- Fannie Mae and Freddie Mac will soon buy mortgages of nearly $1 million in high-priced markets.

- The higher loan limits — required by law — come as home prices surge at historic pace across the US.

- The agencies aim to make homes attainable, but they're just catching up to a runaway market.

Mortgages are pretty expensive right now. Even the government is shelling out more and more for them.

As of this week, Uncle Sam is required to buy mortgages nearly as high as $1 million in some areas through its agencies Fannie Mae and Freddie Mac.

Blame the Housing and Economic Recovery Act of 2008 for the government backing high-six-figure mortgages in the name of affordable housing.

Since the 2008 law passed, the government-sponsored enterprises Fannie Mae and Freddie Mac have had to keep something called "the conforming loan limit" close to the going rate for houses in markets around the country. The law is meant to make it easier for homebuyers to borrow cash.

In an ordinary year, the limits climb by a few thousand dollars. Yet the record home-price inflation seen through 2021 will soon require Fannie and Freddie to buy mortgages worth roughly $100,000 more than last year's. That's how a law intended to help Americans afford homes more easily has turned into the government splashing out more and more to keep up with the market.

The conforming loan limit for single-family properties rose to $647,200 from $548,250, according to a press release. That matches the 18% year-over-year jump in the FHFA's Home Price Index.

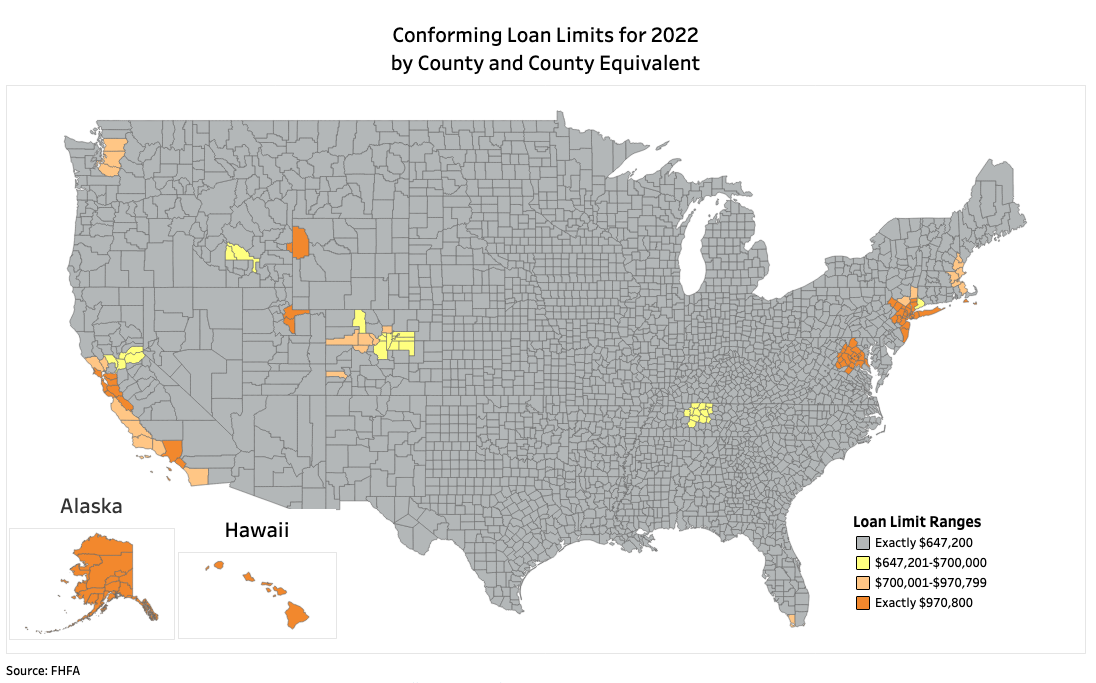

In areas where median home values are much higher than the baseline limit, the ceiling for one-unit properties will be $970,800, according to FHFA. That higher limit will be effective in 102 counties starting next year. Metropolitan hubs in California, New York, and Washington, DC host most of the pricier counties.

Broadly, conforming loan limits will be higher in all but four US counties.

Home prices climbed at a record pace through much of 2021 as historically low mortgage rates sparked a wave of pandemic-era moves. A nationwide home shortage left buyers bidding home prices sharply higher. Home inflation is expected to ease over the next several months, but experts forecast price growth will remain historically strong for at least another year.

The new limits underscore just how difficult it's become to afford a home in the US. While the median home price leaped by 18% over the past year, the average hourly wage only climbed 4.9% from October 2020 to October 2021.

The surge in prices has left Americans feeling historically pessimistic about buying a home. Only 38% of surveyed adults said it was a good time to buy a home in October, according to the University of Michigan's Surveys of Consumers. While that's up from the four-decade low of 32% seen in September, it still signals sour attitudes toward the white-hot market.

In more encouraging news, relief is on the horizon. Fannie Mae's latest housing forecast estimates home-price inflation peaked in the third quarter and will move lower over the next two years. Price growth will remain historically high in 2022, but inflation in 2023 should be some of the weakest the market has seen in nearly a decade, Fannie Mae's economists said.

The market could heal even faster if supply-chain problems fade, the team added. Bottlenecks of key materials like lumber made homebuilding more expensive this year. Difficulties with rehiring also crimped construction and kept homebuilding from accelerating.

"If these supply constraints can be resolved faster than we currently anticipate, there is upside risk to the pace of housing starts and new home sales," the economists said.

For now, home demand continues to dramatically outpace supply. Buyers in 2022 will have to borrow more than ever just to keep up. And so will the government, in the form of Fannie and Freddie. Instead of making housing more affordable, the agencies are helping buyers take on even more debt to buy a home in this market.