- Theranos, the blood-testing startup once valued at $9 billion, has fallen far from grace.

- Its former CEO and founder Elizabeth Holmes faces criminal charges stemming from allegations that she and former Theranos president Sunny Balwani engaged in a scheme to defraud investors.

- First founded in 2003 by a 19-year-old Holmes, here are the events that contributed to the rise, the fall, the pivot, and now criminal charges facing Theranos and its founder.

- Theranos is the focus of “The Inventor: Out for Blood in Silicon Valley,” a documentary debuting Monday at 9 p.m. ET on HBO.

Theranos’ star was shining bright going into 2015.

The blood-testing startup had racked up a $9 billion valuation with its big vision to test for a number of conditions using a small sample of blood, and its CEO Elizabeth Holmes was featured on the covers of business magazines and lists of top executives. But then questions started being raised about how the company’s technology worked.

As Wall Street Journal reporter John Carreyrou details in his book, “Bad Blood: Secrets and Lies in a Silicon Valley Startup,” the events leading up to the downfall of the company started unfolding years earlier. The book gives a behind the scenes look into the events that propelled Theranos into chaos.

In June 2018, Holmes stepped down as CEO of Theranos, remaining with the company as a founder and chair of the board. She was also charged with wire fraud by the Department of Justice. In September, Theranos shut down.

Theranos is the focus of "The Inventor: Out for Blood in Silicon Valley," a documentary debuting Monday at 9 p.m. ET on HBO.

Here are the events that contributed to the rise, the fall, the pivot, and now criminal charges of the once promising company founded by Holmes.

This article was initially published in May 2018 and has been updated. Charlotte Hu contributed to an earlier version of this post.

Elizabeth Holmes arrived at Stanford University in 2002 filled with ideas. She took one to Dr. Phyllis Gardner, a Stanford Medical School professor. Holmes wanted to build a patch that would scan the wearer for infections and release antibiotics. Gardner tried to explain to her why that might not work (The antibiotics Holmes wanted to use needed to be given at higher doses than a patch could deliver).

Source: Business Insider

But Holmes was not deterred. Holmes went on to drop out of Stanford University in 2003 at the age of 19 to start Theranos, which was then called Real-Time Cures. She was inspired both by her grandfather's medical career, and her summer 2003 internship at the Genome Institute of Singapore.

Shaunak Roy, a PhD student Holmes was assisting in Professor Channing Robertson's lab, joined her at Theranos in May 2004 as its first employee. Robertson joined the company's board as an adviser.

In order to raise initial funding, Holmes leveraged several family connections. The first two investors in Theranos were Tim Draper, the father of her childhood friend and former neighbor, and Victor Palmieri, one of her father's long-time friends. By the end of 2004, Holmes had raised nearly $6 million.

The initial design for the Theranos device in 2005 was a cartridge-and-reader system that was dependent on microfluidics and biochemistry. This prototype was dubbed the Theranos 1.0, and the company had plans to license the technology out to pharmaceutical firms to help them catch side effects during drug trials.

In November 2006, Theranos Chief Financial Officer Henry Mosley was fired after questioning the reliability of its technology and the honesty of the company.

In August 2007, Holmes used the premature Theranos 1.0 in a patient study with terminal cancer patients in Nashville, Tennessee. Theranos also said that it would sue three former employees for stealing intellectual property.

Theranos developed a new prototype in September 2007, named the Edison. The device was a modification of a glue-dispensing robot from New Jersey company Fisnar. By then, Holmes had poached some of Apple's designers and put them in charge of architecting the overall look and feel of the Edison.

Sunny Balwani joined Theranos in September 2009. He had known Holmes since 2002. Balwani had a background in software engineering and business.

Learn more about Sunny Balwani.

By 2010, a startup boom had hit Silicon Valley. That year, Holmes and Balwani approached Walgreens with a business proposition to run health clinics. At the same time, Theranos was also pursuing a partnership with Safeway.

