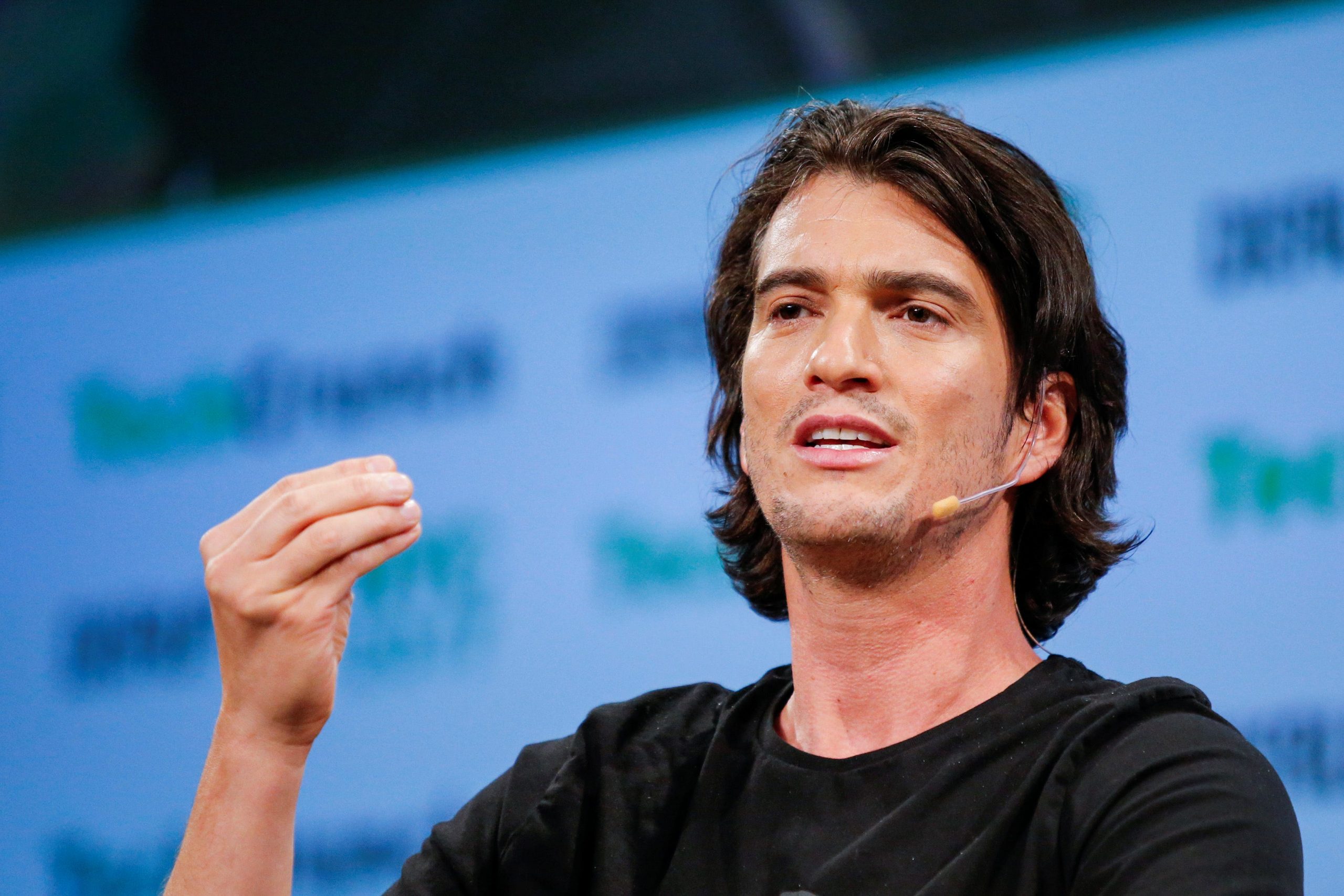

REUTERS/Eduardo Munoz

- David Fano is the founder of CASE, a startup bought by WeWork in 2015.

- On Twitter, Fano said the acquisition process moved quickly, closing in just 25 days.

- But the process almost destroyed his company when employees were faced with a snap decision.

- See more stories on Insider's business page.

The founder of a company acquired by WeWork described the lessons from a whirlwind process of joining Adam Neumann's startup in a Twitter thread on Wednesday.

Dave Fano worked at WeWork for nearly four years after his architecture and planning company, CASE, was acquired in 2015, according to his LinkedIn profile. But it almost didn't happen.

"We spent 7 years building an amazing culture of trust and transparency, and in a span of 24 hours, almost lost it all," Fano wrote. "Caught up in trying to get the deal done, we lost sight of how this process would make everyone feel."

Fano said CASE told its workers of the WeWork acquisition and asked them to return signed documents within 24 hours. The entire process took less than a month from when a verbal agreement was reached to when the deal officially closed.

The transaction put many of the firm's employees in a tailspin, Fano said. CASE was given less than two weeks after the letter of intent was signed to officially close the deal by informing employees and getting the workers to review WeWork's employment agreement.

According to data from Forbes, most mergers and acquisitions take about four to six months, but can also encompass a period of several years. Even at that rate, many employees choose to leave companies after mergers and acquisitions. Data from the MIT Sloan Management School found that within the first year of a company's acquisition 33% of workers leave the company as compared to the standard rate of 12%.

"That was one of the worst business decisions I've been a part of in all my career," Fano, who's now the CEO of career planning company Teal, said in his Twitter thread.

At the time, WeWork was considered a promising startup. It was chosen by Fortune magazine as one of its three unicorns to bet on in 2016 but went downhill fast when it filed to go public in 2019.

Fano left his position at WeWork as the company's chief growth officer about five months before it filed to go public. Within six weeks of filing, WeWork spiraled down from a $47 billion valuation to talk of bankruptcy when its S-1 filing revealed the company had suffered heavy financial losses.

-Dave Fano (@davidfano) April 21, 2021

Since then, the company appears to have turned around for WeWork. In March, the company announced it had reached a deal to go public via a SPAC.

Eventually, Fano said, he asked for more time from CEO Adam Neumann, who agreed to give the team several extra weeks.

Despite the extra time, he said the company still lost many employees as a result of the acquisition. But he does not regret his decision to join WeWork.

Fano said the situation opened his eyes to the importance of company values. By asking employees to make a 24-hour decision, he felt he violated a culture of trust and dependency.

"As intense as that moment was, I would not trade it for the following 4 years at WeWork," he wrote. "Everyone experienced incredible career growth. WeWork enabled people to explore new career paths, take on new responsibilities, and build relationships that will stay with them forever."