Blue Planet Studio/Getty

- The quick ratio evaluates a company's ability to pay its current obligations using liquid assets.

- The higher the quick ratio, the better a company's liquidity and financial health.

- A company with a quick ratio of 1 and above has enough liquid assets to fully cover its debts.

- Visit Insider's Investing Reference library for more stories.

A company's quick ratio is a measure of liquidity used to evaluate its capacity to meet short-term liabilities using its most-liquid assets. A company with a high quick ratio can meet its current obligations and still have some liquid assets remaining.

What is quick ratio?

The quick ratio measures a company's ability to pay its short-term liabilities when they come due by selling assets that can be quickly turned into cash. It's also called the acid test ratio, or the quick liquidity ratio because it uses quick assets, or those that can be converted to cash within 90 days or less. This includes cash and cash equivalents, marketable securities, and current accounts receivable.

Why is knowing the quick ratio important?

A quick ratio of 1 is considered the industry average. A quick ratio below 1 shows that a company may not be in a position to meet its current obligations because it has insufficient assets to be liquidated. This tells potential investors that the company in question is not generating enough profits to meet its current liabilities.

On the contrary, a company with a quick ratio above 1 has enough liquid assets to be converted into cash to meet its current obligations. In essence, it means the company has more quick assets than current liabilities.

"The quick ratio is important as it helps determine a company's short-term solvency," says Jaime Feldman, tax manager at Fiske & Company. "It's the company's ability to pay debt due soon with assets that quickly convert to cash. You can use the quick ratio to determine a company's overall financial health."