The new partnerships meant that Holmes had to create a new device that could perform more than just one class of blood tests. The miniLab was created in 2011, and was nicknamed the 4s after the iPhone model.

In early 2012, Theranos took over blood testing at a Safeway employee health clinic as a beta run. The chief medical officer of Safeway had concerns about discrepancies in the test results. Safeway's CEO brushed it off and retired the following year. Theranos also signed a deal with Walgreens in 2012 to launch its devices in-store but continuously missed deadlines.

Lieutenant Colonel David Shoemaker raised concerns about Theranos' regulatory strategy to the FDA in 2012 after Holmes approached him about deploying the device in the military. The Centers for Medicare and Medicaid Services (CMS) then did a surprise inspection, in which Balwani told regulators the device was still under development. After battling James Mattis, who was on the Theranos board, Shoemaker ultimately agreed to a more limited experiment.

At Theranos, tension was mounting. Ian Gibbons, the chief scientist at Theranos, was growing uncomfortable with some of the issues the blood-testing technology had. In May 2013, Holmes scheduled a meeting with Gibbons, in which he expected Holmes would fire him. The night before, he attempted to take his own life. He died a week later.

In September 2013, Theranos launched its 4s model with a new website and an op-ed by Holmes in The Wall Street Journal, despite protests from several of the company's scientists saying that the technology wasn't ready.

Source: Wall Street Journal

Partner Fund purchased 5.6 million shares of Theranos at a price of $17 a share in February 2014. Theranos was valued at $9 billion and Elizabeth Holmes had a net worth of almost $5 billion.

Theranos and Holmes started gaining media attention, gracing the cover of Fortune magazine in June 2014. In it, she made claims about her blood test like that the company offered more than 200 tests and was ramping up to more than 1,000. In deposition tapes reported by ABC News in January 2019, Holmes was asked if that claim was true. "Reading it now I don’t think it is," Holmes said.

Wall Street Journal investigative reporter John Carreyrou got a tip about Theranos in early February 2015. On February 26, he contacted a former lab director at Theranos who told him about unethical and harmful practices there. At that time the company was operating at a limited capacity and had been generating false and unreliable results for patients. Theranos had also been thinking of conducting HIV tests before the former lab director talked Holmes and Balwani out of it.

Source: Business Insider

While Carreyrou was investigating the company, business carried on as usual. In July 2015, Theranos got its first FDA approval. By this point, scientists were starting to raise some questions about the company's technology.

Source: Business Insider, Business Insider

At Theranos's headquarters, however, the mood was jubilant. Upon getting the FDA approval, Theranos had a party complete with a bouncy house, beer pong, and Holmes dancing to "U Can't Touch This" by MC Hammer.

Source: Business Insider, HBO

Carreyrou's first article dropped that October, revealing the company's struggles to develop its blood-testing technology. That day, Holmes was attending Harvard Medical School's board of fellows meeting as a new member. Holmes sat through the day of meetings and took a break to go on CNBC's "Mad Money" to dispute Carreyrou's reporting.

Source: Business Insider, Business Insider

Later in October, Holmes was scheduled to speak at a conference hosted by The Journal. Holmes went on stage to defend her company, which she kept up for several weeks on TV and at various conferences.

