- US stocks have room to climb higher even as they hit record after record, according to LPL.

- The S&P 500 notched its 50th record closing high of 2021 on Tuesday, below 1995's record of 77.

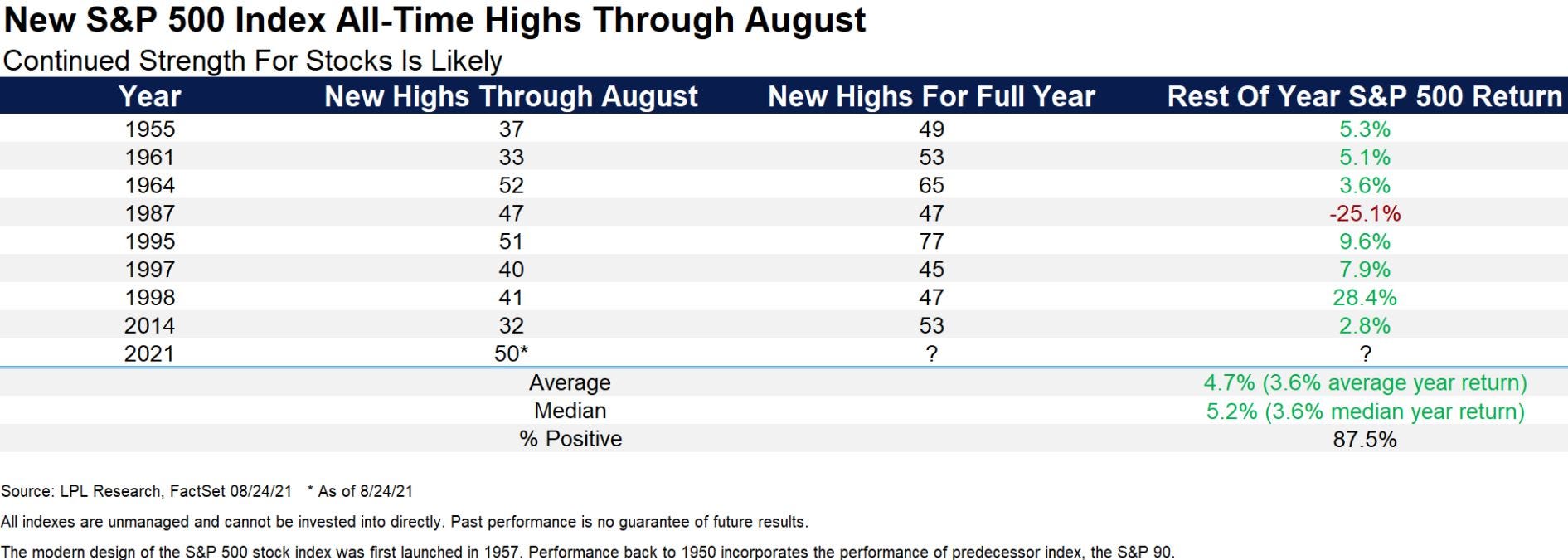

- According to LPL, the S&P 500 returns an average 4.7% in the final months of the year when stocks are this strong.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A continuous surge to record highs in the stock market shouldn't scare away investors who are worried about an imminent crash, according to a Wednesday note from LPL.

The S&P 500 closed at a record high for the 50th time this year on Tuesday, but that's still below 1995's record of 77 closing highs.

"Incredibly, 2021 is currently on pace for 78 new highs. There's a long way to go, but this has been an amazing year and this is yet another way to show it," LPL's chief market strategist Ryan Detrick said.

Detrick crunched the numbers and found stock finished the year strong when the S&P 500 notched more than 30 record closing highs through August. On average, stocks went on to surge 4.7% in the final months of the year, while the median final month return was 5.2%. That's well above the average final month returns of 3.6% in any given year.

Meanwhile, stocks were positive 88% of the time in the final months of the year amid so many closing record highs.

But not everyone has gotten the message, as both institutional and retail investors have raised billions in cash by selling their stocks in August, according to Fundstrat.

"2021 is off to a roaring start and we continue to expect higher prices before all is said and done. We'd use any potential weakness as an opportunity to add before potential higher prices," Detrick concluded.