- Retail investors' buy-the-dip mentality remains strong for stocks, JPMorgan said on Friday.

- But that mentality could be disrupted if the sharp decline in bitcoin continues, the note said.

- "There remains a significant risk of further de-risking given continued decay in our longer lookback period momentum signal," JPMorgan said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A meltdown in cryptocurrencies and the release of "rather hawkish" FOMC minutes didn't stop retail investors from buying the dip in stocks, JPMorgan said in a Friday note.

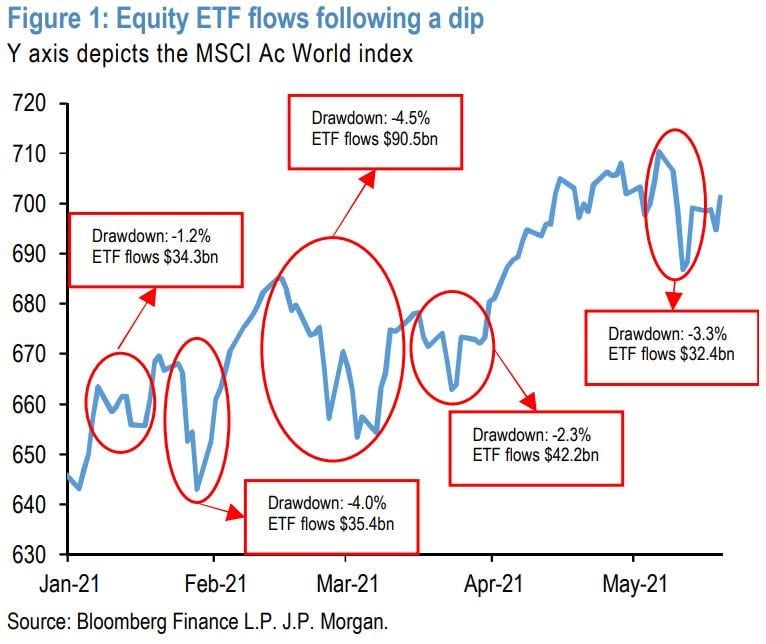

Fund flows into equity funds have been strong year-to-date, with $340 billion entering the sector, or about $17 billion per week. And the greater the stock market decline, the higher the equity ETF inflows that follow, JPMorgan observed, adding credence to the idea that investors remain hungry for stocks.

But that mentality could be disrupted if the sell-off in bitcoin and other cryptocurrencies accelerates and spills over to retail investor confidence more broadly, the note said.

Bitcoin and ether both fell more than 30% in a single day last week, as tweets from Elon Musk and warnings from China drove a sell-off in the crypto space. And that selling could continue, as a deterioration in liquidity conditions amid last week's crypto sell-off makes it "hard to argue that what we have seen thus far represents a capitulation," JPMorgan said.

"This means that there remains a significant risk of further de-risking given continued decay in our lookback period momentum signal and given the absence of buying in either the bitcoin fund space or the regulated bitcoin futures space," JPMorgan explained.

"We believe that it is too early to call the end of the recent bitcoin downtrend," the bank added.

Other factors that could shake confidence in retail investors include a continued flat equity market and a hawkish shift from central banks. That hawkish shift could happen June if the recent FOMC minutes' hint towards tapering gets formalized in the Fed's June meeting, JPMorgan said.

But as long as the strong equity buying persists, the buy the dip mentality among investors should remain as confidence remains strong.