- In hindsight, the Fed's response to rising inflation was "a mistake," former chair Ben Bernanke said.

- The Fed's plan helped the labor market rebound, but every strategy has "occasional downsides," he added.

- Bernanke also said he expects the US to slide into stagflation as growth slows and prices keep rising.

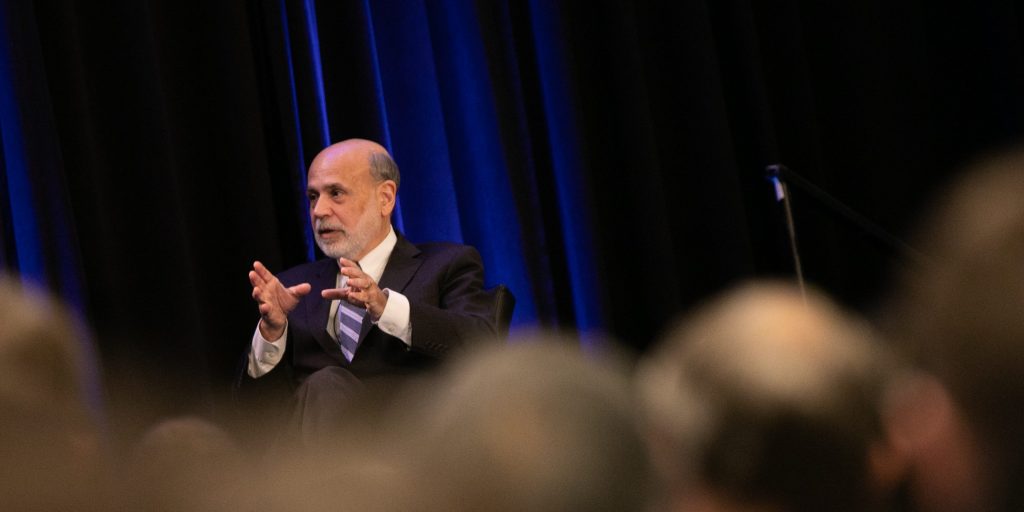

The Federal Reserve moved too late to tamp down on inflation that's now hit the highest levels since the 1980s, former chair Ben Bernanke said.

With prices continuing to surge at breakneck speed, criticism of the central bank has reached a fever pitch. Several Wall Street banks have penciled in a recession in late 2022 or early 2023, arguing the Fed's timing now forces it to slow the economy to a halt in order to cool inflation.

Bernanke took a similarly hawkish stance in a CNBC interview aired Monday, saying the Fed's patience in raising rates contributed to the inflation problem.

"Why did they delay their response? I think, in retrospect, yes, it was a mistake, and I think they agree it was a mistake," the former Fed chairman said.

Bernanke's no stranger to crisis-time policy decisions. He served as the central bank's chair during the 2008 financial crisis, when the Fed dropped interest rates close to zero and oversaw a dramatic expansion of US monetary policy. While the years after the Great Recession saw inflation hold at fairly low levels, Bernanke is the only other Fed chair to preside over an economic downturn as extraordinary as the coronavirus recession.

The Fed is now in peak inflation-fighting mode. Policymakers raised the central bank's benchmark interest rate by half a percentage point earlier in May, doubling the size of its typical rate hikes for the first time since 2000. Chair Jerome Powell hinted in a follow-up press conference that more double-sized hikes are "on the table" for the Federal Open Market Committee's coming meetings, further signaling the Fed will take a more aggressive stance against price growth.

The central bank's messaging throughout the pandemic has hinted at a relatively fixed schedule of rate hikes over the coming months. That forecasting, known within the economics community as "forward guidance," allows the Fed to hint at future policy adjustments and avoid a surprise move that could shock financial markets.

Signaling coming policy changes might've kept markets fairly calm, but it also forced the Fed into a less flexible plan for easing inflation, Bernanke said. If the guidance isn't enough to cool inflation fears, policymakers could be in for an entirely new problem.

"There's no strategy that doesn't have occasional downsides," the former chairman added. "The forward guidance, on the margin, slowed the response of the Fed to the inflation problem last year, to some extent."

That slower response risks dragging the economy into an unusual kind of downturn. Many of the economists faulting the Fed for its timing, see stagflation on the horizon. The term describes a period of weak economic growth and high inflation last seen in the US in the 1970s, and is difficult to counter without pulling the country into a self-imposed recession.

Economic growth is expected to slow "even under the benign scenario" of the Fed's plans to fight inflation working perfectly, making it very likely the criteria for stagflation are met, Bernanke said.

"Inflation's still too high but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high," he said in an interview with The New York Times published Monday. "So you could call that stagflation."