- The S&P 500 could surge up to 25% by year end regardless of who wins the November election, or which party controls the House or the Senate, TradingView’s Piece Crosby said.

- Crosby said a blue, or a red, wave would make it easier for either party to pass any fiscal stimulus measures.

- “Both sides actually are very much on the same page in terms of doing more [stimulus] as long as it applies to their party,” Crosby said.

- Democrats and Republicans have been at loggerheads over more fiscal stimulus since July.

- If realized, the prediction puts the index on course to hit another record after the S&P 500 hit an all-time high in early September.

- Visit Business Insider’s homepage for more stories.

The S&P 500 could surge 25% by year end regardless of whether so-called red- or blue-wave victories by the Democrats or the Republicans play out, according to one expert.

In both scenarios, either party would win the White House and control both chambers of the Congress, making it easier to pass fiscal stimulus measures, said Pierce Crosby, general manager of financial and social trading platform TradingView.

“A blue wave or red wave.. a takeover in either direction gives that level of confidence that more can be done and both can [push] the S&P 500 25% higher by year end,” Crosby said.

The House is currently led by the Democrats, while the Republicans hold control of the Senate.

“Both sides actually are very much on the same page, in terms of doing more [stimulus], as long as it applies to their party,” he added.

A 25% move higher would represent a fresh record high for the S&P 500 index, which hit a record peak of 3,588.11 in early September. The index is trading roughly 4% below this level.

Democrats and Republicans have been at loggerheads over the size and reach of another stimulus package for the economy since the first one expired in July.

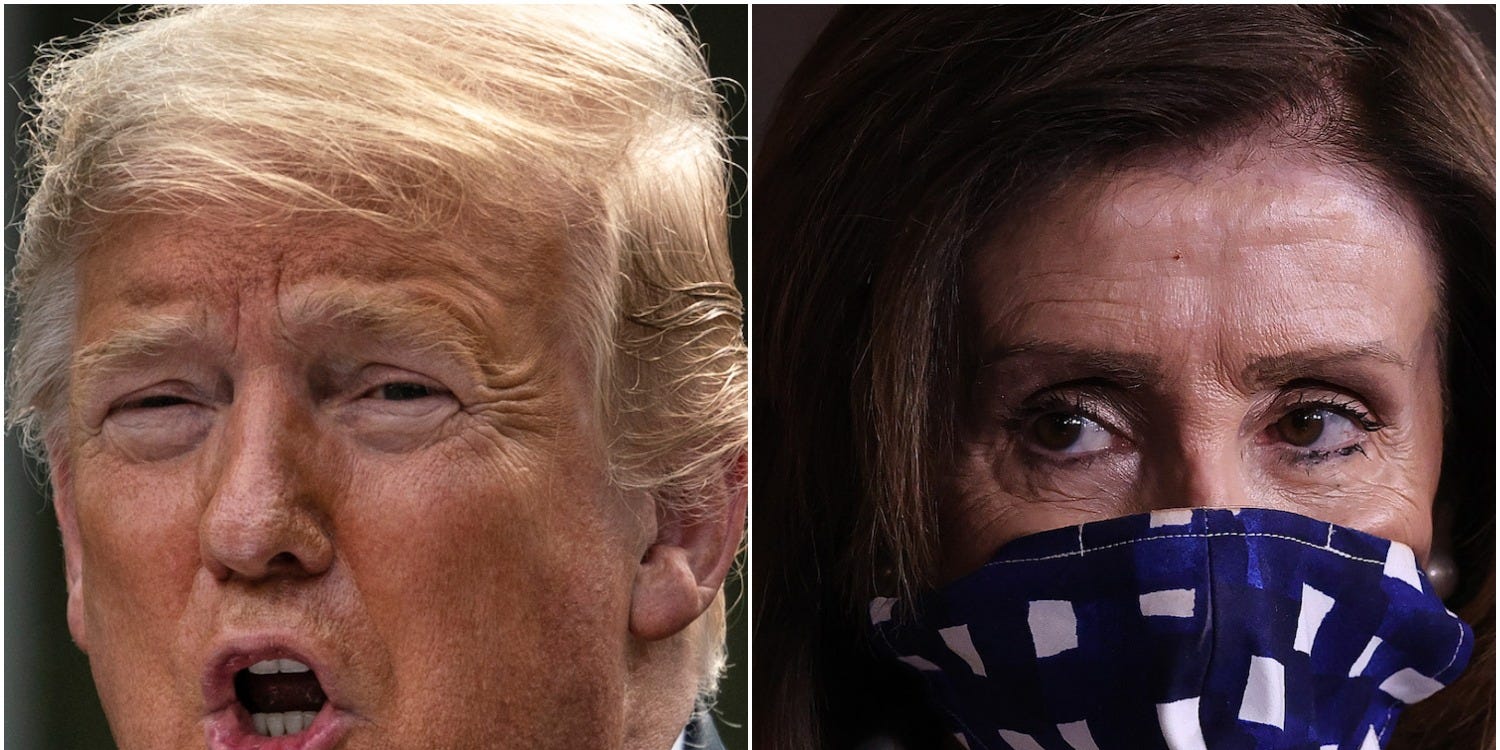

House Speaker Nancy Pelosi and US Treasury Secretary Steven Mnuchin have spoken a number of times in the past week and signaled that there has been progress towards an agreement.

