Reuters

- The stock market has 20% upside potential from current levels, according to a Thursday note from JPMorgan.

- Analysts at the bank said the bull market in stocks is not yet exhausted and that investors should remain overweight stocks.

- Here’s why the stock market is set to continue grinding higher, according to JPMorgan.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Conditioned to “buy-the-dip” in stocks for more than a decade, investors continue to do just that, illustrated by the swift rebound from last week’s 3% decline in the S&P 500.

They should stick with that mentality going forward as the stock market is set to jump 20% from current levels, JPMorgan said in a note on Thursday.

“Stay overweight equities and commodities versus bonds and cash,” JPMorgan said.

According to the bank, the bull market in stocks is not yet exhausted, and any slowdown in the recent strength of retail investors should be made up for by institutions that de-risked their portfolio last week amid an epic short-squeeze in stocks like GameStop and AMC Entertainment.

“While we recognize the risk from a potential slowing in retail investors equity impulse, we are reluctant to reduce our equity overweight in our model,” JPMorgan said.

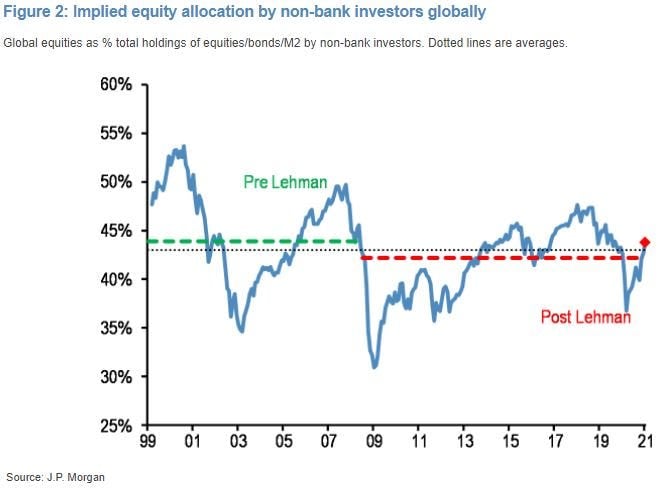

JPMorgan's forecast for 20% upside potential in the stock market is driven by its metric of equity positioning based on global non-bank investors' holdings of bonds, stocks, and cash.

"The argument is that the current implied equity allocation of 43.8% is still significantly below its post Lehman period high of 47.6% seen in January 2018, and that the equity appreciation needed to mechanically shift the implied equity allocation of non-bank investors globally from its current level to the post Lehman period is 23% for the MSCI AC World Index and even more for the S&P 500," JPMorgan explained.

JPMorgan isn't alone in its thinking. Fundstrat's Tom Lee said in a note on Wednesday that the historic decline in volatility over the past three days sets the stock market up well for further upside ahead.