.7 billion in 2013, but ended up leading a $1 billion investment in the business in November of that year.

The Fairfax chief would have liked to sell at least some of his BlackBerry stake in January, when the meme-stock frenzy drove its stock price from under $7 to almost $29 at the peak. However, Fairfax was restricted by SEC rules from making a profit on its shares, as it had swapped an old batch of bonds for its current set last September.

The "short-swing profit rule" requires insiders who own at least 10% of a company - and buy and sell its stock within a six-month period - to return any profits they make to the company. It's designed to prevent the use of inside information for short-term profiteering.

"There was no way, we checked it 10 times," Watsa replied when an analyst on the earnings call asked if he had sold any BlackBerry stock. "We had no option but to wait."

Now that the six-month window has passed, it would seem to make sense for Watsa to cash in some of his BlackBerry shares. The company's stock price climbed as high as $20 on Thursday - its steepest level in nine years excluding the January spike.

Fairfax's 46.7 million shares would fetch over $900 million at that price. If the company converted all of its bonds, its 102 million shares would be worth over $2 billion. That would represent a roughly $1.2 billion profit for Watsa, based on his cost base of $10 a share and the $330 million cost to convert the bonds.

The irony is that Watsa, a value investor who has stubbornly held BlackBerry for seven long years, might finally make some money on it because a bunch of day traders are wildly speculating on meme stocks for fun.