How to calculate quick ratio

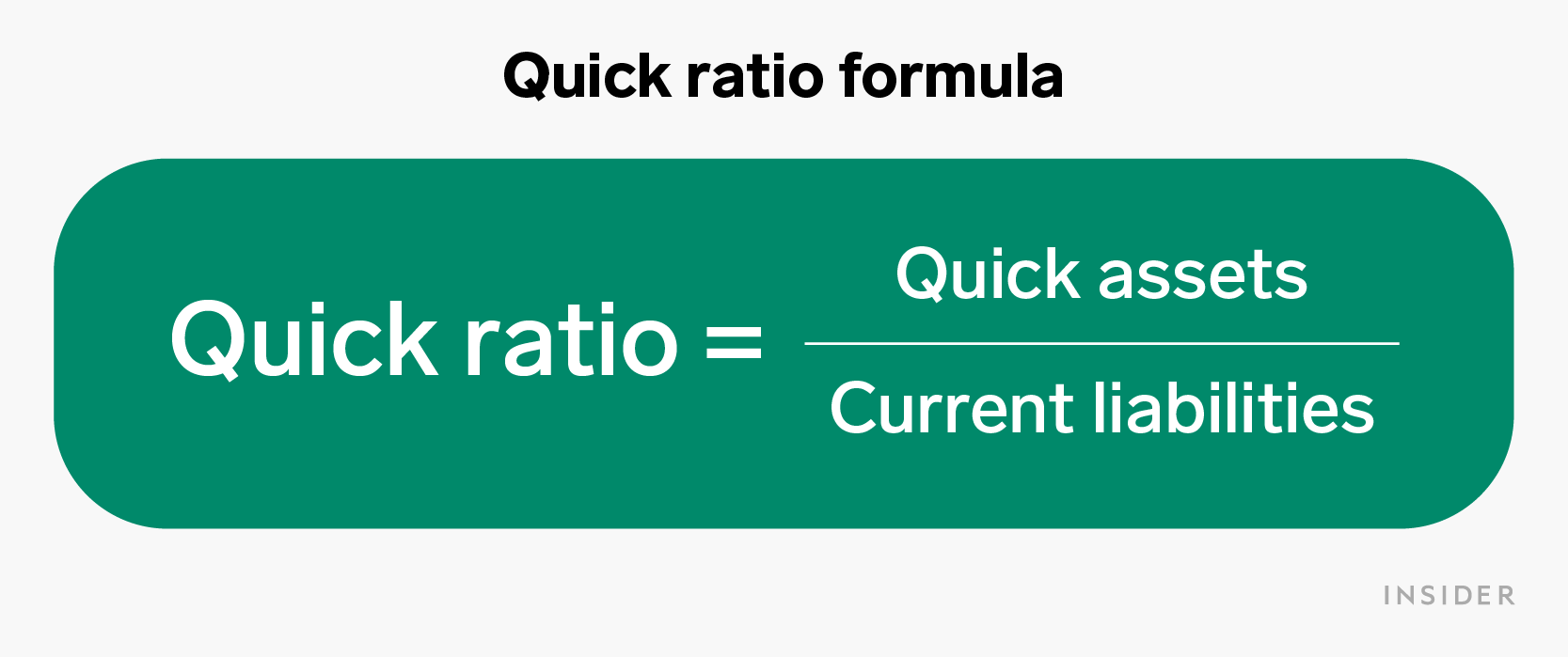

The quick ratio is calculated by dividing the sum of a company's liquid assets by its current liabilities. This is the basic formula:

Quick assets

Quick assets are those that can be quickly turned into cash. Accounts receivable, cash and cash equivalents, and marketable securities are the most liquid items in a company.

For an item to be classified as a quick asset, it should be quickly turned into cash without a significant loss of value. In other words, a company shouldn't incur a lot of cost and time to liquidate the asset. For this reason, inventory is excluded in quick assets because it takes time to convert into cash.

Companies usually keep most of their quick assets in the form of cash and short-term investments (marketable securities) to meet their immediate financial obligations that are due in one year.

Current liabilities

Current liabilities are a company's short-term debts due within one year or one operating cycle. Accounts payable is one of the most common current liabilities in a company's balance sheet. It can also include short-term debt, dividends owed, notes payable, and income taxes outstanding.

Example using quick ratio

Let's say you own a company that has $10 million in cash and cash equivalents, $30 million marketable securities, $15 million of accounts receivable, and $22 million of current liabilities. To calculate the quick ratio, divide current liabilities by liquid assets. In this case:

- Quick assets = ($10 million cash + $30 million marketable securities + $15 million accounts receivable)

- Current liabilities = $22 million

- Quick ratio = $55 million / $22 million = $2.5 million.

- The company's quick ratio is 2.5, meaning it has more than enough capital to cover its short-term debts.

What's considered a good quick ratio?

A company with a quick ratio of less than 1 indicates that it doesn't have enough liquid assets to fully cover its current liabilities within a short time. The lower the number, the greater the company's risk.

"A good quick ratio is very dependent on the industry of the company being represented. A good rule of thumb though is to have a quick ratio around or above 1," says Austin McDonough, an associate financial advisor at Keystone Wealth Partners. "This shows that a company has enough cash or other liquid assets to pay off any short-term liabilities in case they all come due at once."

Quick ratio vs. current ratio:

The quick ratio and current ratio are two metrics used to measure a company's liquidity. While they might seem similar, they're calculated differently. The quick ratio yields a more conservative number as it only includes assets that can be turned into cash within a short period 一 typically 90 days or less.

Conversely, the current ratio factors in all of a company's assets, not just liquid assets in its calculation. That's why the quick ratio excludes inventory because they take time to liquidate.

The financial takeaway

The quick ratio evaluates a company's capacity to meet its short-term obligations should they become due. This liquidity ratio can be a great measure of a company's short-term solvency. As an investor, you can use the quick ratio to determine if a company is financially healthy. "The higher the ratio result, the better a company's liquidity and financial health is," says Jaime.

However, it's essential to consider other liquidity ratios, such as current ratio and cash ratio when analyzing a great company to invest in. This way, you'll get a clear picture of a company's liquidity and financial health.