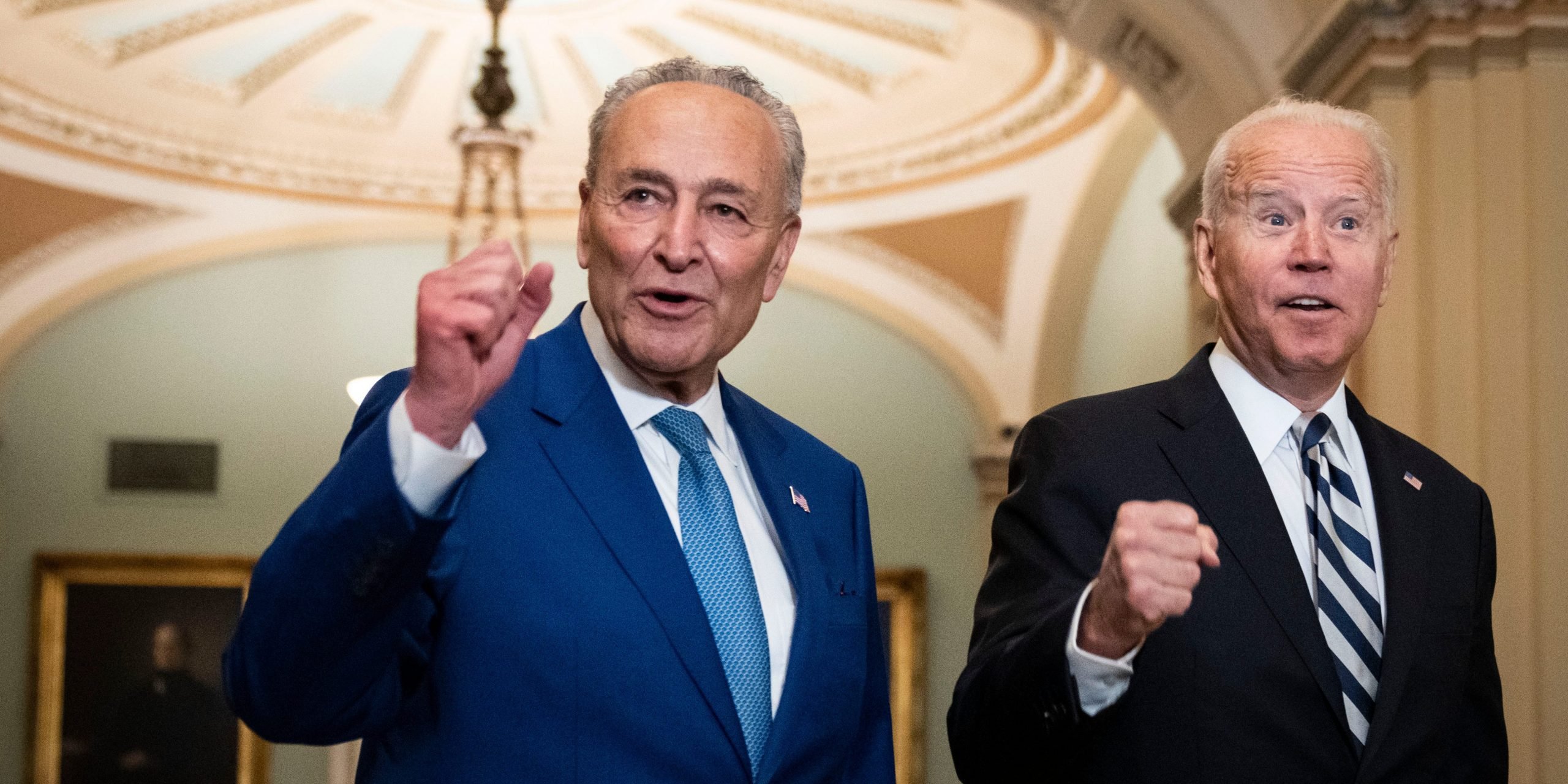

Drew Angerer/Getty Images

- The US government is poised to send the first batch of child tax credit payments on Thursday.

- Policymakers estimate 35.2 million families could see cash deposited into their bank accounts.

- The success of the program will determine whether Democrats can extend it as another form of Social Security.

- See more stories on Insider's business page.

America's neglected social safety net could be getting its largest patch in a generation on Thursday, when the US begins a year-long experiment providing a guaranteed income for families with children. Its success will determine whether it becomes a permanent fixture.

The Internal Revenue Service is poised to send the first batch of monthly child tax credit payments stemming from President Joe Biden's stimulus law, which was approved in March over united Republican opposition. For six months, families can get a $300 monthly benefit per child age 5 and under, amounting to $3,600 this year. The measure provides $250 each month per kid age 6 and 17, totaling $3,000. Half of the benefit will come as a tax refund.