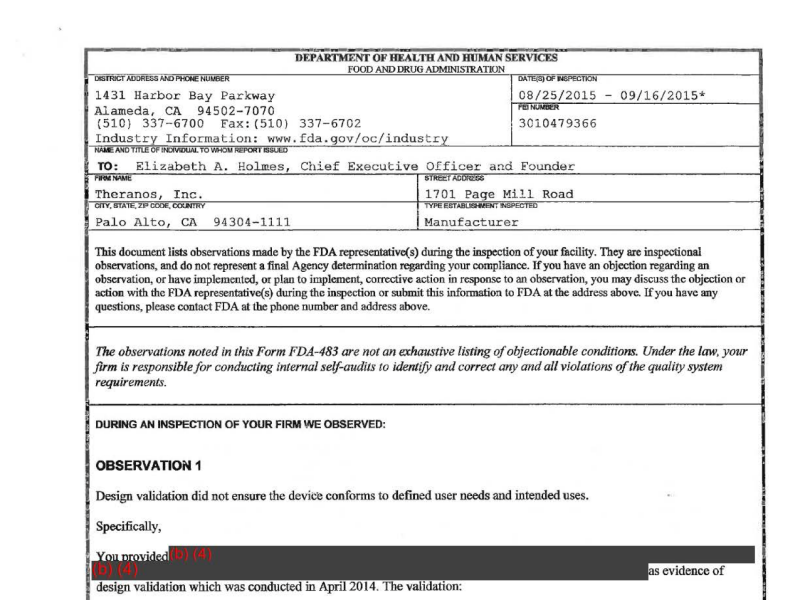

But the facts were starting to come out. In documents related to the FDA's visit to Theranos' lab, the agency told the company that it was shipping an "uncleared medical device."

Source: Business Insider

By November, the partnership with Safeway had fallen through, and the Walgreens relationship was on thin ice.

Source: Business Insider

By early 2016, more regulators were finding problems with Theranos. In January, CMS, which regulate blood-testing labs, cited concerns that one of Theranos' labs posed a safety risk to patients. In April, the SEC started its investigation into the company.

Source: Business Insider

In May 2016, Theranos President Sunny Balwani left the company, leaving Holmes as the sole top executive.

Source: Business Insider

In June, Walgreens ended its partnership with Theranos and closed all of the Wellness Centers it had opened in Arizona and California.

Source: Business Insider

In July, CMS banned Holmes from the lab-testing industry for two years. Theranos later in 2017 settled with the regulatory body for $30,000. As part of the settlement, Theranos agreed not to own or operate a clinical lab until 2019.

The following month, Theranos finally presented at a scientific conference, though the details about the company's technology were still lacking. Theranos appeared to be pivoting toward focusing on its new sample processor, the miniLab.

Source: Business Insider

The presentation over the summer foreshadowed Theranos' pivot just a few months later, in which the company shut down its clinical labs, laid off about 340 employees, and went to work solely on its miniLab technology.

Source: Business Insider

Lawsuits then started piling up from all sides including Walgreens, investors and patients in Arizona. Those cases all ultimately got settled, with Theranos paying millions to refund patients who took its tests in Arizona.

Source: Business Insider

Some of the big names on Theranos' board departed shortly after, including former US Secretaries of State Henry Kissinger and George Shultz. The company also went through another round of layoffs.

Source: Business Insider, Business Insider

By the end of 2017, Theranos was in need of a cash infusion and made a deal with Fortress Investment Group for $100 million in secured debt financing to get it through 2018. The deal relied on Theranos hitting certain development milestones as it worked to get its Zika virus approved by the FDA.

Source: Business Insider

Then in March, the SEC charged Holmes, Balwani, and the company with "massive fraud," though Theranos and Holmes settled. As part of the resolution, Holmes paid a fine and cannot be a director or officer of a publicly traded company for 10 years.

Source: Business Insider

Facing setbacks in its Zika test development in the spring of 2018, Theranos laid off the majority of its remaining employees and appealed to investors for more funding.

Source: Business Insider

In June 2018, Holmes and Balwani were charged with wire fraud by the Department of Justice. Holmes, ahead of the indictment, stepped down as CEO of Theranos.

Source: Business Insider

By the end of the summer, it appeared to be the end for the company itself. The Wall Street Journal reported in September 2018 that the company told its shareholders that it planned to formally shut down.

Source: The Wall Street Journal

Vanity Fair's Nick Bilton reported that in the final days of the company, Holmes got a Siberian husky puppy named Balto, who accompanied her to work but wasn't potty trained, making a mess of the company's offices and labs. Holmes, based in San Francisco, and Balwani await trial. Their next court appearance is slated for April 22.

Source: Vanity Fair