- The risk for the Nasdaq is to the downside if interest rates keep rising, Ned Davis Research said in a note on Thursday.

- If the 10-year US Treasury yield rises to 2% later this year, the Nasdaq could decline by as much as 20%, NDR said.

- The 10-year US Treasury yield traded down from its recent peak of 1.61% on Thursday to 1.52%.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The Nasdaq could fall 20% if interest rates continue to rise, according to a Thursday note from Ned Davis Research.

High-growth technology stocks fell out of favor with investors over recent months as a rotation into cyclical stocks poised to benefit from the full reopening of the economy occurred. This trend will likely continue if the 10-year US Treasury yield rises to the 2% level later this year, which NDR believes will happen.

The 10-year US Treasury yield traded down from its recent peak of 1.61% on Thursday to 1.52%. At the start of the year, the yield was below 1%.

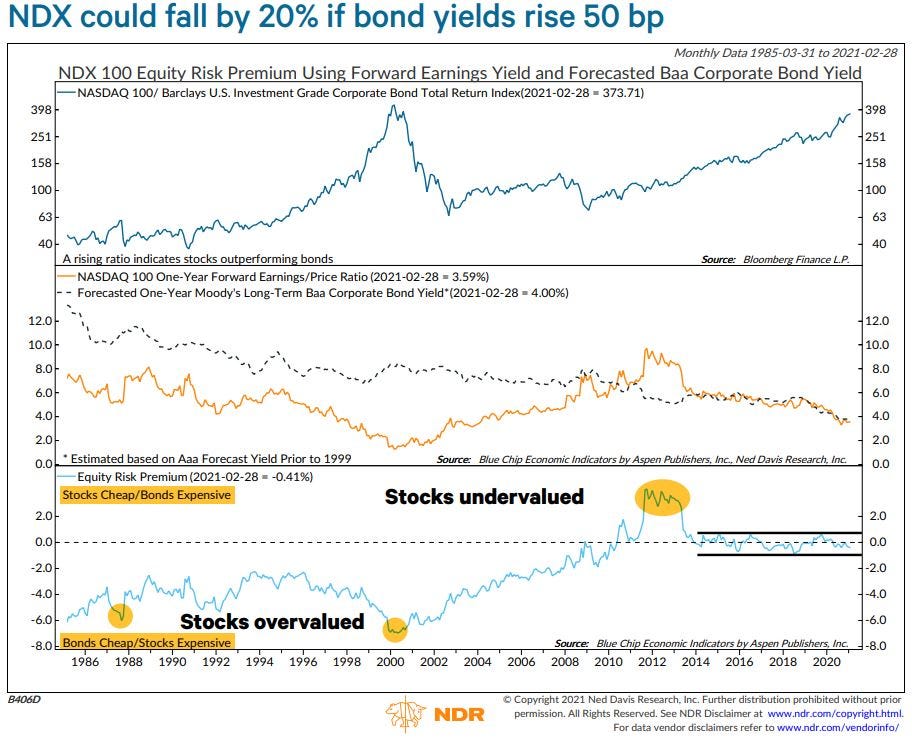

NDR's forecast for a continued decline in the Nasdaq is predicated on the relationship between corporate bond yields and the equity risk premium, according to the note.

A rise in the 10-year yield to 2% "could drive the long-term Baa bond yield to 4.50%" which, assuming no changes in earnings forecasts, "the Nasdaq would have to drop 20% to make the two yields equivalent," NDR said.

But investors shouldn't rush for the exits, according to NDR, which recommends an overweight allocation to equities and an underweight allocation to fixed income.

Two new NDR valuation indicators that calculate economic margin and the difference between forward earnings yields and the expected real treasury yield suggest the broader stock market still has further room to the upside.

"With real yields low, equity valuations should be higher" as stocks remain undervalued relative to bonds, NDR said.