If all goes to plan, the federal government will deposit cash directly into the bank accounts of 36.2 million families, according to projections from administration officials shared with reporters on Wednesday evening. That represents the bulk of the 39 million families the IRS has identified as being eligible for the child allowance.

Experts say the one-year child tax credit payments could shift public attitudes on cash benefits given its wide reach and mark a big step forward in slashing child poverty – some estimate it could be cut by up to half.

"It's hard to understate the significance of this expansion for child poverty in America," Samuel Hammond, a welfare policy expert at the center-right Niskanen Center, told Insider. "Most countries have some form of child or family allowance – and the US has been an outlier in excluding the lowest income households from our version of a child benefit," he said, adding "once you start on this path, it's hard to turn back."

Some Democrats are already drawing comparisons between the program and the birth of Social Security in 1935, a milestone that set up a critical source of income for retired and disabled Americans.

"It's the most transformative policy coming out of Washington since the days of FDR," Sen. Cory Booker of New Jersey recently told The New York Times.

'Some bumps in the road'

Bill Clark/CQ-Roll Call

Democratic lawmakers and Congressional aides have labored behind the scenes to ensure a smooth rollout of the payments. The child tax credit was revamped to include low-income families not required to file taxes, a group previously shut out from tapping into the benefit.

There were some signs of problems early on. Some experts and community groups raised concern that an IRS portal to sign up the poorest families was too complex and inaccessible for people who lacked desktop computers.

Sen. Michael Bennet of Colorado, an architect of the measure, said on Monday the IRS has given the child tax credit "100% of their attention" and said he's regularly communicated with the agency.

Still, he cautioned there could still be some snags. The pandemic has added to the IRS's responsibilities over the past year and strained its depleted staff. It has gone from being a tax-collecting agency to a benefit distributor on par with the Social Security Administration.

"I'm sure there will be some bumps in the road as there always are when rolling out something new like this," he told reporters. "But it's important as bumps arise to iron them out."

Some of those potential problems, Bennet told Insider, include "people not getting the benefit they were supposed to receive and accounting issues that might arise. I hope they won't be systemic issues, I don't think they will be."

The IRS has struggled sorting through a massive backlog of tax returns in recent months, delaying tax refunds in at least some cases. Hammond said it was unclear whether distributing monthly child benefits via the IRS is "sustainable in the long run."

"We've increasingly asked the IRS to do an awful lot of social policy beyond taxing and collecting revenues, and the IRS is just not equipped to be a benefits administrator," he said.

