Sarah Silbiger/Getty Images

- The Republican Study Committee is urging the GOP to tie inflation concerns to Biden's spending, Axios reports.

- Their memo uses year-over-year comparisons to show inflation rapidly accelerating amid reopening.

- The problem is May 2020 was lockdown, when prices sat well below their previous highs.

- See more stories on Insider's business page.

Republicans are doubling down on their claims that President Joe Biden's spending risks an inflation crisis.

Yet their latest argument relies on data that makes an irresponsible comparison between today's prices and those seen one year ago.

House Republicans are set to ramp up concerns over inflation and connect soaring prices to the Biden administration's spending efforts. In a memo first reported by Axios' Alayna Treene, Rep. Jim Banks of Indiana urged fellow party members to tell voters that inflation is "Democrats' hidden tax on the Middle Class" and that additional spending would only exacerbate the problem.

"Their 'infrastructure' plan would be reckless under normal circumstances – but passing a bill this bloated right now is downright insane," Banks, who also chairs the Republican Study Committee, said in the Friday memo.

The Republican Study Committee

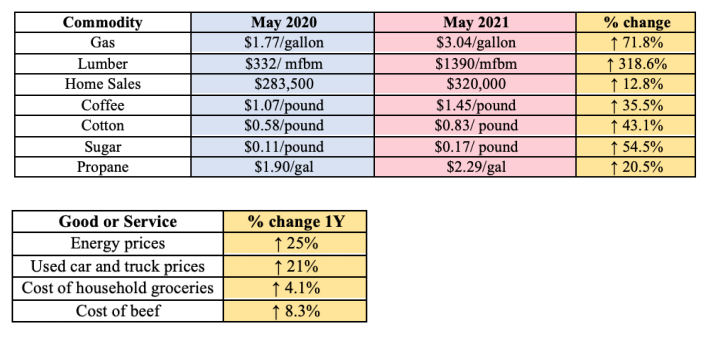

The congressman included a table comparing prices in May 2020 to those of today. Price growth included in the table ranges from a 13% jump in home-sales items to a 319% leap in the cost of lumber.

The inflation statistics initially seem worryingly large. But they ignore the fact that, in May 2020, the economy was mired in lockdowns, daily COVID-19 case counts were higher, and, critically, prices were significantly lower than their pre-pandemic levels.

The pandemic's hit to the US economy led prices to broadly decline in March and April of last year as businesses closed and spending froze. Inflation gauges began picking up again in May 2020, but the still-soft prices now make for a far easier year-over-year comparison than in times of average economic growth.

This dynamic, also known as base effects, has been flagged by the Federal Reserve for months as economists theorize about how inflation will trend. Fed Chair Jerome Powell repeatedly warned that year-over-year comparisons would be skewed through the spring as last year's data makes for a lower bar to clear. The Fed expects reopening to drive a period of stronger price growth before inflation normalizes at lower levels.

Some of the more drastic examples of surging inflation are also linked to severe supply-chain bottlenecks. Lumber, for example, has been in drastically short supply as the housing market boom caught the industry by surprise, according to Vox. Gas prices have also shot higher as travel demand rebounds and Americans return to their typical commutes.

To be sure, Biden's spending plans likely played a part in driving costs higher. The administration's $1.9 trillion stimulus measure fueled a massive uptick in spending in March as Americans put relief payments and expanded unemployment benefits to work.

The rebound in consumer demand quickly ran up against strained supply, and as healthy spending continued in April, producers began lifting prices. The Fed has maintained its view that stronger inflation will soon fade, but Republicans and even moderate Democrats have raised fears that the economy is overheating.

Still, to peg the rising prices to Biden's stimulus package alone is irresponsible and ignores other factors that are just as relevant. Rep. Banks also notes that another $5 trillion in spending would spark even more stifling inflation, but he fails to add that Biden's follow-up spending proposals are meant to be spent over eight to 10 years. That compares to the rapid rollout of Democrats' March stimulus bill.

Until more economic data comes in and the US settles into a new normal, it's unclear whether elevated inflation will intensify or prove to be merely transitory. But comparing today's prices, which reflect a widespread economic recovery, with those from the depths of the pandemic paint a grossly inaccurate picture of how inflation is trending.