- Stock market gains added roughly $3 trillion in wealth to US households in the first quarter of 2021, Fed data reveals.

- Data also shows the wealthiest Americans saw their stock wealth increase by 74% during the pandemic.

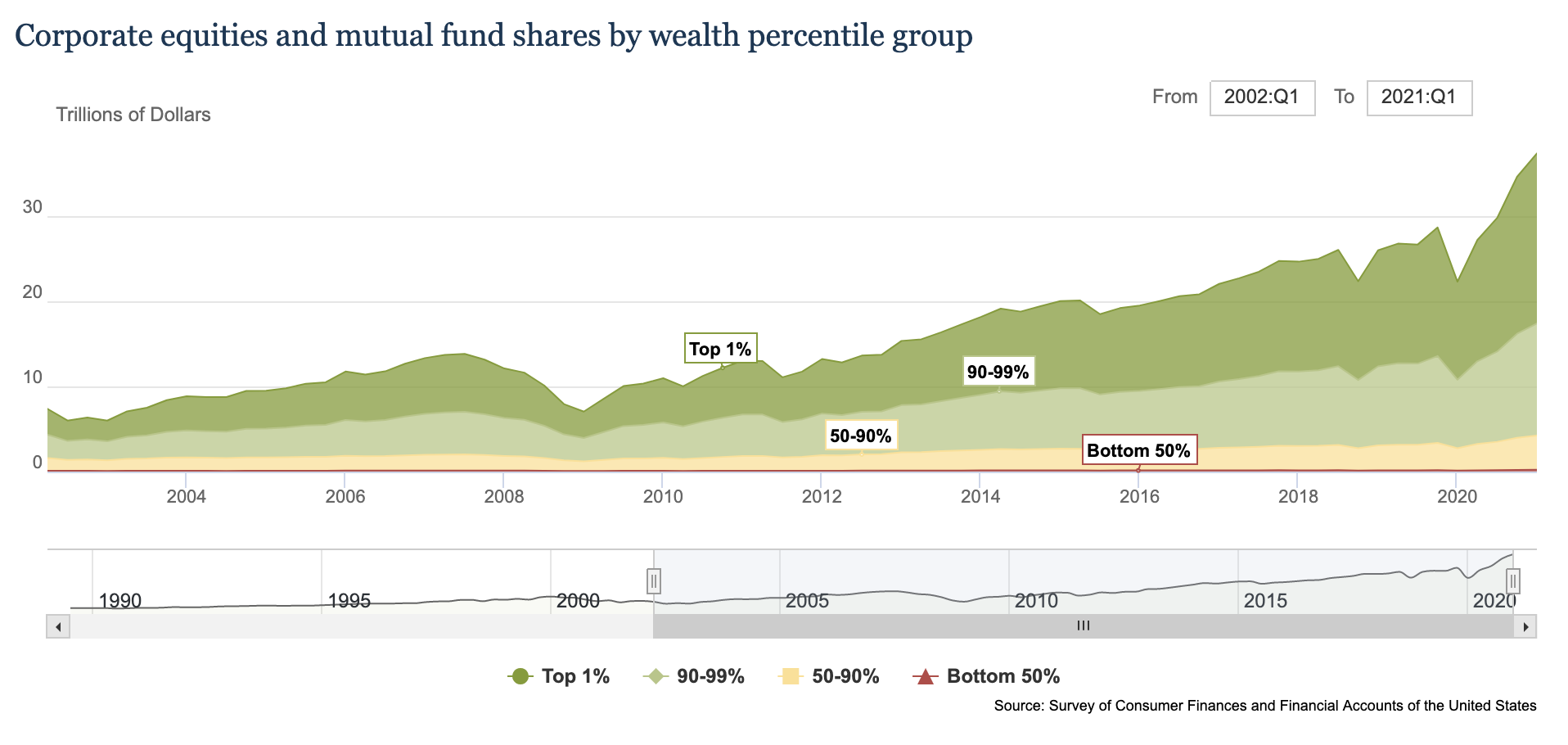

- Wealthy Americans are also scooping up more ownership of the stock market than previous years.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Stock market gains added roughly $3 trillion to the wealth of US households in the first quarter of 2021, according to data released by the Federal Reserve.

The gain came as the S&P 500 jumped 7% and investors continued to bet on rising corporate earnings amid the economic recovery.

Fed data also shows that the wealthiest Americans got especially rich investing in stocks during the pandemic. Over the past year, the top 1% saw their stock wealth increase by 74%, adding $8 trillion. It's the largest and fastest increase on record, according to CNBC.

The rest of Americans also saw their stock wealth increase, but by a smaller amount. The bottom 99% saw its stock wealth increase by 61% from the first quarter of 2020 to the first quarter of 2021.

It's a sign of the unusual nature of the pandemic-driven recession where Americans added wealth, paid off credit-card debt, saved more, and refinanced into cheaper mortgages, while accommodative monetary and fiscal policy pushed the stock market to all-time highs.

Meanwhile, rich Americans are scooping up more ownership in the stock market. As of the first quarter of 2021, the top 10% of Americans own 89% of all stocks and mutual funds. Meanwhile, the bottom 90% of all US households' stock ownership has fallen nearly half since 2002, dropping from 21% to 11%.