The future of Biden's child allowance

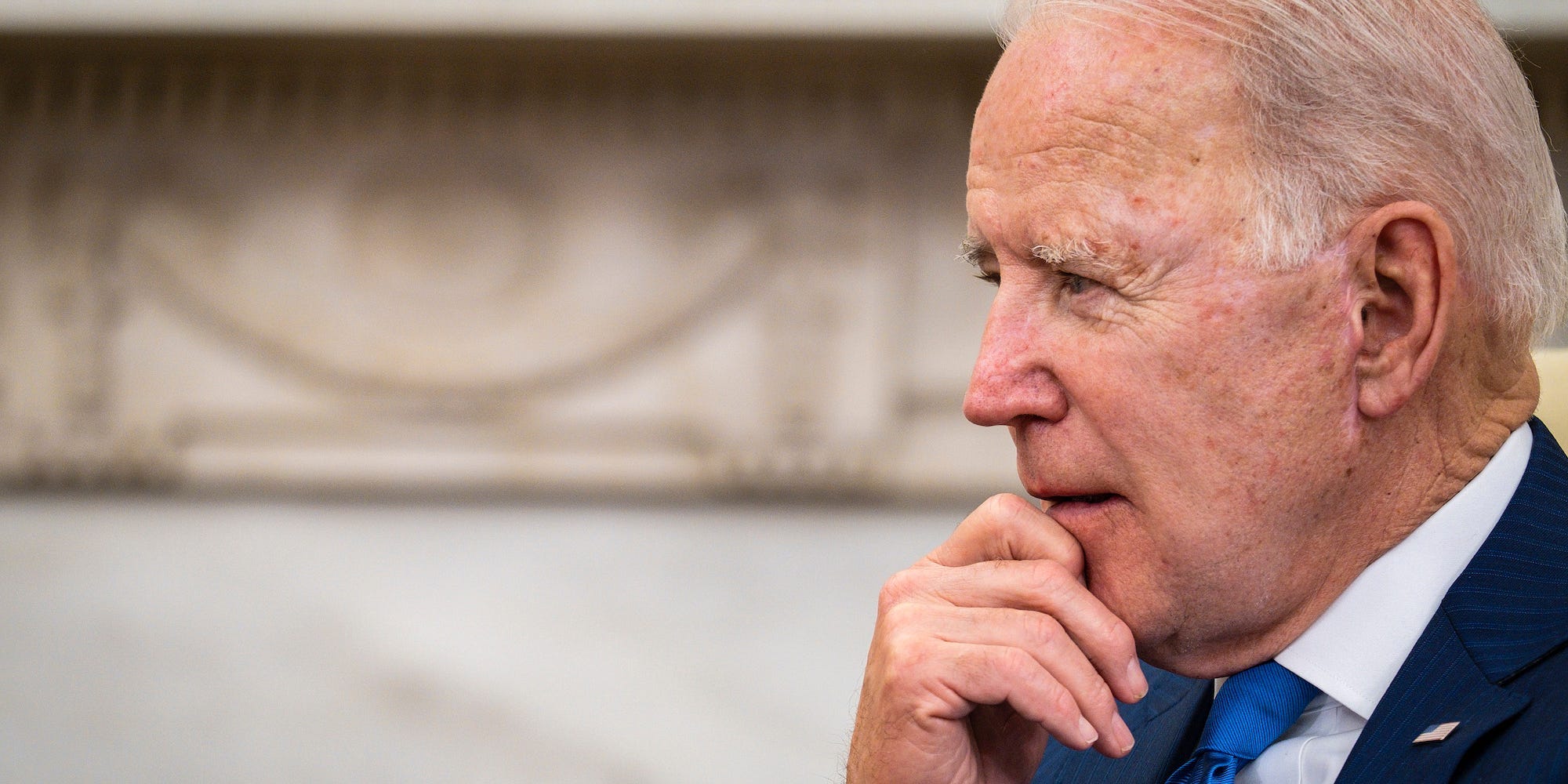

Pete Marovich-Pool/Getty Images

The bulked-up child tax credit is a rare measure that enjoys deep support among both House and Senate Democrats. Bennet, Sen. Sherrod Brown of Ohio, and Reps. Rosa DeLauro of Connecticut and Suzan DelBene of Washington, are among the lawmakers spearheading efforts to make it permanent.

Biden proposed in his spending plans to extend the bulked-up benefit until 2025, the same year that Trump-era tax cuts for individuals end. It's possible Republicans could trade support to renew the pair of benefits, given the GOP is generally opposed to cash aid as a standalone measure.

"I think we should embrace allowing people to keep more of their own money, if we're applying it towards their payroll tax," Sen. Marco Rubio of Florida told Insider last month. Rubio and Sen. Mike Lee of Utah led efforts to double the size of the child tax credit in the 2017 Republican tax law. The pair favor boosting the benefit amount for workers.

On Wednesday, Rubio released a statement tearing into the child allowance. "The way President Biden tells it, the handout is part of his administration's 'pro-family' plan," he said. In reality, he has transformed the pro-worker, pro-family Child Tax Credit into an anti-work welfare check."

Senate Democrats are kicking off a flurry of negotiations to finalize what measures will ultimately be included in a $3.5 trillion budget deal that would mostly be paid for with tax increases. They'll advance it in a pathway known as reconciliation, which allows them to approve certain bills with a simple majority instead of a filibuster-proof 60 votes. Every Democrat must stick together for the budget package to clear the Senate.

Brown, the Banking Committee chairman, said talks were in their early stages so no child allowance expiration date was set. "Not clear what year yet, but it's going to be a popular program like Social Security," he told Insider on Wednesday. "Republicans will not only be afraid to take it away, they'll start taking credit for it."

He also suggested its hefty price tag could keep a permanent extension out: "I think its so costly it may not [be included], but I'm still fighting for permanence," he said.

Brown also rejected the notion of changing the income thresholds. "I think that's pretty locked in. We've all been talking about how important that is, 90% of the public getting this is really consequential and key to its popularity," he told Insider.

Some Democratic moderates may balk at renewing the child tax credit in its current state. Sen. Joe Manchin of West Virginia, a swing vote, told Insider he was open to a permanent extension last month. Others are undecided on the program's fate.

"I consider it not an easy issue," Sen. Angus King of Maine, an independent who caucuses with Democrats, said in an interview. "It is a major expansion of what amounts to an entitlement program. I certainly supported it as part of the pandemic relief package. But supporting it on a permanent basis is something that I have to have more data on and understand how it'll be paid for."

Dit artikel is oorspronkelijk verschenen op z24.nl