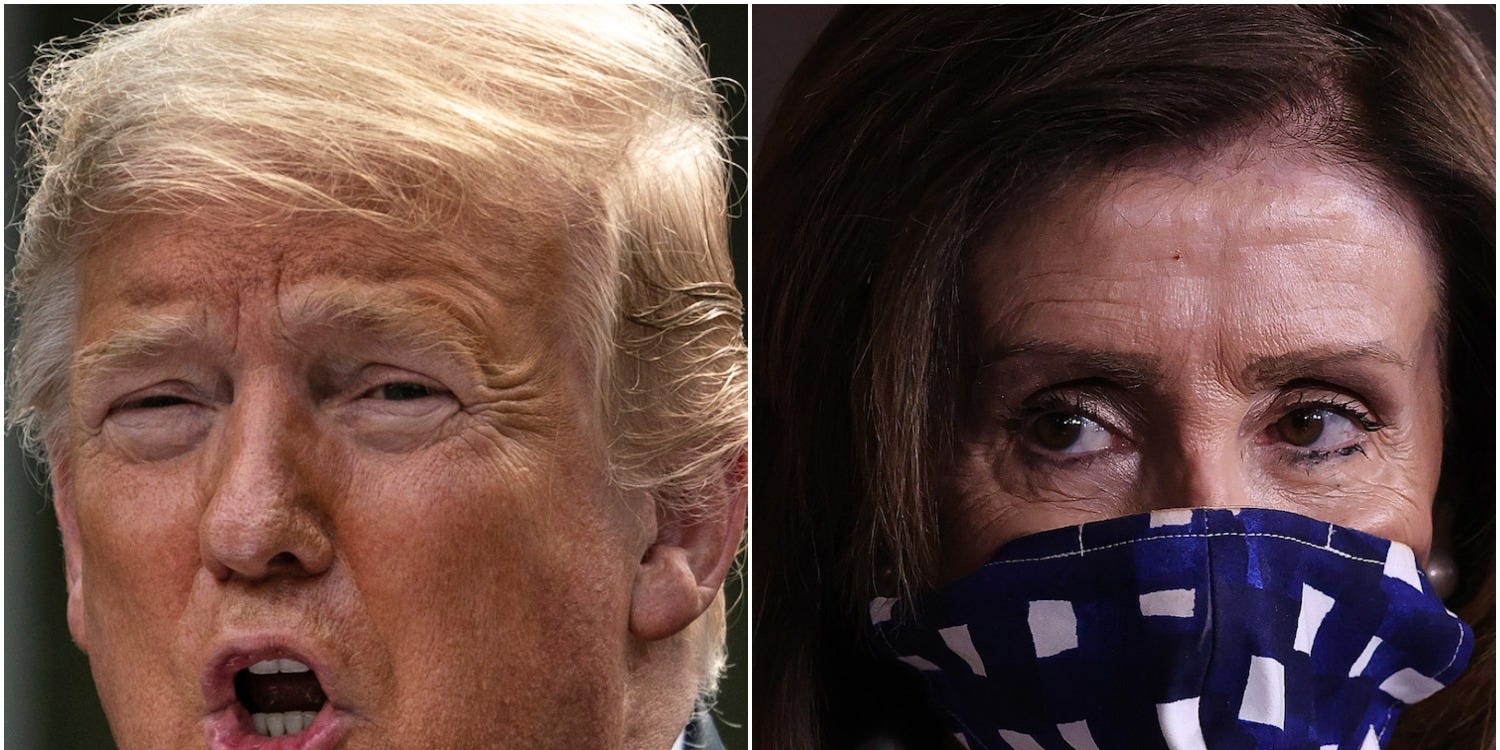

However, the markets were thrust into a tailspin on Tuesday, when President Donald Trump initially called off talks until after the election, which triggered a nosedive in shares on the S&P 500. Trump then appeared to reverse course, calling for piecemeal aid for airlines, something Pelosi has ruled out without a broader deal.

The House backed a $2.2 trillion stimulus proposal last week, but this is unlikely to get approved in the Senate.

Nonetheless, the S&P 500 is likely to push at least 10% higher by year-end, even if the election outcome doesn't result in a sweeping victory in both chambers of the legislature and the White House, Crosby said.

Crosby said: "It's a pretty conservative forecast, just because we do see a tale of two sectors that really kind of define the outcome for the S&P 500 by year end."

He said a Biden presidency could a negative impact on the energy sector, given the Democrat candidate's support for a shift to cleaner sources of energy. At the same time, Crosby said a Biden presidency would likely boost health care shares, while a Trump win would have the opposite effect on those two sectors.