Tom Williams/CQ-Roll Call Inc. via Getty Images

- Democrats are struggling to roll back the Trump tax law and may leave most of it untouched.

- "That would be a great irony – if a Democratic president, House and Senate embraced the 2017 tax cuts," Sen. Mark Warner of Virginia said.

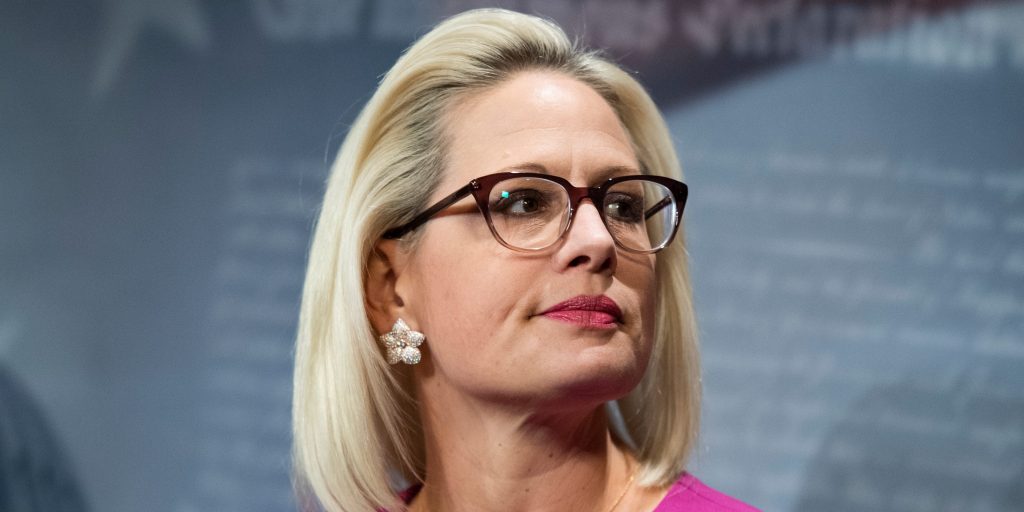

- Biden recently conceded that rolling back the law was off the table due to resistance from Sen. Kyrsten Sinema of Arizona.

President Joe Biden campaigned on rolling back his predecessor's signature tax law on "day one" of his administration.

Yet Democratic efforts to fulfill that promise are about to fall by the wayside because of resistance within their ranks to undo a law they repeatedly assailed as a giveaway to the rich. The Trump tax law could emerge as one of the biggest winners of the $1.75 trillion social spending package.

The party needs near-unanimity in the House and all 50 Democratic senators to approve the spending plan, given they are facing unified Republican resistance. That means all 50 Senate Democrats have the power to either sink or demand major adjustments to the plan.

Some Senate Democrats are unhappy that swaths of the Trump tax law are likely to be left untouched once the spending plan reaches Biden's desk for his signature.

"That would be a great irony – if a Democratic president, House and Senate embraced the 2017 tax cuts," Sen. Mark Warner of Virginia told Insider last month.

An early centerpiece of their spending proposal sought to lift the corporate tax rate to 28% from the current level of 21%. They also sought to raise the top marginal tax rate for richer individuals to 39.6% from 37%. Both steps amounted to a partial rollback of the Trump tax law, named the Tax Cuts and Jobs Act.

"I think it's a missed opportunity not to take on the Tax Cuts and Jobs Act head-on," Marc Goldwein, the policy head at the nonpartisan Committee for a Responsible Federal Budget, said in an interview. "But I don't want to be dismissive of the very real things that they're still doing in this bill."

Goldwein said Democrats were still on track to overhaul the international tax code and levy a corporate minimum tax rate. Both would contribute to over $800 billion in new tax revenue over the next decade, per the Joint Committee on Taxation.

Democrats are also eyeing rolling back another part of the law: lifting the amount of state and local taxes that people can deduct from their federal tax bills. The House legislation lifts the cap to $80,000 from the current $10,000 cap, and Goldwein argues it will largely benefit rich people in blue states like New York and California.

Biden recently conceded that raising corporate and income tax rates were off the table due to resistance from Sinema. "She says she will not raise a single penny in taxes on the corporate side and/or on wealthy people, period," Biden said at a CNN town hall last month. "And so that's where it sort of breaks down."

Sinema's opposition forced Democrats to scramble for alternatives like a new 3% surtax on rich Americans earning above $5 million and a billionaires' tax aimed at 700 wealthy individuals. The latter was scrapped only hours after it was introduced when Sen. Joe Manchin of West Virginia came out in opposition, arguing it was too divisive.

Some Democratic lawmakers say they aren't giving up just yet. "I have consistently been working to take away so many of the flawed and misguided pieces of the Trump tax cuts," Senate Finance Committee chair Ron Wyden of Oregon told Insider last week.